Report Highlights: Important Revelations

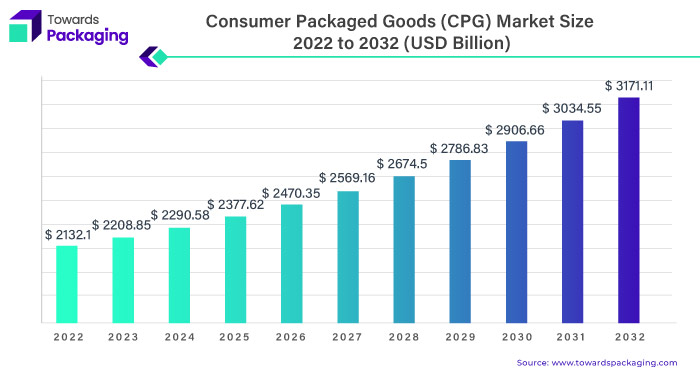

- The global consumer packaged goods (CPG) market is anticipated to witness substantial growth, with an value of USD 2,132.1 billion in 2022.

- This growth trajectory is projected reaching an value of USD 3,171.11 billion by the year 2032.

- Over the period from 2023 to 2032, the market is expected to experience a CAGR of 4.1%.

- Interconnected markets driving consumer packaged goods companies to explore international opportunities.

- North America’s CPG industry commands a $2 trillion valuation.

- Asia Pacific’s consumer package goods set to expand rapidly by 2030.

- Food and beverage reigns supreme in consumer packaged goods sales.

- Consumer packaged goods companies prioritize large offline retailers in operations.

Consumer Packaged Goods (CPG) Market Overview:

-

- CPGs are essential for daily life, ranging from food and beverages to apparel and cosmetics.

- The sector shows robust growth with an 8% year-over-year increase, reaching a projected $1.62 trillion in annual sales.

Interconnected Markets Driving Consumer Packaged Goods Companies to Explore International Opportunities

- CPG products, from food and beverages to personal care items, constitute essential and routine consumer purchases, driving consistent demand.

- The perishable nature of many CPG goods and the routine consumption patterns necessitates regular replenishment, ensuring a continuous market demand.

- The broad spectrum of CPG offerings, including food, clothing, cosmetics, and household items, caters to a wide range of consumer needs, expanding market reach.

- Shifting consumer preferences and evolving lifestyles influence the types of CPG products in demand, prompting innovation and adaptation by manufacturers.

- Technology integration in manufacturing, distribution, and marketing processes enhances efficiency, reduces costs, and improves overall supply chain management for CPG companies.

- The rise of online shopping platforms provides consumers convenient access to a wide array of CPG products, reshaping traditional retail dynamics and expanding market accessibility.

- Increasing health and wellness awareness influences consumer choices, driving demand for healthier food options, organic products, and environmentally friendly packaging within the CPG sector.

- As markets become increasingly interconnected, CPG companies are exploring global opportunities, leading to the expansion of their product distribution and market presence.

- Growing environmental consciousness among consumers propels CPG companies to adopt sustainable practices, including eco-friendly packaging, reducing emissions, and incorporating responsible sourcing.

Sustainability Initiatives:

-

- CPG companies are adopting sustainability practices, particularly in packaging, to reduce environmental impact.

- Holistic sustainability initiatives extend beyond packaging, including emission reduction and responsible sourcing.

Consumer Preferences Across Generations (2023):

-

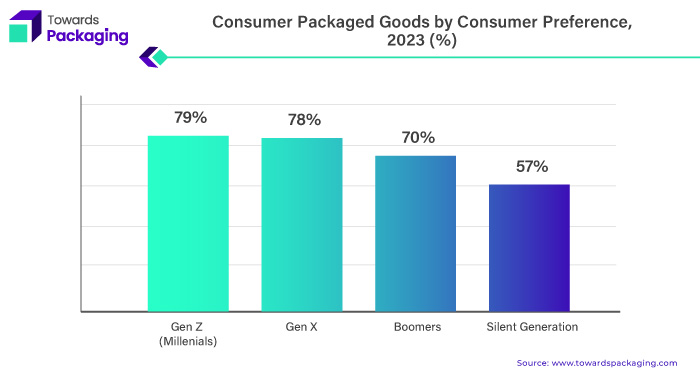

- Millennials (Gen Z) show the highest preference for CPG products (79%).

- Generation X closely follows with a preference of 78%.

- Boomers also have a substantial preference (70%), while the Silent Generation shows a relatively lower preference (57%).

Interconnected Markets Driving CPG Opportunities:

-

- CPGs, being essential, drive consistent demand with routine replenishment.

- A broad spectrum of CPG offerings meets diverse consumer needs, expanding market reach.

- Technology integration enhances efficiency, while online platforms reshape retail dynamics.

Consumer Packaged Goods (CPG) Market Trends (2023):

-

- Significant shift towards online marketing and e-commerce.

- Embrace of eco-friendly practices, including sustainable packaging.

- Direct-to-consumer expansion for enhanced brand loyalty.

- Prioritization of supply chain resilience to mitigate risks.

North America’s CPG Industry ($2 Trillion Valuation):

-

- North America’s CPG industry is valued at $2 trillion.

- Industry leaders like Coca-Cola, Procter & Gamble, and L’Oréal play key roles.

- Increased marketing expenditures, with 23% of CPG budgets dedicated to marketing initiatives.

Global Expansion and Opportunities in Asia:

-

- Asia’s consuming class is rapidly expanding, with 3 billion individuals (70% of the population) projected to join by 2030.

- Projections for specific countries like Indonesia and India show substantial growth in the consuming class.

- Higher-income consumers are expected to lead future consumption growth.

Food and Beverage Dominance in CPG Sales:

-

- Food and beverage represent 44% of online CPG sales, generating a projected $26,774 million in revenue.

- Ongoing challenges include raw material shortages, production delays, and increased costs.

Offline Retail Dominance:

-

- Large offline retailers dominate CPG transactions, with $297 average spending on food and beverage products.

- Online spending is growing but remains at $64, highlighting the enduring significance of physical retail channels.

Top 10 Consumer Goods Companies (2023):

-

- Nestlé, PepsiCo, LVMH, Procter & Gamble, JBS, Unilever, AB InBev, Tyson Foods, Nike, and Coca-Cola lead the industry.

- Competition involves innovation, sustainability, and adapting to changing consumer preferences.

Recent Developments and Market Segments:

-

- Chobani acquires La Colombe for $900 million.

- Mars acquires UK Chocolate Brand Hotel Chocolat.

- General Mills establishes Fera Pets through the acquisition of Veterinarians.

- e.l.f. Beauty purchases Naturium for $355 million in shares and cash.

Consumer Packaged Goods (CPG) Market Segments:

-

- Segmentation by application includes food and beverage, household supplies, personal care, and cosmetics.

- Distribution channels include online and offline.

- Regions covered are North America, Europe, Asia Pacific, and LAMEA.