Dairy Product Packaging Market Size and Key Players

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5100

Report Highlights: Important Revelations

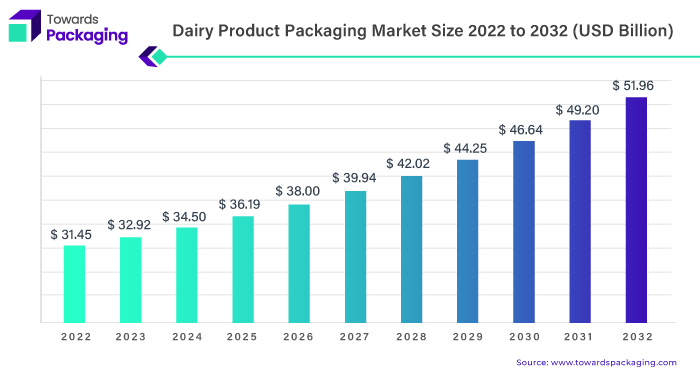

- Current Market Size (2022): USD 31.45 billion.

- Projected Market Size (2032): Land up at USD 51.96 billion.

- Compound Annual Growth Rate (CAGR): Anticipated growth rate of 5.2%.

- Growth Period: The growth is expected to occur between 2023 and 2032.

- Asia Pacific’s dominant force in the growing dairy product packaging market.

- Shaping consumer preferences in North America’s dairy product packaging.

- Significance of continuous packaging innovation in the evolving cheese market.

- How packaging innovations shape the future of the dairy industry.

- Plastic packaging solutions for dairy distribution and storage.

Dairy Product Packaging Market Trends

Convenience-Oriented Packaging

Sales in dairy product packaging continue to be driven primarily by convenience. Consumers are increasingly seeking packaging that is easy to handle, offers portion control, and can be resealed. As the demand for efficient, time-saving solutions rises, single-serve options, on-the-go products, and user-friendly designs are becoming more popular.

Smart Packaging Technologies

Innovative solutions are emerging in dairy product packaging, incorporating smart technologies such as QR codes, RFID tags, and sensors. These advancements provide consumers with information about product origin, freshness, and safety. Additionally, smart packaging assists dairy producers in optimizing inventory management and supply chain processes.

Customization and Personalization

The dairy industry is responding to diverse consumer preferences by offering more customizable and personalized packaging options. This trend includes personalized labels, varying packaging sizes, and tailored product compositions that address specific dietary needs. Brands are leveraging technology to enhance the consumer experience through greater personalization and engagement.

Extended Shelf-Life Packaging

Extending the shelf life of dairy products is crucial for both producers and consumers. Packaging solutions that enhance freshness and prevent spoilage are increasingly popular. Techniques such as Modified Atmosphere Packaging (MAP) and vacuum packing help improve product longevity and reduce food waste.

Asia Pacific’s Dominance in the Dairy Product Packaging Market

The Asia Pacific region has established itself as a leading force in the dairy product packaging market, experiencing rapid growth and making significant contributions to the sector’s overall expansion. Several factors underpin the region’s importance in this market, including its status as the largest milk-producing area globally. In 2022, production is projected to grow by 2.1% annually, reaching approximately 419 million tonnes, with significant increases expected in countries like India, China, Japan, Pakistan, Uzbekistan, and Kazakhstan.

The rising population and increasing disposable incomes in many Asia Pacific nations have led to heightened dairy consumption. As demand grows for dairy products such as milk and various cheese types, the need for effective and efficient packaging solutions has also surged. Additionally, urbanization and evolving lifestyles in the region have created a preference for convenience-oriented dairy products, prompting packaging manufacturers to adapt their offerings to meet consumers’ desires for ready-to-eat and on-the-go options.

Innovations in the Dairy Market

The Asia Pacific region has witnessed remarkable advancements in packaging technologies and materials. Manufacturers are investing in cutting-edge facilities and adopting sustainable practices to address global environmental concerns. The diverse range of dairy products consumed in the region, from traditional milk to dairy-based snacks, has driven demand for adaptable and customizable packaging solutions. This variety necessitates a responsive dairy product packaging market.

The leadership of the Asia Pacific dairy product packaging market can be attributed to factors such as population growth, rising disposable incomes, changing lifestyles, technological advancements, and varied consumer preferences. As the region’s economy and culture continue to evolve, the Asia Pacific dairy product packaging market is poised to remain a dynamic and influential player in the global landscape.

For Instance:

In September 2021, the Dairy Farming Promotion Organization of Thailand (DPO) launched the “National Milk” product line in SIG’s portable carton packs made from SIGNATURE Full Barrier packaging material, marking a first for Asia with certified forest-based renewable materials.

North America: A Key Player in Dairy Product Packaging

North America is the second-largest market for dairy product packaging, characterized by a vibrant business environment and several factors contributing to its prominence. The region’s sophisticated consumer base, which favors a variety of dairy products, significantly drives market share. Changing consumer preferences in North America are influenced by sustainability, convenience, and health considerations, fostering demand for innovative and user-friendly packaging solutions. The region’s technological and manufacturing expertise has led to the development of packaging techniques that align with these shifting consumer demands.

