Global High-Density Polyethylene (HDPE) Bottles Market Growth Prospects and Regional Outlook

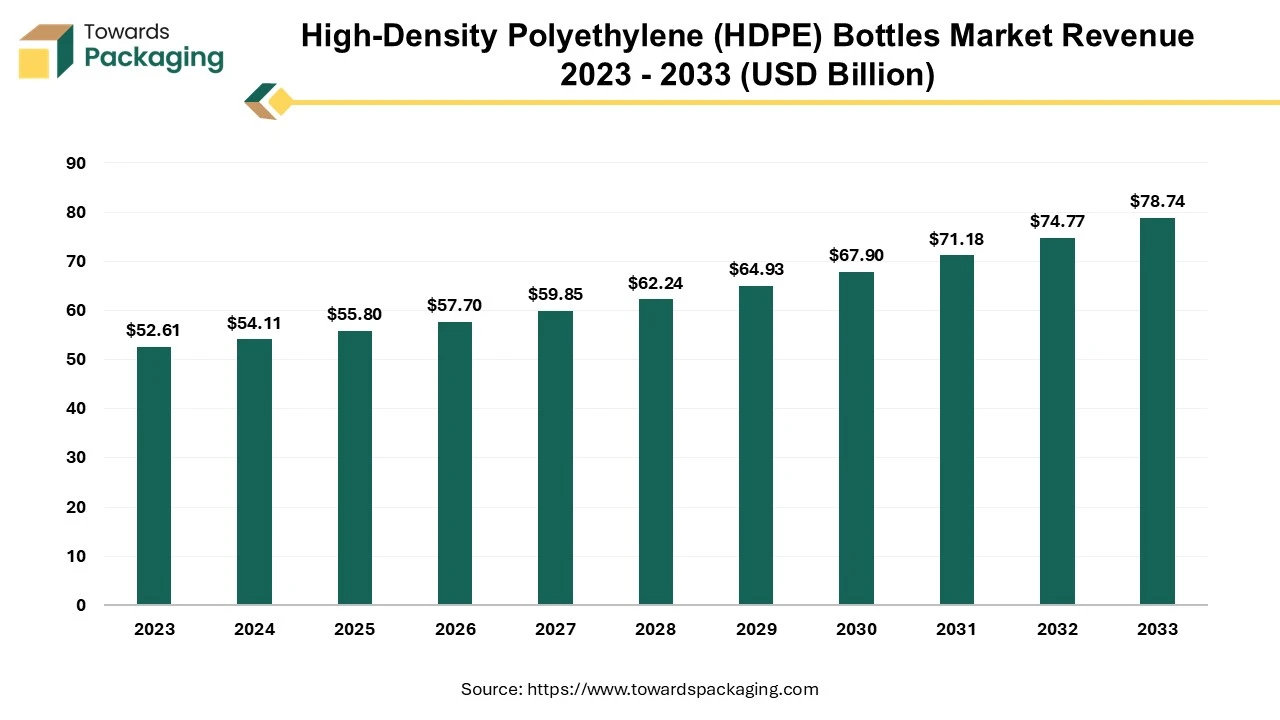

The global market for high-density polyethylene (HDPE) bottles is projected to grow significantly, reaching an estimated value of USD 78.74 billion by 2033, up from USD 52.61 billion in 2023. This represents a compound annual growth rate (CAGR) of 4.26% from 2024 to 2033.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5353

Key Trends and Insights

Sustainability has become a major concern in the global push to reduce single-use plastics in packaging. High-density polyethylene (HDPE) is one of the most recycled plastics, offering an eco-friendly option as it can be reused to create new products without significant loss of quality. Recycled HDPE is used in durable goods like pipes and plastic timber, making it a valuable material in the recycling industry.

There is also a growing trend towards lightweight HDPE bottles, which are gaining popularity due to their lower material usage and reduced emissions during transportation. Brands are embracing innovative packaging designs that prioritize sustainability, such as promoting bottle reuse and minimizing waste in single-use packaging.

Consumers are becoming increasingly conscious of product ingredients, especially in the wake of the COVID-19 pandemic, which has made people more aware of their eating habits and overall health. Beverage brands, in particular, are under pressure to clearly display ingredient lists and highlight any health benefits or free-from claims to meet customer expectations.

With an overload of information, many brands are moving towards simpler, clearer packaging designs. Minimalist labels that focus on the most important information—often with ample white space—are becoming more popular. These designs not only stand out on crowded shelves but also convey a sense of quality and sophistication, appealing to health-conscious and environmentally aware consumers.

Regionally, North America led the market in 2023 with a share of 35.93%, driven by strong demand in the food and beverage, and pharmaceutical industries, as well as a growing emphasis on eco-friendly packaging and environmental regulations.

Meanwhile, the Asia-Pacific region is expected to experience the fastest growth, with a projected CAGR of 6.24% from 2024 to 2033. This growth is fueled by rapid industrialization, urbanization, rising disposable incomes, and the expanding food and beverage and healthcare sectors across the region.

Segment Analysis

Barrier Type Segment:

The high-barrier segment led the market in 2023, with a 65.38% share. These bottles are essential in industries like pharmaceuticals, where they protect sensitive products from moisture and oxygen, preserving their quality. The rise in chronic illnesses has increased demand for such packaging. High-barrier bottles also maintain product characteristics like flavor and texture, supporting their continued market growth.

End-Use Industry Segment:

The food and beverage sector, particularly bottled water, was a major market driver in 2023. Bottled water sales in the U.S. hit a record high in 2022, surpassing soft drinks for the seventh year in a row. HDPE bottles, known for being lightweight, durable, and recyclable, are the preferred choice for bottled water, offering cost savings and protection against spoilage while being eco-friendly.

Recent Developments by Key Market Players

September 2024:

Castrol India announced that 50% of its HDPE bottles are now made from recycled plastic as part of its sustainability efforts. The company plans to use approximately 2,600 tonnes of recycled plastic annually in its packaging by the end of the year. This initiative aligns with Castrol’s global PATH360 goal, which aims to reduce plastic waste by 50% by 2030.

June 2024:

Berry Global Group unveiled a customizable rectangular HDPE container, made with up to 100% post-consumer recycled plastic, for the personal care, home, and beauty sectors. The 250ml Domino bottle is fully recyclable, provided proper collection systems are in place. Its efficient rectangular design allows for better stacking, saving space on shelves, in storage, and during transit.

Buy Premium Global Insight: https://www.towardspackaging.com/price/5353

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/