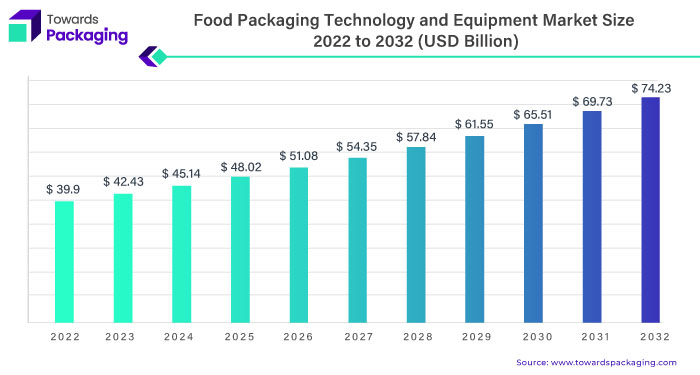

The global food packaging technology and equipment market is poised to ascend from the commanding figure of USD 39.9 billion in 2022 to an estimated USD 74.23 billion by 2032. This meteoric rise is projected to be achieved through a consistent Compound Annual Growth Rate (CAGR) of 6.4% between 2023 and 2032.

The food packaging technology and equipment market refers to the industry that involves developing, producing, and distributing technology and machinery used in packaging food products. This market plays a crucial role in ensuring food items’ safety, quality, and preservation from the point of production to the end of consumption.

The food packaging technology and equipment market constitutes a diverse spectrum of industries engaged in developing, manufacturing, and distributing technologies and machinery dedicated to packaging food products. The food industry will continue to be the largest purchaser of packaging machinery, accounting for slightly under 32% of the global market, which is followed by the beverage industry, which holds 31.5%.

Operating at the core of the food industry, food packaging technology and equipment market market plays a pivotal role in guaranteeing food items’ safety, quality, and longevity across the entire supply chain. It encapsulates a multifaceted landscape that includes various facets such as packaging technologies, cutting-edge equipment, stringent regulatory compliance measures, ongoing innovations in packaging materials and practices, a growing emphasis on sustainability, and the ever-evolving dynamics of the global market.

The global packaging sector has experienced consistent expansion, driven by an annual average growth of 25% in cross-border e-commerce transactions. This surge is attributed to exploring new markets and the increasing prosperity of the global middle-income demographic. This intricate interplay of elements underscores the critical importance of the food packaging technology and equipment market in facilitating food products’ seamless and secure movement from production facilities to consumers, ultimately ensuring that these items meet the highest safety standards, quality, and environmental responsibility.

For Instance,

- In May 2023, Syntegon unveils four devices for the most popular vertical form, fill, and seal applications across different food industries with its newly created SVX series.

Food Packaging Technology and Equipment Market Trends

| Trends | |

| Sustainable Packaging | Increasing awareness of environmental concerns has led to a growing demand for sustainable packaging solutions. Biodegradable materials, recyclable packaging, and eco-friendly practices are becoming prevalent in the food packaging technology and equipment market. |

| Smart Packaging | Integrating technology into packaging, such as sensors and RFID tags, enables enhanced traceability, quality control, and communication between consumers and producers. Smart packaging is a trend that aligns with the growing demand for transparency and information about food products. |

| E-commerce Packaging Solutions | The rise of online shopping and food delivery services has spurred innovations in packaging suitable for e-commerce. Packaging must now not only protect products during transit but also provide a positive unboxing experience for consumers. |

| Focus on Extended Shelf Life | Advancements in packaging technologies aim to extend the shelf life of food products, reducing food waste and ensuring the availability of fresh and safe food for consumers. Modified atmosphere and active packaging are examples of technologies contributing to this trend. |

