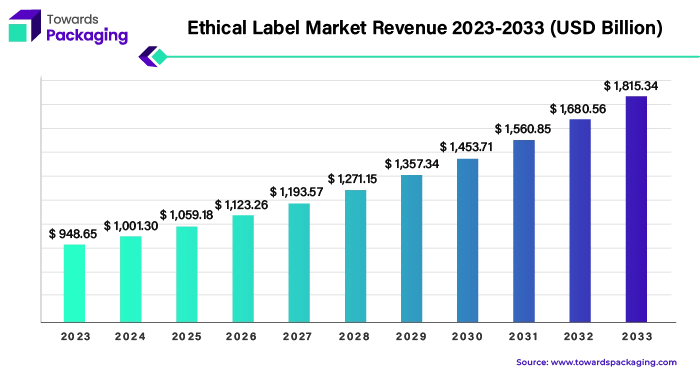

The global ethical label market size is estimated to reach USD 1815.34 billion by 2033, up from USD 948.65 billion in 2023, at a compound annual growth rate (CAGR) of 6.83% from 2024 to 2033.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5218

The ethical label market is anticipated to augment with a considerable CAGR during the forecast period. Ethical labels, like Fairtrade, came into existence to assist the customers in recognizing goods and businesses offering a diverse range of ethical assurances. And there are constantly new ones emerging. Products that fulfill specific requirements are acknowledged by them, such as providing fair compensation to the laborers or adhering to the animal welfare guidelines. However, there are significant differences between them in terms of the real level of ethical demands and the strength of their checks. Ethical labels are now widely used. Moreover, sustainable labels have become popular since they provide businesses with a means of handling ethical concerns and provide activists with an effective model for enacting change. The Ecolabel Index tracked 455 labels in 25 industry categories and 199 countries in 2022.

From 2025 to 2030, the global ethical label market is projected to experience significant growth, with an estimated increase from USD 1059.18 billion in 2025 to USD 1453.71 billion by 2030. This represents a robust compound annual growth rate (CAGR) of 6.83% during this period. The rise of new ethical certifications and the growing focus on corporate social responsibility are expected to further accelerate market expansion, reflecting a strong commitment from businesses and consumers alike to support and promote ethical and sustainable practices.

The rising consumer awareness and the demand for sustainable and ethically produced goods coupled with the growing importance of food safety is anticipated to augment the growth of the ethical label market within the estimated timeframe. The integration of Corporate Social Responsibility (CSR) into business strategies along with the supportive regulatory frameworks and government initiatives is also expected to support the market growth. Furthermore, the development of new certification standards and product innovations as well as the increasing number of collaborations between businesses, non-governmental organizations (NGOs), and regulatory bodies is also likely to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Key Trends Fairtrade and Sustainability Initiatives

- According to the research by Fairtrade International’s, Fairtrade is the most well-known and reliable label, and there is still a lot of attention for ethical and environmental certificates. In order to guarantee that producers receive an equitable cost, the majority of consumers are also ready to pay extra for products that have ethical labels.

- In terms of demographics, those between the ages of 18 and 34 are far more probable as compared to the older people to be aware of the environmental and the ethical labels. They are also considerably inclined to report purchasing a number of Fairtrade items each month.

- There are numerous procedures in place to increase the transparency and support the customers in making wise decisions. For instance, Foundation Earth (FE) developed and implemented a prototype eco-score labeling program utilizing the “Eco-Impact” approach in September 2021. This program offers a comprehensive overview of the carbon emissions, water pollution, and water use and biodiversity loss over the course of a product’s life cycle.

- Also, restaurants are looking into measures to reduce their environmental effect and inform customers of these initiatives. As a result, several restaurants suggest an improved climate-friendly offering on their menus by using labels or terms connected to sustainability.

- North America held largest market share of 35.01% in 2023. This is owing to the high consumer awareness and the demand for sustainable products, strong CSR initiatives by companies along with the supportive regulatory environments.

- Asia-Pacific is expected to grow at a CAGR of 8.91% during the forecast period due to the expanding middle class, increasing urbanization as well as the traditional sustainable practices.

Market Drivers

Growing Consumer Awareness and Demand

The increasing awareness about environmental and social issues and the growing demand for transparency and accountability to augment the growth of the ethical label market during the forecast period. Consumers are increasingly conscious of how their product choices affect both themselves and the globe. Clean labeling is becoming a customer demand instead of a trend, and the food packaging industry as a whole is reacting by emphasizing these features more and more.

In a worldwide poll conducted by the Fairtrade America of 11,150 customers, comprising 2,200 consumers of the United States and discovered that the 61% of the people identify the Fairtrade label, representing a 118% increase in familiarity since 2019. In general, 72 percent of the customers stated they trusted the label, with forty-eight percent stating they had some faith in it and 38% stating they had a great deal of faith in it. Additionally, Consumers are becoming more interested in Fairtrade items in stores and are ready to pay more for them. Sixty-seven percent of consumers believe, or strongly agree, that they would be willing to pay extra for these products in spite of inflation. The frequency with which consumers buy Fairtrade products has also increased; 91% of consumers who are aware of the Fairtrade label report are obtaining certified goods either occasionally or frequently.

