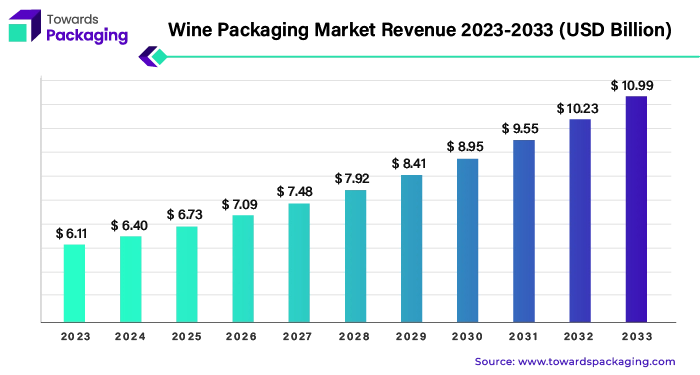

The global wine packaging market size is estimated to reach USD 10.99 billion by 2033, up from USD 6.11 billion in 2023, at a compound annual growth rate (CAGR) of 6.19% from 2024 to 2033.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5217

Wine Packaging Market Expands with Innovation

The wine packaging market is expected to augment with a substantial CAGR during the forecast period. The majority of wine consumed is from the glass bottles. Due to the stringent packing requirements, wine packaging is mostly standardized throughout the wine industry and also has a strong historical foundation. Wine can only be sold in certain sizes, according to the Alcohol and Tobacco Tax and Trade Bureau (TTB), unlike beer, which is permitted in all sizes. However, winemakers can now pack goods in ways that the customers want due to the new sizes. The newly added 355 ml capacity is equivalent to a standard 12-oz can of beer. This form of packaging gives the consumers a glass-free choice, making wine more portable as well as approachable for wineries. The TTB is contributing to economic growth and expanding the wine industry’s reach by introducing new package sizes.

From 2025 to 2030, the wine packaging market is projected to experience robust growth, driven by increasing consumer demand for convenience, sustainability, and innovative packaging solutions. During this period, the market is expected to expand at a compound annual growth rate (CAGR) of approximately 6.19%, with the market size anticipated to rise from USD 6.73 billion in 2025 to around USD 8.95 billion by 2030.

The increasing consumer demand for convenience has led to the popularity of alternative packaging formats coupled with growing emphasis on sustainability is anticipated to augment the growth of the wine packaging market within the estimated timeframe. The rise of online wine sales along with the improvements in the packaging technology are also expected to support the market growth. Furthermore, the expansion of the wine market in developing economies as well as the increasing consumer interest in premium and artisanal wines is also likely to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Sustainable Packaging Boosts Wine Industry Trends

- Choosing packaging that is more sustainable is a beneficial choice. With alternate wine packaging, the wine business benefits from cheaper manufacturing and delivery expenses. Younger generations will find this corporate approach appealing since they expect that businesses will place a high priority on social responsibility. Group Barthe is one such example of an organization that has made a commitment to using only sustainable packaging.

- Customers who want all those sustainable advantages but still long for the conventional bottle have the option of switching to the bag-in-a-bottle. The exterior container, similar to the bag-in-box, is made of recyclable paperboard that has been molded into a more traditional wine bottle form using heat and moisture and water-based glue.

- One of the greatest and most efficient methods to help a company stand out in a highly competitive market has always been through creative packaging. But there has never been a more important combination of simple packaging alternatives and customer awareness of a winemaker’s narrative. When it comes to purchasing, more than half of customers are dedicated to supporting sustainable companies and they are looking for vineyards that exhibit more ethical practices via retail channels.

- Single-serving portions are growing in popularity as a result of a busier and health-conscious population. Take “Le Froglet,” a French wine brand that offers Chardonnay, Shiraz, and Rosé varieties. These single-serving Tulip wine glasses, complete with a peel-off foil cover, are used by the company.

- Asia-Pacific is expected to grow at a fastest CAGR of 9.65% during the forecast period owing to the growing population, increasing middle-class consumption, and the increased wine consumption in the region.

- North America held considerable market share in 2023. This is due to the growing interest in alternative formats like cans and bag-in-box solutions driven by convenience and sustainability trends. The U.S. is the key market with a focus on the premium and eco-friendly packaging.