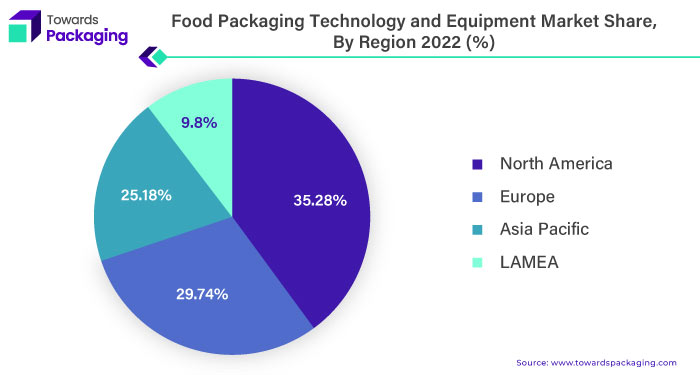

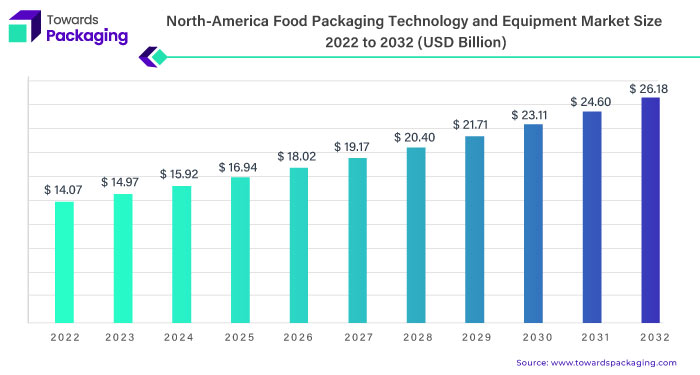

North America’s Leadership Weaved into the Fabric of Food Packaging Technology and Equipment Market

Within the intricate tapestry of the food packaging technology and equipment market, regional dynamics emerge as a defining factor, shaped by a confluence of economic, technological, and consumer-centric considerations. As of the current landscape, North America stands prominently as a leading region in this dynamic market, its pre-eminence underpinned by a combination of factors that collectively contribute to its robust market position.

At the forefront of North America’s ascendancy is the maturity of its food industry, a hallmark of economic development that propels the demand for advanced packaging technologies and equipment. The region boasts a well-established and sophisticated food production ecosystem with diverse products that necessitate innovative packaging solutions.

The food packaging technology and equipment market, marked by a continuous pursuit of efficiency and quality, acts as a catalyst for adopting cutting-edge packaging technologies and equipment to meet the evolving needs of producers and consumers.

Stringent regulatory frameworks further elevate North America’s status within the food packaging technology and equipment market. Regulatory measures designed to ensure the safety and integrity of packaged food products foster an environment where adherence to high-quality standards is imperative. The food packaging technology and equipment market rigorous regulatory landscape compels industry players to invest in state-of-the-art packaging technologies and equipment that comply with existing standards and position North American products as exemplars of safety and quality on the global stage.

The food packaging technology and equipment market defining feature of North America’s leadership is its unwavering commitment to technological advancements. The region serves as a crucible for innovation, with a dynamic landscape that continually pushes the boundaries of what is possible in food packaging. Investments in research and development, coupled with a culture that embraces technological progress, contribute to the rapid integration of cutting-edge packaging solutions.

The food packaging technology and equipment market relentless pursuit of innovation positions North America as a trendsetter, with new technologies often setting global industry standards benchmarks. Online grocery buying has evolved into a significant competitive battleground. Millennials are the group most likely to purchase groceries online, accounting for nearly half of all buyers in the US. By 2025, twenty per cent of US food spending is expected to occur online, generating a $100 billion business, effectively fuelling the growth of the food packaging and equipment market.

Sustainability is a cornerstone of North America’s influence in the food packaging technology and equipment market. A growing societal consciousness and an environmentally aware consumer base have catalyzed eco-friendly practices and materials. Cognizant of this paradigm shift, North American businesses are increasingly investing in and adopting sustainable packaging solutions. This commitment to sustainability aligns with broader environmental goals and resonates with consumers who prioritize products that demonstrate a genuine dedication to reducing their ecological footprint.

