Table of Contents

ToggleElectronics APET Film Market Size, Trends and Developments

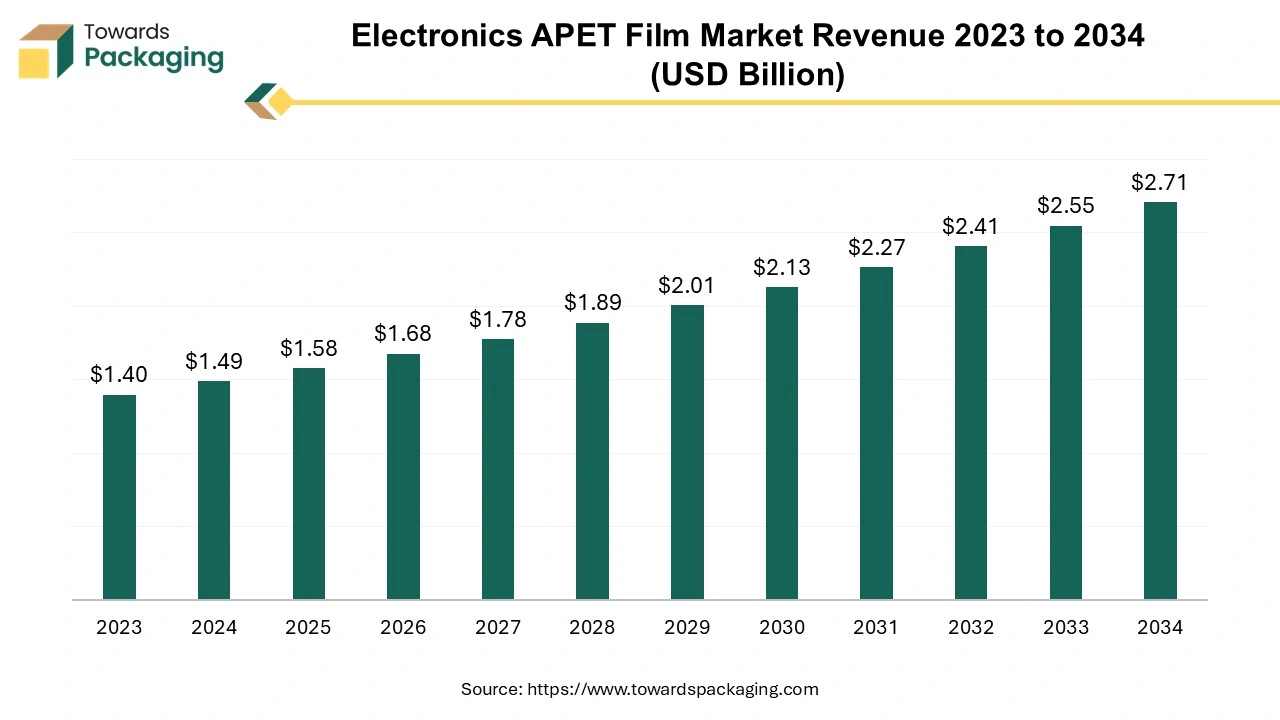

The electronics APET film market is projected to grow significantly, reaching a size of approximately US$ 1.49 billion in 2024 and expected to expand to around US$ 2.71 billion by 2034, reflecting a CAGR of 6.2% over the forecast period.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5321

The surge in the electronics APET film market is driven by the burgeoning electronics and electrical sectors, which require semiconductor devices and components such as circuit boards and semiconductors for various applications. The increasing prevalence of electrical devices across all industries further propels the demand for electronics APET film.

APET film, a rigid polyester or PET film, is rapidly gaining traction as a packaging material due to its exceptional strength, clarity, and ease of handling. Furthermore, its composition as an environmentally friendly alternative to conventional plastics, such as PVC film, enhances its appeal. The electronics APET film plays a crucial role in protecting sensitive components like circuit boards and semiconductors in diverse applications. The global packaging market is also expected to grow from USD 1.20 trillion in 2022 to USD 1.58 trillion by 2032, achieving a CAGR of 3.16%.

Key Drivers: Environmental Considerations

A major driver of market growth is the increasing demand for eco-friendly and biodegradable packaging solutions across industries. The thermal stability, recyclability, and clarity of electronics APET film help manufacturers reduce their environmental footprint. Additionally, the growing food and beverage sectors, alongside consumer preferences for clean and transparent packaging, further stimulate demand for electronics APET film. The versatile industrial applications of APET film, spanning electronics to automotive sectors due to its electrical insulating properties, contribute to its broadening market appeal.

A notable partnership occurred in September 2024 when Pester Pac collaborated with Solutum Technologies to develop an eco-friendly packaging solution aimed at creating sustainable film materials for wrapping machines and overwrapping systems.

Emerging Trends in the Electronics APET Film Market

- Increased Demand for Sustainable Packaging: There is a noticeable trend towards the sustainable packaging of electronic products, driven by innovative solutions and adherence to environmental regulations.

- Growing Electronics Consumption: The rising variety of electronic devices necessitates proper packaging methods to ensure product safety, with APET films serving as protective layers for large displays.

- Electronics Market Expansion: Urbanization and industrial growth in developing economies are fueling demand for electronic products across various sectors, driving the need for effective packaging solutions.

- Advancements in Packaging Technology: Ongoing innovations in integrated circuit packaging processes, including system-in-package (SiP), 3D packaging, and fan-out wafer-level (FOWL) packaging, are enhancing the capabilities of electronics APET films.

Market Opportunities: E-commerce Growth

The electronics APET film market is poised for further growth, particularly with advancements in technology. Innovations in handling techniques and surface treatments are expected to enhance the performance characteristics of electronics APET films, making them suitable for specialized applications in sectors like renewable energy and automotive. Additionally, the expansion of e-commerce necessitates robust packaging solutions that maintain product integrity, solidifying the position of electronics APET films as a preferred choice for both manufacturers and consumers.

Market players are increasingly prioritizing sustainability, with the development of bio-based alternatives to traditional electronics APET films representing a promising avenue in line with global initiatives aimed at reducing environmental impacts. The sector is experiencing significant growth driven by a combination of innovation, increasing demand, and shifting consumer preferences.

In March 2024, TOPPAN Holdings Inc. launched the GL-SP barrier film, utilizing biaxially oriented polypropylene (BOPP) technology, further demonstrating the trend toward sustainable packaging solutions.

Regional Insights: Asia Pacific as a Market Leader

In 2023, the Asia Pacific region dominated the electronics APET film market, attributed to its versatile applications and favorable market conditions. The increasing electronics industry in countries like Japan, India, China, Thailand, and South Korea has resulted in heightened demand for APET films.

The region’s focus on high-performance electrical products, including quality display screens, has spurred the demand for APET films, known for their heat resistance and lightweight properties. As environmental concerns grow, there is a shift towards sustainable packaging solutions, with APET films being favored due to their recyclability and lower energy consumption during production compared to other plastics. Stringent regulations governing plastic packaging also impact the growth of the electronics APET film market in this region. Additionally, ongoing infrastructure development is driving demand for high-quality electronics, further necessitating reliable packaging solutions that protect against damage, from minor scratches to more significant impacts.