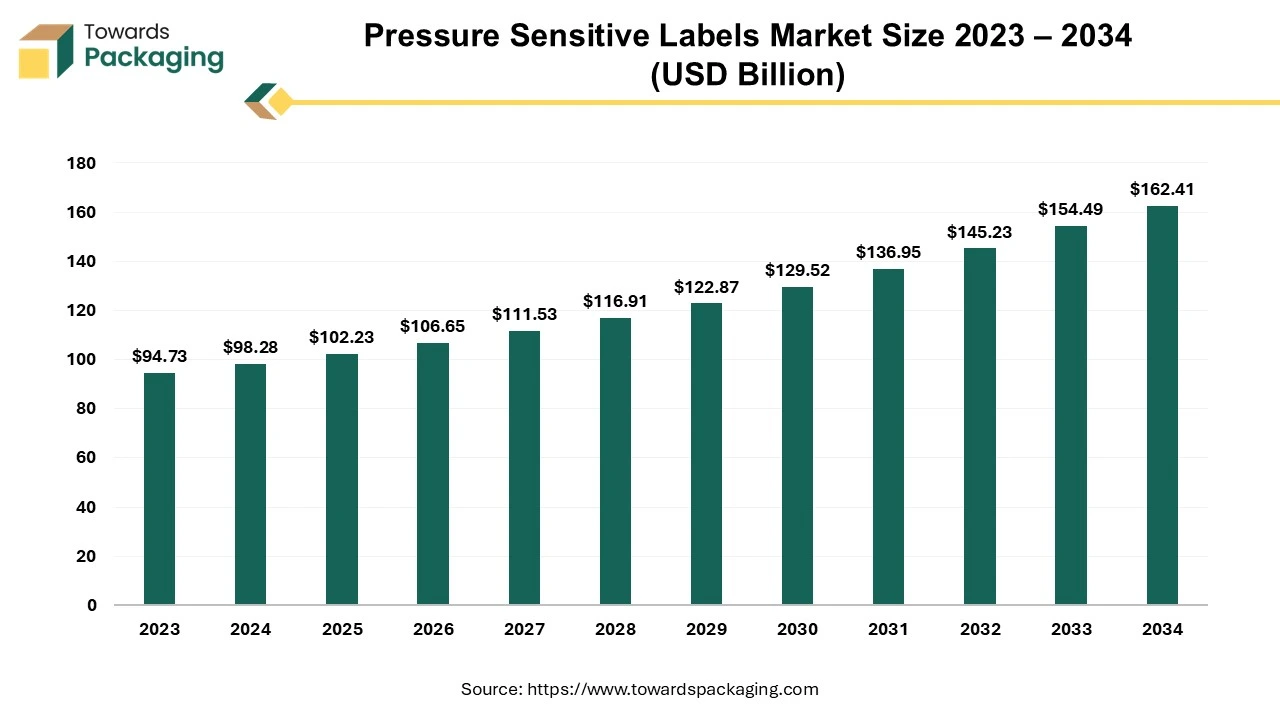

The pressure sensitive labels (PSL) market has seen robust growth in recent years, driven by innovations in materials and the increasing demand across various industries. These labels are used in a wide range of applications due to their ease of use and versatility. As we look at the market from different angles—material segments, end-user industries, and regional insights—several key trends and growth drivers emerge. The global pressure sensitive labels market is estimated to reach USD 162.41 billion by 2034, up from USD 94.73 billion in 2023, reflecting a compound annual growth rate (CAGR) of 5.15% from 2024 to 2034.

Get All the Details in Our Solution – Download Brochure: https://www.towardspackaging.com/download-brochure/5381

Material Segment Analysis

In 2023, the film/plastic segment dominated the pressure sensitive labels market, holding a substantial share of 55.42%. This segment’s widespread use can be attributed to the inherent qualities of film materials, which ensure longevity, a polished appearance, and resilience in harsh environments. Film labels, which are resistant to humidity, temperature changes, and chemicals, are perfect for applications requiring durability. Their transparency and clarity enhance product appeal, while the flexibility and tear resistance make them suitable for irregularly shaped containers. Common film materials like Polyester (PET), Polypropylene (PP), and Polyethylene (PE) continue to dominate the market.

The growth of flexible packaging has further supported the expansion of this segment, making film materials a preferred choice for packaging applications. On the other hand, paper labels, known for their affordability, are projected to grow at a significant CAGR during the forecast period, as they serve a variety of uses across different sectors.

End-User Industry Segment Analysis

The food and beverage sector emerged as the largest consumer of pressure sensitive labels, accounting for 38.16% of the market share in 2023. This growth is primarily driven by the rapid expansion of the beverage industry, especially bottled water, soft drinks, and alcoholic beverages. Additionally, the rising demand for processed foods, particularly in urban areas, coupled with the popularity of ready-to-eat meals, snacks, and single-serve beverages, is expected to propel the market forward.

There is also a growing preference for organic, gluten-free, and plant-based products, which further contributes to the demand for efficient and attractive labeling solutions. The rise in online grocery shopping, along with the expansion of the frozen and refrigerated food segments, is likely to support the food and beverage sector’s growth, driving the demand for pressure-sensitive labels in the coming years.

Regional Insights

Asia Pacific: Fastest Growing Region

Asia Pacific is expected to witness the fastest CAGR of 7.25% during the forecast period. This can be attributed to the expansion of industrial activities and the rapid growth of urban centers across the region. The increasing penetration of the e-commerce market and the expanding food and beverage sector are expected to contribute to the region’s market growth. The Indian food and beverage packaging market, for instance, is anticipated to grow from US$ 33.7 billion in 2023 to US$ 46.3 billion by 2028, which will drive demand for pressure-sensitive labels.

In addition to this, the region benefits from low-cost raw materials and labor, which makes it an attractive hub for the production of pressure-sensitive labels. The growing demand for product information, safety, and traceability is expected to further boost the market in the Asia Pacific region.

North America: Strong Market Presence

North America holds a significant market share of 35.94% in 2023, primarily due to the strong presence of the healthcare and pharmaceutical sectors, which rely on pressure-sensitive labels for packaging. Additionally, the growth of e-commerce and retail, along with consumer demand for aesthetically appealing packaging, plays a vital role in driving the market.

The surge in e-commerce retail sales, especially in Canada, with US$ 40.3 billion expected by 2025, is fueling the growth of pressure-sensitive labels. Furthermore, the adoption of smart labeling technologies and increased use in industrial applications are key factors supporting market expansion in North America.

Recent Developments by Key Market Players

In April 2023, Innovia Films launched Rayoface AQBSA, a novel printable coated cavitated white BOPP facestock film for pressure-sensitive labeling applications. This 58-micron thick film boasts 91% opacity, making it ideal for a variety of industries, including food and beverage, personal care, and consumer packaged goods.

In August 2023, Avery Dennison introduced AD LinrSave and AD LinrConvert, innovative linerless decorative alternatives that significantly reduce packaging waste. These products, created using unique micro-perforation technology, help reduce label waste, CO2 emissions, and water consumption, aligning with the growing demand for sustainable packaging solutions.

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5381

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/