In essence, North America’s pre-eminence in the food packaging technology and equipment market is a convergence of a mature food industry, stringent regulatory oversight, a relentless pursuit of technological progress, and a steadfast commitment to sustainability. As the region continues to set benchmarks and redefine industry norms, its influence reverberates globally, shaping the trajectory of the broader food packaging landscape.

For Instance,

- In October 2021, ATS Packaging Machinery launched a new line of capping machines for food and beverage applications.

Within the expansive landscape of the food packaging technology and equipment market, Europe stands out prominently as the second leading region, leveraging a unique blend of factors delineating its commanding position in this dynamic industry. The food packaging technology and equipment market key hallmark of the European market’s ascendancy is its unwavering commitment to sustainability, which resonates across the continent.

Many European countries have taken proactive measures by implementing stringent regulations to curb plastic waste, reflecting a conscientious effort to address environmental concerns associated with conventional packaging materials. This sustainability-centric approach underscores a broader societal shift towards eco-friendly practices, creating a distinctive identity for the European food packaging landscape.

The food packaging technology and equipment market robust emphasis on sustainability within the European market is not merely a regulatory obligation but is deeply ingrained in the ethos of the region’s business practices. Companies operating within the European food packaging sector increasingly embrace sustainable packaging solutions, responding to consumer demand for environmentally conscious products and the imperative to align with overarching global sustainability goals. This commitment has fuelled innovation in materials and practices, driving the adoption of alternative packaging solutions that minimize environmental impact.

For Instance,

- European company Ahlstrom and The Paper People, a sustainable packaging manufacturer, collaborate to produce fibre-based frozen food packaging.

Its unwavering dedication to technological innovation further fortifies the European market’s influence. A hotbed of research and development, Europe continually pushes the boundaries of food packaging technology, setting benchmarks for the global industry. Investments in cutting-edge technologies, including advancements in intelligent packaging, active packaging, and materials science, position European companies at the forefront of innovation. This proactive pursuit of technological excellence enhances the efficiency of food packaging processes and ensures that European products meet the highest safety, quality, and traceability standards.

Its well-established and sophisticated food and beverage industry is crucial to Europe’s standing, which forms a robust foundation for the food packaging technology and equipment market. The diversity and complexity of products within the European food industry necessitate advanced and adaptable packaging solutions. Recognizing the need for precision and efficiency, European manufacturers invest significantly in state-of-the-art packaging equipment to meet the evolving demands of a discerning consumer base. This well-oiled machinery of production and distribution contributes to the overall resilience and competitiveness of the European market on the global stage.

The European market’s journey to the forefront of the food packaging technology and equipment market arena is marked by a convergence of sustainability-driven policies, a relentless pursuit of technological prowess, and a well-established food and beverage industry. As the region continues to navigate the evolving landscape of consumer preferences, regulatory frameworks, and technological advancements, its influence remains pivotal, shaping the trajectory of the global food packaging market. Europe’s position as the second leading region reflects more than just its regulatory landscape. Still, it is a testament to its holistic approach that seamlessly integrates sustainability, innovation, and industry expertise.

Advancements in Material Trends for Food Packaging

In the food packaging technology and equipment market, the choice of materials stands out as a pivotal determinant, wielding significant influence over industry dynamics. Plastic asserts its dominance as a prevailing material due to its unparalleled versatility, cost-effectiveness, and lightweight attributes. This preference for plastic has historically been driven by its ability to provide diverse packaging solutions that cater to various food product requirements. The cost-effectiveness of plastic, combined with its adaptability to different shapes and sizes, has made it a staple choice for packaging across the food industry.

However, the tides of industry preference are undergoing a noteworthy shift, fueled by an escalating global consciousness towards environmental sustainability. In response to mounting environmental concerns, there is a discernible surge in the exploration and adoption of sustainable alternatives, marking a departure from the conventional reliance on plastic. Biodegradable plastics, heralded for their capacity to disintegrate naturally and reduce environmental impact, have gained traction as a promising substitute. This shift reflects a conscientious effort within the industry to mitigate the ecological footprint associated with traditional plastic packaging.

