Home Care Packaging Market Size, Growth and Trends

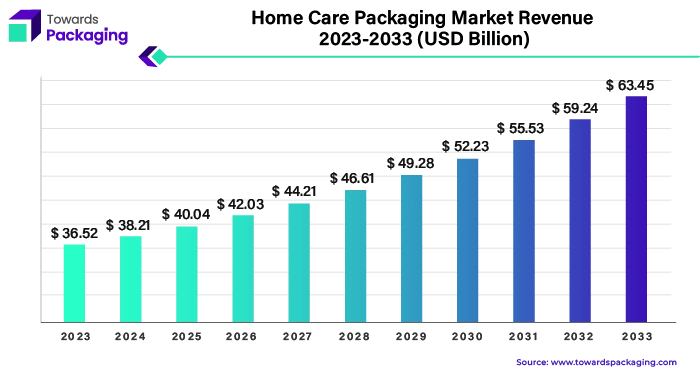

The global home care packaging market is projected to grow from USD 36.52 billion in 2023 to USD 63.45 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.79% from 2024 to 2033.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5194

Key Trends and Findings

Consumer research conducted by Amcor across Europe reveals that individuals are increasingly motivated to adopt sustainable living practices. However, many consumers find it challenging to grasp the meaning behind various environmental symbols, claims, and messaging, as well as to identify what environmentally friendly packaging truly entails.

In light of health concerns, customers are enhancing their cleaning and disinfection routines at home to eliminate visible and invisible pollutants and protect against potentially harmful viruses.

Refill options are emerging as a viable strategy for home care manufacturers. Refillable pouches for detergents, soaps, and cleaners allow consumers to repurpose their existing bottles, sprayers, and dispensers. Additionally, the lightweight and convenient shipping of refill pouches makes them easy to purchase online.

Reusable packaging is garnering attention from home care providers. Nearly half of these companies are either implementing or testing biodegradable and post-consumer recycled materials to align with their goals of reducing environmental impact and minimizing single-use plastics.

The Asia-Pacific region held the largest market share of 38.23% in 2023, driven by increasing urbanization, rising disposable incomes, and shifting lifestyle patterns. Meanwhile, North America is expected to grow at a CAGR of 4.87% during the forecast period, fueled by the expanding e-commerce sector and heightened consumer awareness of hygiene and cleanliness.

Market Drivers

Increased Consumer Focus on Cleaning Products

The growing emphasis on hygiene and sanitation, particularly following the COVID-19 pandemic, has significantly altered consumer behavior. More individuals are prioritizing cleanliness and establishing new routines, such as regularly washing clothes and disinfecting frequently touched items. This shift presents home care companies with an opportunity to engage more deeply with their customers. For example, P&G reported a over 30% increase in sales of their organic home care products in October 2020, with double-digit growth across all regions. In the U.S., 59% of consumers and 52% of UK consumers reported increased use of disinfectants and cleaning products, resulting in a rise in sales of bleach and other disinfectants. Unilever also experienced a doubling of turnover in home care products in 2021.

Moreover, home care products have evolved into lifestyle brands. These brands are now positioned to educate customers on the proper use of cleaning and disinfection products. For instance, Clorox has released numerous “how-to” guides, including instructions for creating homemade disinfectants. Unilever’s brand Domestos also saw significant double-digit growth by informing consumers about the importance of cleaning high-touch surfaces to prevent virus transmission, collaborating with environmental health experts in the process.

To maintain this heightened level of consumer engagement, brands should leverage innovative packaging to deliver effective usage information. Amcor’s MaXQ digital packaging, for instance, allows consumers to scan a code for instant access to cleaning tips and product guides. This approach not only enhances customer trust but also aids companies in tracking products, optimizing supply chains, and combating counterfeiting. It is anticipated that consumers will retain their heightened cleaning habits and awareness of home hygiene in the coming years.

Market Restraints

Growing Environmental Concerns and Stringent Regulations

Rising environmental concerns and regulations are likely to restrain growth in the home care packaging market during the forecast period. As global awareness of environmental issues increases, regulatory bodies are imposing stricter guidelines on packaging materials to mitigate their ecological impact. California, for example, has enacted comprehensive legislation aimed at reducing plastic use, mandating a 25% reduction in single-use plastics and expanded polystyrene by 2023. By 2028, at least 30% of all plastic products sold in the state must be recyclable, and by 2032, this requirement will increase to 65%. Noncompliance with these regulations can result in fines of up to $50,000 per day.

Similarly, the UK has introduced regulations aimed at reducing plastic usage. Starting in April 2022, companies that manufacture or import over ten tons of finished plastic packaging must register for the Plastic Packaging Tax, which imposes a fee of £200 per ton on plastics containing less than 30% recycled material. To qualify for an exemption, organizations must prove and maintain documentation showing that their plastic contains at least 30% recycled content. These laws and the overall shift toward a greener environment are expected to impact the home care packaging industry by limiting the types of materials available, thereby influencing design and cost structures.

Market Opportunities

Eco-Friendly Innovations Transforming Home Care Packaging

The rising consumer demand for eco-friendly products is anticipated to drive the need for sustainable packaging solutions within the home care market. This trend encompasses the adoption of biodegradable, compostable, and recyclable materials. Companies are increasingly investing in the development of sustainable packaging options to enhance brand loyalty and potentially justify higher price points.

Recent Developments by Key Market Players

- April 2024: Unilever disclosed the fast-acting laundry detergents in PCR PET bottle. The Wonder Wash laundry detergent is being distributed by the company in 100% recyclable PET bottles that contain 35% post-consumer recycled content. The detergent is intended to deliver an effective wash on a 15-minute cycle. It is anticipated that using post-consumer recycled content will assist Unilever in advancing its Sustainable Living Plan.

- March, 2024: Grove Collaborative Holdings, Inc. declared the debut of a new product and rebranding for Grove Co., its primary owned brand. The Company is offering updates on important sustainability efforts and key alliances in support of an emerging brand strategy that is focused on consumer demands and sustainability. This will help the Company continue to lead the industry beyond its dependency on single-use plastic trash.

- February, 2023: Grove Collaborative Holdings, Inc. revealed that its Grove Co. home care brand will now be officially available on Amazon, at a few Walmart locations nationwide, and on Walmart.com. From February 2023, a range of gel and foaming hand soaps from Grove Co. started to appear at more than 1,000 Walmart shops and on Walmart.com.

Market Companies

Some of the key players in home care packaging market are Amcor plc, Berry Global Inc., AptarGroup, Inc., Sonoco Products Company, Ball Corporation, RPC Group, Winpak Ltd., Silgan Holdings Inc., Sealed Air Corporation, and Smurfit Kappa Group, Ecover, and Chemco Group, among others.

Market Segment

By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

By Type

- Bottles & Containers

- Metal Cans

- Cartons & Corrugated Box

- Pouches & Bags

- Others

By Product

- Dishwashing

- Insecticides

- Laundry Care

- Toiletries

- Polishes

- Air Care

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Buy Premium Global Insight: https://www.towardspackaging.com/price/5194

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

Get a Subscription – Towards Packaging

With our commitment to delivering accurate and up-to-date data, our annual packages ensure continuous access to a wealth of valuable information.