Market Drivers

Digitalization and E-commerce

The wine e-commerce sector is constantly changing and for the wineries and the producers, getting digital is now more of a need than a choice. The emergence of the digital platforms and e-commerce has revolutionized the way wine is discovered, bought and enjoyed by consumers. Online retailers give the customers access to a huge global wine variety, allowing them to try the new flavors and find niche vineyards that may not have been readily available in the conventional brick-and-mortar establishments. Additionally, the social media and digital marketing have made it possible for wineries to communicate with the customers more directly, tell their stories as well as develop a sense of brand loyalty.

As e-commerce continues to grow in importance within the wine industry, many platforms have taken advantage of this market. A software program provided by an e-commerce platform enables wine sales and purchases to take place in the same location for both the vendor and the customer. Wineries can now use e-commerce solutions from a number of organizations. For instance, Underground Cellar, an online wine platform that preserves the value of expensive wines, is developing an intriguing idea to benefit the winemakers. Rather than offering high-quality wines at discounted costs, they make wine shopping more like a form of gaming.

Also, VinoShipper is a specialized platform designed to increase and streamline wineries, distillers, breweries, retailers and other businesses direct sales to US customers. It assists the wineries by handling their shipping, gathering orders and reporting, and handling their taxes. The introduction of the digitalization and e-commerce has facilitated wineries with the ability to connect with a worldwide consumer base, promoting a more diverse and integrated wine community. As a result, there is an increasing demand for the versatile and innovative packaging options that provide superior protection, such as reinforced bottles, tamper-evident closures and shock-absorbing materials.

Market Restraints

Carbon Footprint with Production of Wine Bottles

The carbon footprint with production of wine bottles is likely to hinder the growth of the wine packaging market within the estimated timeframe. Wine sustainability certifications typically only take into the consideration the distance the wine must travel to reach its ultimate destination, rather than how it is packed. However, a 2022 analysis of the carbon emission studies related to the wine sector found that packaging is frequently identified as the leading source of greenhouse gas emissions, frequently generating more emissions than the combined effects of the winemaking and cultivating grapes. Glass, the most common material used to make wine bottles, produces a significant amount of carbon dioxide during manufacture; heat-intensive procedures release about 86 million metric tons of carbon dioxide yearly.

Additionally, the carbon footprint of these bulky, delicate glass bottles is increased by their transportation, particularly when they are made in one place and sent to another for manufacturing. The world might accept this, but there’s a big catch: those bottles are usually thrown away as soon as the wine is drained out. The entire process that consumes energy and releases greenhouse gases is required to be repeated again. But the environmental impact of wine bottle packaging extends beyond glass; capsules, corks and labels are just a few of the other materials that contribute to the waste generated by the wine industry. Also, over the past few years, numerous companies have complained about the rising prices and reported issues acquiring the bottles. Since 2018, bottles from China, a significant supplier to the US, have been impacted by 25% tariffs on top of the standard supply-chain issues.

Market Opportunities

Integration of Advanced Technologies in Packaging

These days, it’s common to see designs where the package is a work of art itself. This is generally true for luxury goods like wine and chocolates, but it can also happen with mid-range goods. However some firms are going over and above by fusing augmented reality with wine labels! Through a blend of entertainment, storytelling, and brand involvement, augmented reality leads the customer on an interactive trip. It gives the owner of the brand the chance to interact with their audience, contribute content, and learn more about them.

For instance,

- Australian wine brand 19 Crimes introduced distinctive wine labels. Each 19 Crimes wine label relates to the tale of a separate convict from the eighteenth century who went on to establish a colony and committed anyone of the 19 crimes that carried a transportation penalty. Also, Bandit Wines unveiled their creative augmented-reality based wine packaging, “Go Explore National Parks.” The 360-degree video portal feature of the Augmented Reality (AR) platform is a novel strategy for customer engagement. With the help of Aircards and Snap’s Camera Kit, users can digitally explore all of the America’s national parks using their own devices, from the spectacular coastlines that characterize Olympic National Park to Yosemite’s glacier-capped mountains. Thus, with these technologies wine producers can not only improve their packaging’s functionality and appeal but also gain valuable insights into the consumer preferences and behavior, driving innovation and the growth in the market.

Buy Premium Global Insight: https://www.towardspackaging.com/price/5217

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/