For Instance,

- In May 2022, Trioworld introduced the first plastic film approved for frozen food packaging—post-consumer recycled (PCR) film.

Furthermore, a rising momentum favours paper-based packaging, gaining prominence for its biodegradability and recyclability. Paper, a renewable resource, aligns with the growing consumer preference for eco-friendly packaging solutions, providing a viable alternative to mitigate concerns associated with non-biodegradable materials. The versatility of paper in accommodating various printing techniques for branding and information purposes adds an extra layer of appeal for manufacturers and consumers alike.

Compostable materials represent another facet of this eco-conscious transition, offering packaging solutions designed to break down into natural elements under specific conditions. Compostable packaging aligns with the circular economy concept, contributing to waste reduction and environmental impact. The emphasis on compostable materials underscores an industry-wide commitment to rethinking the entire packaging lifecycle, from production to disposal.

Regulatory pressures do not solely drive the rationale behind this transformative shift in material preferences but are increasingly moulded by consumers’ evolving expectations. Modern consumers exhibit a heightened awareness of environmental issues and are inclined towards brands and products that align with their values. As sustainability becomes a central tenet of consumer choice, the food packaging technology and equipment market are compelled to adapt and innovate.

While plastic remains a stalwart in the industry, the ascent of sustainable alternatives such as biodegradable plastics, paper-based packaging, and compostable materials reflects a conscientious pivot towards environmental responsibility. This shift not only echoes regulatory imperatives but, more importantly, mirrors a collective industry commitment to meeting consumer demands for eco-friendly packaging solutions. The evolving material landscape underscores the dynamic nature of the food packaging technology and equipment market, where innovation harmonizes to redefine industry norms.

Developments in Active and Smart Technologies Transforming Food Packaging Technology

Simultaneously, the emergence of intelligent packaging technologies represents a paradigm shift in how food products are monitored and managed throughout the supply chain. Notable components of innovative packaging include QR codes, Near Field Communication (NFC), and sensors. Ubiquitous in retail, QR codes now find application in food packaging by providing consumers instant access to comprehensive product information.

This includes details about the product’s origin, ingredients, nutritional facts, and interactive content. NFC technology, facilitating communication between devices in proximity, enhances traceability by allowing consumers to engage with products through their smartphones. These technologies contribute to greater transparency in the supply chain, enabling consumers to make informed choices about the products they purchase. Retailers of food estimate that 31 per cent of food products are thrown out because they decay, resulting in losses of US$146 billion. In the case of counterfeit products, innovative packaging might help prevent losses exceeding US$460 billion.

Sensors embedded in intelligent packaging play a critical role in real-time monitoring, offering a proactive approach to quality and safety assurance. These sensors can measure and transmit data on various parameters such as temperature, humidity, and freshness. For example, in the perishable goods sector, temperature sensors ensure that the cold chain is maintained, preventing spoilage and preserving the integrity of the products from production to consumption. Real-time monitoring facilitated by these sensors enhances supply chain efficiency and enables swift responses to deviations from optimal storage conditions, minimizing compromised products reaching consumers.

For Instance,

- In October 2021, the technology company GEA launched a new food and dairy powder or granule packing range. The new GEA SmartFil M1 has been designed to accommodate various filling configurations for low-capacity applications, catering to the different needs of the food, dairy, and pet food industries.

The advancements in food packaging technology, particularly in active and intelligent packaging technologies, signify a transformative era for the industry. These innovations address critical product shelf life and quality challenges and pave the way for a more transparent and consumer-centric food supply chain. As technology continues to evolve, integrating these solutions is poised to become increasingly sophisticated, further elevating the standards of safety, quality, and efficiency in the food packaging sector.

For Instance,

- In May 2022, MULTIVAC Group launched the R3 thermoforming packaging machine for the food industry. It is designed to be a cost-effective and sustainable packaging machine for the future.

