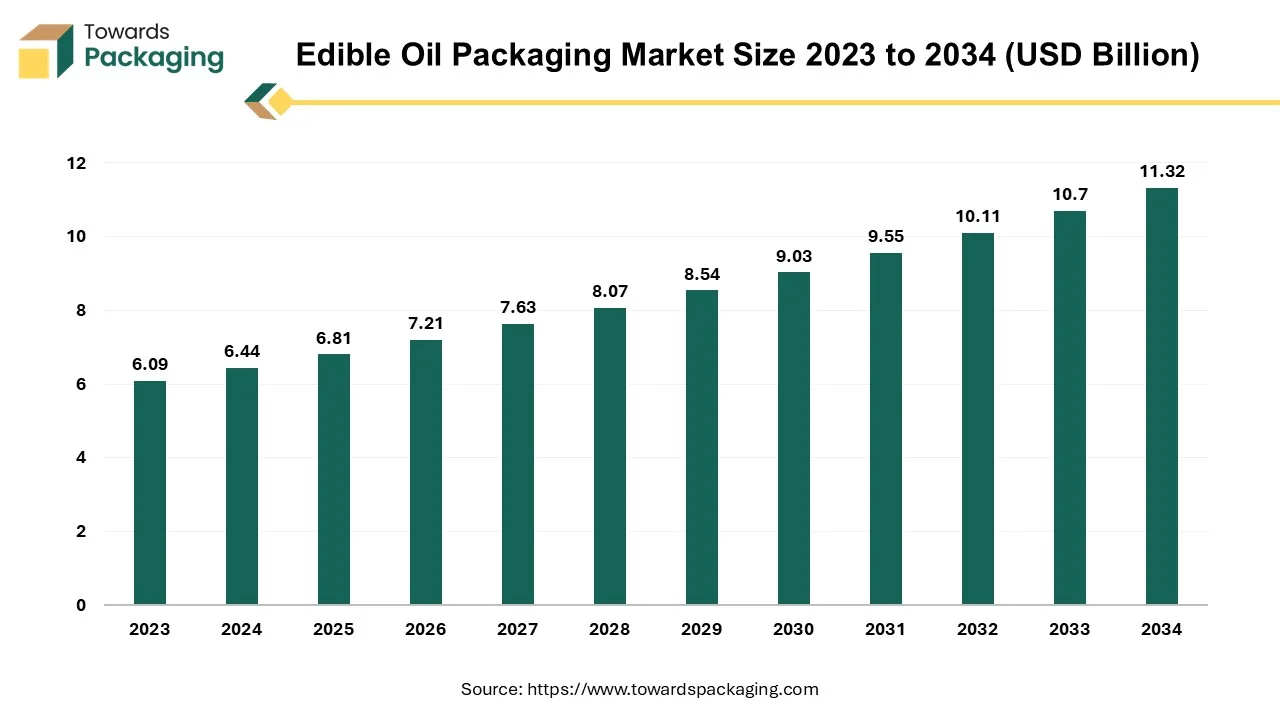

Edible Oil Packaging Market Growth Forecast (2023 – 2032)

The global market for edible oil packaging is expected to grow from USD 5.78 billion in 2022 to approximately USD 10.11 billion by 2032. This growth represents a compound annual growth rate (CAGR) of 5.8% from 2023 to 2032.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5178

Key Insights from the Report:

- The global edible oil packaging market is set for growth, starting at a value of USD 5.78 billion in 2022.

- The market is projected to reach approximately USD 10.11 billion by 2032, growing at a steady rate of 5.8% annually from 2023 to 2032.

- The growth of edible oil packaging in the Asia Pacific region is being driven by various factors.

- North America plays a key role in the growth of the edible oil packaging market, with several important drivers at play.

- Plastic packaging technology is essential to the edible oil industry, playing a significant role in packaging solutions.

- The market for edible oil bottles is also expanding, contributing to the overall growth of the sector.

- Packaging is playing a crucial role in supporting sustainable palm oil production.

- Retail stores are having a noticeable impact on the packaging of edible oils.

Edible Oil Packaging Market Trends

- Emphasis on Product Safety and Quality: Brands and manufacturers in the packaging sector prioritize consumer safety and product quality. Packaging testing is used to identify potential contaminants, allergens, and harmful substances, ensuring products meet safety standards.

- Growth in Packaging Innovation and Complexity: The rise in innovative and complex packaging solutions requires advanced testing methods to assess different materials, formats, and functionalities. This ensures packaging can meet evolving consumer demands.

- Focus on Sustainability and Environmental Impact: There is increasing attention on the environmental impact of packaging. Manufacturers are evaluating materials and processes to reduce waste and improve sustainability, reflecting consumer concerns about eco-friendly practices.

- Impact of Digitalization and Automation: The adoption of digitalization and automation in packaging testing labs is transforming the industry. These technologies improve testing efficiency, streamline processes, and enhance data management, making the packaging process faster and more accurate.

Role of Plastic Packaging in the Edible Oil Industry

Plastic has become the dominant material for edible oil packaging due to its ability to preserve the quality and freshness of oils. Plastic packaging offers several advantages: it provides a strong barrier against moisture, oxygen, light, and contaminants that could spoil the oil. It is also lightweight, recyclable, and durable, which reduces waste and makes it easier to store and transport without the risk of breakage or spillage.

Plastic packaging can be molded into various forms such as bottles, pouches, and containers, catering to diverse consumer needs. For example, PET bottles offer excellent oxygen and odor barriers, while HDPE bottles are known for their strength, chemical resistance, and durability. Multi-layered plastic pouches offer space-saving and lightweight properties, making them ideal for storage.

The growing demand for convenient, on-the-go packaging, along with advancements in sustainable and recyclable plastic technologies, is fueling the rise of plastic packaging in the edible oil market. As the demand for vegetable oils increases globally, the need for effective packaging solutions also grows, contributing to the expansion of plastic packaging in the sector.

Example:

In February 2023, Sunpure, a leading brand in Maharashtra, acquired Riso, a premium oil brand, to strengthen its market position.

Key Players in the Edible Oil Packaging Market

The edible oil packaging market is highly competitive, with established players like Cargill, Guala Closures, Nichrome Packaging, Sunpack Corp, Tetra Pak, Berry Global, Scholle IPN, Glenroy, Crown Holdings, Sealed Air, and Amcor leading the industry. These companies compete with new direct-to-consumer firms that use digital platforms to reach consumers. Competitive factors include product innovation, sustainability, and responsiveness to changing consumer preferences.

Cargill, for example, focuses on sustainable packaging, leveraging its extensive supply chain expertise to deliver oils in an environmentally friendly way.

Example:

In March 2023, Cargill introduced its Nutriferesh® product with the #Khitsistiehik campaign, aiming to promote a healthier lifestyle with oils that have 20% lower absorption, aligning with their vision to support active living.

Buy Premium Global Insight: https://www.towardspackaging.com/price/5178

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/