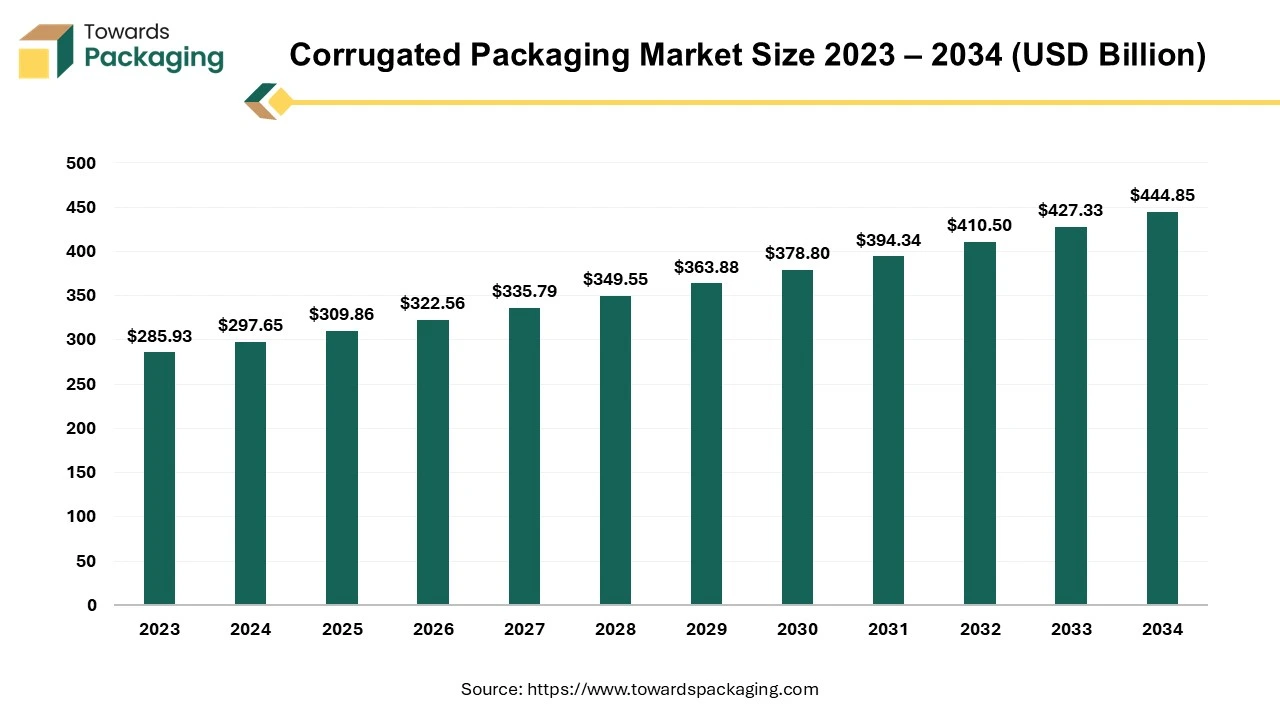

As of mid-2024, promising signs are emerging that the cardboard box recession, which has plagued the U.S. since late 2022, may finally be nearing its end. This resurgence in demand for cardboard boxes could signal a broader economic recovery, as an estimated 80 percent of the U.S. economy depends on the movement of goods through corrugated boxes. The global corrugated packaging market, valued at USD 297.65 billion in 2024, is predicted to reach USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2024 to 2034. This indicates not only a recovery in the U.S. but also global growth in the packaging industry.

Get All the Details in Our Solution – Download Brochure: https://www.towardspackaging.com/download-brochure/5063

Background of the Cardboard Box Recession

The downturn, often referred to as the “cardboard box recession,” began to take hold at the close of 2022, continuing well into early 2023. Analysts even compared the situation to the Great Financial Crisis due to the severe challenges the packaging industry faced during this period. Many packaging companies had high expectations for a rebound in containerboard demand by the end of 2023, especially with new mills coming online to increase production. However, early 2023 reports indicated that the anticipated recovery might not materialize until 2024, leaving the industry in a state of uncertainty.

Recent Industry Insights and Positive Trends

Fast forward to mid-2024, and an industry survey is suggesting that the U.S. box recession is coming to an end. The growth outlook for box shipments has seen a significant improvement, shifting from a modest 0.6 percent to over 3 percent. This positive change is considered a substantial indicator of recovery.

The survey revealed a widespread sentiment that box prices will likely continue to rise, largely driven by ongoing inflation and increased costs within the industry. Despite the signs of recovery, box shipments had stagnated due to destocking and other factors since the latter half of 2022. However, the recent uptick in shipments indicates a resurgence in consumer demand and the potential for significant restocking activities.

E-Commerce and Price Adjustments

Encouragingly, the survey also pointed to an optimistic outlook for e-commerce, leading analysts to revise their forecasts upward. Expectations for pricing and earnings have been increased by 2 to 4 percent as a result. This news has been eagerly awaited by the packaging market, which faced considerable challenges following a sharp drop in old corrugated containers (OCC) and mixed paper prices toward the end of 2022. While these prices have been slow to rebound, the positive momentum in box shipments has begun to ease pressure on the sector.

Impact of Rising Costs and the Recycled Fiber Market

The packaging industry, heavily reliant on recycled fiber, has faced rising costs related to labor, freight, and fiber. Prices for recycled fiber, including transportation premiums, have surged by about $100 per ton. In response, containerboard companies are adjusting their pricing to offset these inflationary pressures while banking on the increased demand for packaging materials.

Survey Reflections and Future Outlook

Survey results further reinforce the positive outlook. Looking ahead, 62 percent of respondents anticipate demand to be either “better” or “much better” over the next six to twelve months. This is a dramatic improvement from the 39 percent who shared the same sentiment in April 2024. This optimism signals a much-needed boost for the industry, suggesting that the cardboard box market is on the verge of a significant turnaround, which could contribute to broader economic growth.

As the industry adapts to rising costs and shifting demand patterns, the revival of box shipments and price increases point toward a stabilizing and possibly growing market. The global corrugated packaging market is also set to benefit, with its anticipated growth from USD 297.65 billion in 2024 to USD 444.85 billion by 2034, reflecting a broader trend of recovery and expansion in the packaging sector. This development suggests that the cardboard box industry’s revival could herald a brighter economic landscape, driven by the essential role of packaging in the movement of goods across the U.S. and around the globe.

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5063

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/