Revolutionizing Packaging Efficiency with Vertical Form Fill and Seal Machines

Vertical Form Fill and Seal (VFFS) packaging machines have become indispensable across diverse industries, and their widespread adoption is rooted in their efficiency and cost-effectiveness. These machines prove to be optimal packaging solutions, maximizing the utilization of limited factory floor space.

The core structure and operation of vertical packing machines follow a consistent pattern. They use a substantial roll of film, shape it into a bag, fill it with goods, and then seamlessly seal it—all while moving vertically at impressive speeds of up to 100 bags per minute. This standardized process ensures a swift and reliable packaging mechanism.

VFFS machines exhibit remarkable versatility in handling various materials. They are adept at packaging Paper, Polystyrene, Polyethylene, Plastic laminate, Cellophane, Aluminum foil, Metalized film, and Composite film (laminated). This adaptability makes them suitable for a wide array of products, ranging from candies to crisps, detergent powder, juices, beverages like milk, snacks like nuts, and other food items such as oats. These machines find application across a broad spectrum of sectors, seamlessly meeting diverse production and packaging requirements imposed by specific businesses. Their efficiency not only reduces the labor required but also cuts down on associated expenses, particularly for the production of large quantities of items.

One of the standout features of VFFS machines is their ability to output between 30 to 200 bagged items every minute. This high-speed production capability not only saves money but also enhances market competitiveness. The increased output provides customers with a broader range of choices, thereby contributing to expanded market reach. The integration of vertical packaging equipment proves to be a strategic and effective method for businesses looking to optimize their production processes, reduce costs, and stay competitive in today’s fast-paced market landscape.

For Instance,

- In November 2023, SEE has unveiled the introduction of the CRYOVAC CE Vertical Form-Fill-Seal System. It is cutting-edge automated packaging solution is meticulously crafted to address the distinctive needs of liquid products.

Competitive Landscape

The food packaging technology and equipment market is characterizing characterized competition among key industry players, including Arpac LLC, Oyster Holding GmbH, Bosch Packaging Technology, GEA Group, Coesia Group, Innovia Filmckner Pentaplas, Ishida Co. Ltd, MULTIVAC Group, Omori Machinery Co. Ltd., Nichrome India Ltd., Robert Bosch GmbH, Lindquist Machine Corporation, and IMA Group. These entities are making significant investments in manufacturing Food Packaging Technology and Equipment market solutions. Notably, industry leaders are adopting inorganic growth strategies such as acquisitions, mergers, partnerships, and collaborations to augment their product portfolios, thereby contributing to the global expansion of the Food Packaging Technology and Equipment market.

In December 2023, Global packaging machinery maker Serac claimed that its newly established cup sector brought in $31.6 million in revenue, installing more than 1,000 machines and dosing systems for significant clients. Serac, the global leader in producing food product cup packaging equipment, aims to increase its production by thirty per cent in the next three years.

Major Key Players in the Food Packaging Technology Market Include:

- Arpac LLC

- Oyster Holding GmbH

- GEA Group

- Bosch Packaging Technology

- Coesia Group

- Innovia Filmckner Pentaplas

- Ishida Co. Ltd

- MULTIVAC Group

- Nichrome India Ltd.

- Robert Bosch GmbH

- Omori Machinery Co. Ltd.

- Lindquist Machine Corporation

- IMA Group

Recent Developments

- In March 2023, Cepac, the UK’s most inventive and active corrugated packaging company, purchased EW Cartons, a sustainable corrugated tray manufacturer.

- In May 2023, Amcor, a leader in developing and producing sustainable packaging solutions globally, said that it had finalized a deal to purchase Moda Systems, a top producer of automated, cutting-edge protein packaging equipment.

- In August 2023, The Oregon-based GEM Equipment, which produces fryers and blanchers, was acquired by the international freezing and cooling equipment manufacturer FPS Food Process Solutions.

- In August 2023, The UK-based food company Regal Food Products Group announced that it acquired Packaging ‘R’ Us, a supplier of disposable food packaging solutions.

- In December 2023, The Packaging Development Centre, worth US$10.8 million, was officially opened by SIG on the location of the company’s packaging facilities in Linnich, Germany.