Growth of the Alcoholic Beverage Packaging Market

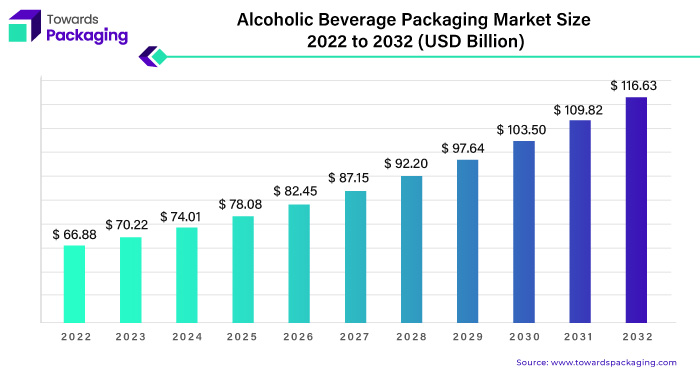

The global alcoholic beverage packaging market is expected to experience substantial growth, rising from USD 66.68 billion in 2022 to USD 116.63 billion by 2032. This growth reflects a compound annual growth rate (CAGR) of 5.8% from 2023 to 2032.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5104

Report Highlights: Key Insights

- The global alcoholic beverage packaging market is expected to grow from USD 66.68 billion in 2022 to USD 116.63 billion by 2032.

- The market is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2032.

- The alcoholic beverage packaging industry is thriving, driven by strong growth in the Asia-Pacific region and the increasing use of glass in packaging across North America.

- Glass is becoming a key trend in the spirits sector, and bottles that address environmental concerns are gaining popularity.

- Alcohol has a rich history, evolving from ancient methods of storage like gourds and clay flasks to modern packaging options such as glass bottles, cans, pouches, and bag-in-box containers. This evolution reflects advances in packaging technology and shifting consumer preferences.

- The alcohol industry is dynamic, balancing tradition with innovation to meet the needs of a modern, sophisticated consumer base. As alcohol consumption increases globally, packaging demands rise in response.

Rising Alcohol Consumption Driving Packaging Growth

From 1990 to 2017, global per-capita alcohol consumption grew from 5.9 liters to 6.5 liters. By 2030, it is expected to rise another 17%, reaching 7.6 liters. This surge in alcohol consumption is a major driver behind the growth of the packaging market.

Adapting to Consumer Demands

As consumer preferences shift towards convenience, sustainability, and unique experiences, alcoholic beverage companies are exploring new packaging options. The industry is adapting to modern demands by incorporating technology and embracing innovative packaging techniques while preserving traditional craftsmanship. The evolving history of alcohol packaging reflects the industry’s ability to adapt to cultural and social changes.

Glass Material Dominates Spirits Packaging

Glass packaging is especially popular in the premium and craft spirits sectors. Many consumers associate glass with high-quality products, with 79% of consumers linking it to superior spirits. Glass packaging enhances the brand’s image by providing a tactile experience and allowing for unique design features like embossing, hot stamping, and textured surfaces. These features contribute to the perceived premium value of the product.

Around 46% of premium spirits bottles have custom textures or shapes, emphasizing the importance of glass packaging in brand identity. Additionally, glass is infinitely recyclable, which appeals to environmentally conscious consumers. In fact, 74% of consumers are more likely to try a new spirit if it comes in a single-serve glass package.

Example:

In October 2023, Stoelzle Glass Group, a leading producer of high-quality glass bottles, introduced the Signature Collection at Luxepack Monaco. This collection featured ten uniquely designed glass bottles.

Key Market Players

- Amcor plc.

- Diageo PLC

- ProAmpac

- Tetra Pak Group

- Ball Corporation

- Ardagh Group S.A.

- Berry Global Inc.

- Sonoco Products Company

- Crown Holdings Inc.

- Brick Packaging

Recent Developments

- In August 2023, Beam Suntory and Frucor Suntory launched Suntory Oceania, a new AU$3 billion multi-beverage cooperation in Australia and New Zealand.

- In May 2023, EcoSpirits, a circular packaging startup, received a $10 million investment from Pernod Ricard.

- In August 2023, Tilray Brands acquired eight beer and beverage brands from Anheuser-Busch, expanding its presence in the US craft beer market.

- In August 2023, Crown Holdings Inc. acquired Helvetia Packaging AG, a beverage can and end production facility in Saarlouis, Germany.

Buy Premium Global Insight: https://www.towardspackaging.com/price/5104

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/