For Instance:

In February 2022, Danone North America’s plant-based Silk brand expanded its product line to include Silk Enhanced Almond Creamers and Silk Sweet Oat Latte Creamer.

The North American dairy industry has experienced a surge in premium and specialty dairy product consumption, heightening the demand for packaging that preserves freshness and enhances brand experience. Consequently, packaging manufacturers are investing in research and development to create solutions that cater to the premiumization trend in the dairy sector. North America’s strong position in the dairy product packaging market is supported by consumer-driven trends, technological innovation, and a responsive packaging industry that meets the evolving demands of the market.

Continuous Packaging Innovation in the Evolving Cheese Market

Cheese dominates the specialty foods sector in the United States, showcasing sustained market growth year after year. With around 600 cheese varieties produced and over 1,000 licensed artisan, specialty, and farmstead cheesemakers, the country offers an array of handmade, naturally flavored, and farm-fresh cheeses. This diversity is increasingly appealing to consumers, reflecting a growing preference for artisanal and unique dairy products. Notably, cheese ranks 112th among globally traded items. Despite its low ranking, the cheese sector has witnessed significant growth, largely due to packaging innovations that address consumer needs.

A prominent example of packaging innovation is Sargento’s successful launch of Balanced Breaks, on-the-go cheese snacks. This creative packaging approach aligns with evolving consumer lifestyles, offering convenient, portable solutions that drive sales. Insights into consumer preferences indicate diverse choices in packaging size and type. Preferences vary, with notable interest in containers for shredded (34%), sliced (35%), and cottage/ricotta (36%) cheeses. Block (36%) and spread (41%) cheeses also see strong preference, while a significant portion of respondents (39%) expressed no preference for block cheese packaging, indicating opportunities for innovative solutions.

For Instance:

In December 2023, a French brand introduced premium cheeses in recyclable paper packaging supplied by Amcor, a leader in flexible and paper packaging.

The Impact of Packaging Innovations on the Future of the Dairy Industry

Packaging plays a crucial role throughout the food and beverage value chain, from production to consumption, being essential for developing and maintaining robust food supply networks. This overview emphasizes packaging’s significance in the dairy supply chain and its impact on consumers’ daily lives, promoting sustainability and resilience. The goal is to create packaging that minimizes environmental impact while enhancing the overall efficiency of food supply networks. A nuanced approach is required to understand the factors influencing the dairy industry’s packaging material choices.

The focus lies in achieving the right balance between essential packaging functions and environmental considerations. No single packaging material is universally suitable; rather, the selection requires a careful equilibrium between fulfilling basic needs and minimizing environmental effects. Dairy products must be packaged using inert materials to prevent interactions with their contents. However, new developments in container design are shifting toward incorporating customized interactions to extend the shelf life of dairy products, encapsulated in the concept of “smart, active, or intelligent packaging,” where innovative methods enhance packaging’s functionality beyond mere containment.

For Instance:

In August 2023, materials science company Dow launched an all-polyethylene (PE) yogurt pouch in collaboration with Chinese dairy manufacturer Mengniu.

Plastic Packaging Solutions for Dairy Distribution and Storage

Plastic packaging combines strength, lightweight properties, stability, ease of sterilization, and flexibility (from films to rigid applications) for dairy products. For example, plastic packaging does not alter the flavor or quality of dairy items. Currently, plastic constitutes over 75% of dairy product packaging. Its barrier properties protect food from external contamination while preserving its natural flavor. Moreover, plastic packaging provides practical distribution and storage solutions, showing high resistance to heat, cold, and moisture. Multi-layered plastic films extend the shelf life of perishable foods and can be recycled, repurposed, or used for energy recovery.

For Instance:

In November 2023, Sidel introduced a new ultra-light and ultra-small PET dairy product bottle, designed to provide liquid dairy producers with a competitive edge.

High-density polyethylene (HDPE) is the preferred material for pasteurized milk storage containers, while polyethylene terephthalate (PET) is commonly used for milk packaging. Pigmented polymer-emulsion (PET) coatings protect food flavor from light-induced lipid oxidation. Additionally, drinking yogurt products are typically packaged in HDPE bottles sealed with polyethylene (PE-LD) caps or aluminum foil laminate heat-seal closures. Other types of plastic bottles, such as PET, are also utilized in the industry.

Market Segments

By Material

- Plastic

- Glass

- Paper & Paperboard

- Metal

- Others

By Type

- Bags and Wraps

- Films

- Bottles

- Cans

- Pouches

- Boxes

- Carton

By Product

- Cheese

- Yoghurt

- Butter

- Frozen Products

- Cream

- Others

By Region

- North America

- Europe

- Asia Pacific

- LAMEA

Buy Premium Global Insight: https://www.towardspackaging.com/price/5100

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/