Retail Ready Packaging Market Projected Growth and Future Outlook

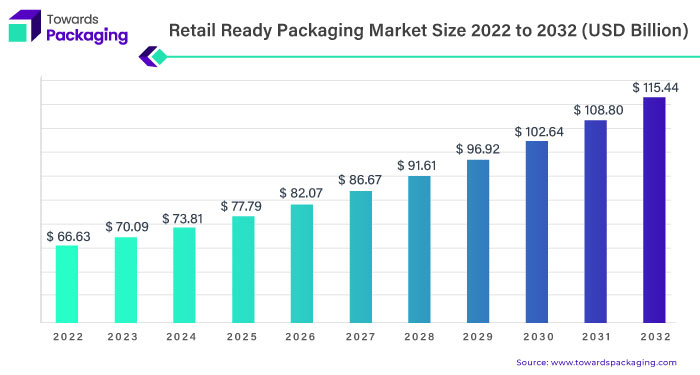

The global retail ready packaging (RRP) market is expected to experience significant growth, with its size increasing from USD 66.63 billion in 2022 to an estimated USD 115.44 billion by 2032. This growth reflects a compound annual growth rate (CAGR) of 5.7% from 2023 to 2032, driven by rising demand for more efficient and consumer-friendly packaging solutions.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5094

Retail Ready Packaging Market Trends: Key Insights and Developments

The retail ready packaging (RRP) market is evolving rapidly, driven by changing consumer behaviors, advancements in packaging technology, and the need for greater efficiency in retail operations. Below are some key trends shaping the market:

1. Increased Demand for Consumer Convenience As consumers seek more convenient shopping experiences, retail ready packaging has gained popularity due to its ability to streamline product handling. RRP allows products to be easily displayed on shelves, minimizing the need for additional unpacking and reducing shelf restocking time. The convenience it offers both for consumers and retailers has been a major factor driving market growth.

2. Focus on Sustainability Sustainability continues to be a key driver in the retail ready packaging industry. Consumers are becoming more environmentally conscious, prompting retailers and manufacturers to adopt eco-friendly materials for packaging. Biodegradable and recyclable materials, such as paper-based packaging, are gaining traction as companies seek to reduce their environmental footprint.

3. Growth of E-Commerce and Omnichannel Retail With the rise of e-commerce, there is an increasing demand for packaging solutions that are optimized for both in-store and online retail environments. Retail ready packaging is being tailored to ensure it is suitable for direct-to-consumer delivery while maintaining its functionality in physical retail settings. This omnichannel approach helps retailers meet the needs of a broader range of customers.

4. Innovations in Packaging Designs Packaging designs are becoming more innovative to attract consumers and improve the product display. Retail ready packaging is being designed with features such as easy-open mechanisms, tamper-evident seals, and clear visibility to improve shelf appeal. These innovations not only enhance the consumer experience but also improve product security and accessibility.

5. Integration of Smart Technologies Advancements in technology are playing a significant role in transforming retail ready packaging. The integration of smart packaging solutions, such as RFID tags and QR codes, is gaining momentum. These technologies help retailers track inventory, enhance supply chain efficiency, and provide consumers with interactive experiences, offering personalized content and promotions through their smartphones.

6. Cost Efficiency and Supply Chain Optimization Retail ready packaging offers cost advantages by improving supply chain efficiency. It allows for better space optimization during transportation, reduces the risk of product damage, and simplifies the inventory management process. As supply chain costs continue to be a key concern for retailers, the adoption of RRP solutions is seen as a way to lower operational expenses.

7. Expansion in Emerging Markets Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, are seeing increased demand for retail ready packaging as consumer purchasing power rises and modern retail infrastructure expands. Retailers in these regions are adopting RRP to cater to evolving consumer preferences and to stay competitive in a rapidly changing retail landscape.

8. Enhanced Branding Opportunities Retail ready packaging offers significant branding opportunities for manufacturers. With visually appealing designs and the ability to stand out on store shelves, brands can leverage RRP to reinforce their identity and engage consumers. The packaging itself becomes a marketing tool, helping brands communicate their values and capture attention in a crowded marketplace.

Recent Developments

- In May 2022, UK’s Smurfit Kappa announced the acquisition of Atlas Packaging, a Leading company in corrugated packaging.

- In January 2023, Paper-based packaging expert Solidus published its first sustainability report, detailing investments made since January 2023 totalling roughly €11 million for a new line of retail and foodservice packaging under the Futurline brand across its converting plants in the Spain, Netherlands, and the UK.

- In September 2023, The merger of Smurfit Kappa and WestRock resulted in Smurfit WestRock becoming a world leader in sustainable packaging with unmatched scope, calibre, and diversity of products and regions.

- In January 2023, West Pharmaceutical Services, Inc. increased its innovations for global customers and their patients by releasing three new products.

Retail Ready Packaging Market Key Players

Mondi PLC, WestRock Company, DS Smith, Smurfit Kappa, International Paper Company, Weedon Group, Georgia Pacific LLC., Graphic Packaging International, STI – Gustav Stabernack GmbH, The Cardboard Box Company.

Buy Premium Global Insight: https://www.towardspackaging.com/price/5094

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/