Furthermore, concerns regarding the animal utilization in the production of the food are being expressed by consumers, interest organizations and the legislators, leading to a growing conversation about animal welfare. For instance, according to a study conducted by the American Society for the Prevention of Cruelty to Animals (ASPCA) in 2023, 79% of the participants were worried about how industrial animal husbandry would affect the welfare of animals. In the same way, almost half of the EU residents want clear information about the care and upbringing of animals (European Commission 2022). The labels make the animal welfare feature more noticeable, which helps the consumers distinguish between products that meet the highest and lowest criteria for animal care. Due to this, companies are using ethical labels in greater numbers to stand out in an increasingly competitive sector, draw in socially conscious customers as well as promote brand loyalty. It is anticipated that this pattern will hold true, further fueling the market growth for ethical labeling.

Market Restraints

Difficulties with Certifications

The main issues with the certifications are related to the customer awareness and corporate expenses. The expense of becoming verified or certified is the largest obstacle for firms. Furthermore, the certification procedure could be expensive, time-consuming, and uncertain. The original cost estimate for a firm will go up due to unanticipated expenditures, lab analyses, reviews, etc., as is the case with many custom evaluations. The majority of firms in various nations might not be able to afford the high cost of becoming accredited with certain labels. As per the U.S. Small Business Administration, small firms generate up to two-thirds of the net new jobs and account for over 44% of the economic activity in the country. This puts small enterprises at a disadvantage as even if they implement the sustainable and ethical policies, the cost barrier won’t represent their good practices. Since small firms have minimal access to their intended audience or the niche of sustainable customers, larger companies with larger marketing costs will continue to beat them.

Furthermore, the largest barrier to customer communication is the consumer education as well as awareness. Majority of the customers, particularly people who do not actively seek out sustainable items, are unlikely to comprehend the relevance or the function of the certifications and labeling. Customers might not recognize the significance of a certification or sustainable label even after seeing it on several products for years. Eliminating the knowledge gap is essential for a business to get the benefits of obtaining the certification. A company’s strategic plan should include selecting the most suitable or reputable certification as it is a means for demonstrating its dedication to better practices.

Market Opportunities

Increasing Government Initiatives and Growing Partnerships

The increasing government initiatives and growing partnerships between non-governmental organizations (NGOs), governmental bodies and other businesses, companies is likely to create significant opportunity for the growth of the market in the years to come.

- In April 2024, the Middle East Vegan Society (MEVS) and V-Label formed a new cooperation to promote transparent and clear labeling of vegetarian and vegan items in the Middle East. This partnership is a major step forward for the promotion of plant-based diets and the growing number of Middle Eastern customers who are adopting vegan diets.

- In July 2023, the mandatory production labeling system in Germany was approved by the Bundesrat/Federal Council. Initially aimed at items derived from fattening pigs, the program known as Tierhaltung is anticipated to swiftly expand to encompass other animal species and entities beyond the retail industry, like manufacturers and restaurants. It will increase customer support for greater welfare options and bring attention to animal welfare standards.

- In June 2023, a multi-step initiative to improve the verification of claims about growing animals was announced by the U.S. Department of Agriculture (USDA). In addition to implementing President Biden’s Executive Order on Promoting Competition in the American Economy, this action expands upon the substantial work USDA has previously done to safeguard consumers from false and misleading labels.

- In February 2023, in an effort to support farmers and agricultural workers in achieving the Sustainable Development Goals (SDGs) and working toward Agenda 2030, Fairtrade and the International Trade Centre (ITC) announced an expanded partnership.

These collaborative efforts demonstrates how the partnerships help in overcoming the industry challenges such as green washing, certification challenges and inconsistent standards as well as promotes sustainable and ethical practices on a global scale, benefiting businesses, consumers and the environment.

Detailed View of Market Segments

Label Type Segment Analysis Preview

The sustainability and Fairtrade labels segment captured significant market share in 2023. Fairtrade is a globally recognized and accepted sustainability label. Over 500 million small-scale communities of farmers rely on agriculture for their livelihoods, thus maintaining a sustainable environment is essential. Farmers provide the food, textiles and fuel that consumers, merchants, and retailers depend on to meet the basic demands of an expanding world population. By using a distinctive, two-pronged strategy, Fairtrade labels seek to encourage environmentally friendly practices and sustainable food production. Farmers that adhere to the Fairtrade standards and get recognized as Fairtrade producers are expected to enhance the water and soil effectiveness, manage the pests and the waste, refrain from applying dangerous pesticides, minimize the production of greenhouse gases and safeguard the biodiversity. In addition to supporting healthy plants and attracting wildlife that helps manage pests and illnesses, this enables farmers to improve their property and create nutrient-rich soils.

In terms of production, Fairtrade encourages and supports the application of agro-ecology concepts to move to stronger farming methods and to put measures in place for adapting to the changes in the environment. Fairtrade actively participates in the commercial sphere and promotes greater environmental equity in trade by examining laws that attempt to address the damaging effects of trade activities upon the environment. To enable farmers and workers around the world access carbon funding to help combat the consequences of climate change, Fairtrade also provides the opportunity to create Fairtrade Carbon Credits through the Fairtrade Climate Standard, which is in partnership with the Gold Standard.

Buy Premium Global Insight: https://www.towardspackaging.com/price/5218

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/