Aerosol Packaging Market Overview Growth, Trends and Key Players

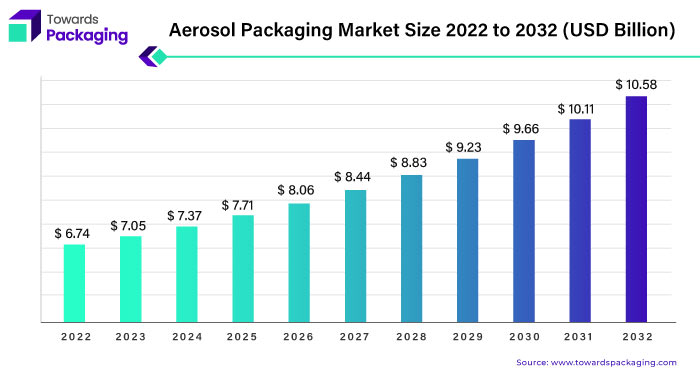

The global aerosol packaging market is expected to expand significantly, growing from USD 6.74 billion in 2022 to approximately USD 10.58 billion by 2032. This growth reflects a compound annual growth rate (CAGR) of 4.62% from 2023 to 2032.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5130

Aerosol Packaging Market Trends

The aerosol packaging market is experiencing several key trends that are shaping its growth and future outlook:

- Sustainability Focus: There is a growing demand for eco-friendly and recyclable aerosol cans, driven by the increasing global focus on sustainability. Companies are investing in greener packaging materials like aluminum and recyclable plastics to reduce environmental impact.

- Technological Advancements: Innovations in aerosol dispensing technology, including precision valves and eco-friendly propellants, are improving the functionality and environmental footprint of aerosol products.

- Expansion in End-Use Industries: The demand for aerosol packaging is rising across various sectors, such as personal care, household products, pharmaceuticals, and food and beverages. This diversification of applications is fueling market growth.

- Convenience Packaging: Aerosol packaging’s convenience, portability, and ease of use make it increasingly popular among consumers, especially in personal care and cleaning products.

- Regional Growth: Developing regions, particularly in Asia-Pacific and Latin America, are seeing a rise in the use of aerosol products due to economic growth, urbanization, and a growing middle class.

Aluminum: The Backbone of Aerosol Packaging

Aluminum is the primary material used in aerosol packaging, offering strong protection for a wide range of products. While brands like Peli are well-known for creating durable, watertight cases, aluminum containers also play a crucial role in packaging, even if they don’t always get as much attention. As the industry moves toward sustainability, there’s an increasing demand for aluminum cans made with high percentages of recycled materials.

However, there is a need for a more reliable supply of high-quality aluminum scrap to support the complex production of aerosol cans. Additionally, creating a consistent recycling design is essential for making the recycling process more efficient and reducing both material waste and packaging complexity.

Aluminum bottles are commonly used in premium beverage and spirits markets, as well as for packaging chemicals, fragrances, and essential oils. However, the global shipment of aluminum aerosol containers fell by 3.9% to 2.9 billion units, as reported by the International Organization of Aluminum Aerosol Container Manufacturers (AEROBAL). Steel and aluminum are the most widely used materials for aerosol containers, followed by glass and plastic. In Europe, cosmetics and home goods dominate aerosol packaging production, accounting for more than 75% of the market.

Key Players in the Aerosol Packaging Market

Leading companies in the aerosol packaging market include Berry Global, Inc., Ball Corporation, Aptar Group Inc., Allied Cans Limited, Crown Holdings, Inc., SC Johnson & Son, Inc., Henkel AG & Co. KGaA, Beiersdorf AG, Exal Corporation, Euro Asia Packaging, and TUBEX GmbH.

Buy Premium Global Insight: https://www.towardspackaging.com/price/5130

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/