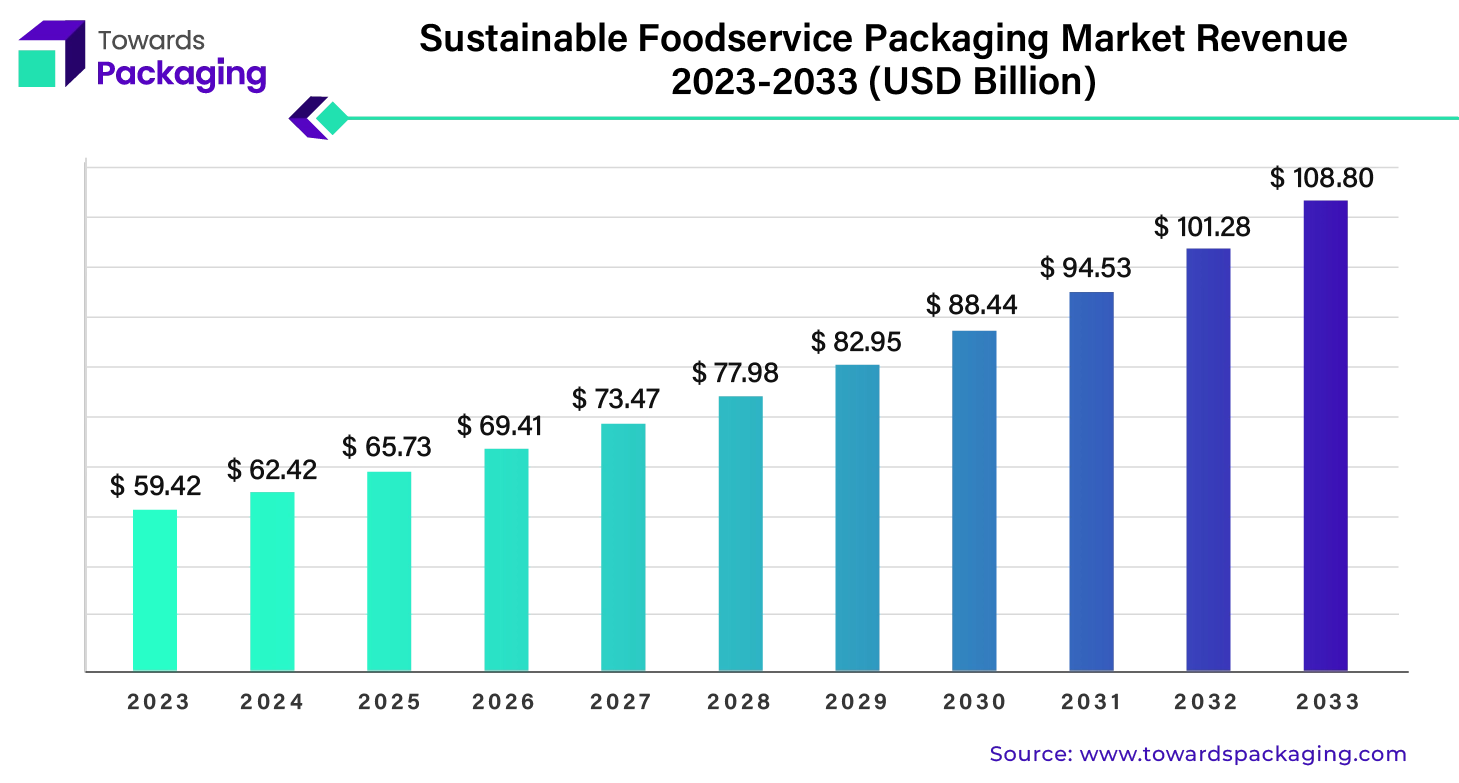

The global sustainable foodservice packaging market size is estimated to reach USD 108.80 billion by 2033, up from USD 59.42 billion in 2023, at a compound annual growth rate (CAGR) of 6.37% from 2024 to 2033.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5212

To significantly reduce the foodservice industry’s environmental effect, sustainable foodservice packaging is necessary. Companies can reduce the waste, preserve the natural resources and decrease the carbon emissions by switching to the sustainable materials. Companies in the foodservice industry can gain a lot from using the sustainable packaging. The sustainable packaging industry is growing at a significant rate. The foodservice sector, which holds a majority share of the market for sustainable packaging, is primarily responsible for this enormous growth. Sustainable foodservice packaging has multiple benefits that extend beyond environmental protection to include improved product quality, brand recognition, economic effectiveness through product repurposing and consumer preference.

The increasing environmental awareness among consumers coupled with the stringent government regulations and bans on single-use plastics is anticipated to augment the growth of the sustainable foodservice packaging market within the estimated timeframe. The development of innovative, cost-effective biodegradable, compostable, and recyclable materials along with the rise of the circular economy concept are also expected to support the market growth. Furthermore, the increasing investment in recycling and composting infrastructure as well as the growing demand for sustainability is also likely to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Key Trends and Findings

- Quick service restaurants (QSRs) are a good option for the busy diner due to their single-use packaging, which enables foodservices to package meals in an economical and practical way while also making it easy for their customers to transport their food. Since people are becoming more mobile, they spend less time preparing meals at home.

- Some States and cities have banned or restricted the usage of not recyclable or non-biodegradable foodservice packaging materials, like straws, due to the environmental concerns. Manufacturers and foodservice operators will continue to be motivated by these trends to create new packaging materials.

- Establishments are standing up to provide better solutions as foodservice operators, diners and manufacturers take into consideration the quantity of food packaging waste and the way it affects the environment. Packaging for foodservice that is recyclable, compostable, biodegradable,and renewable is better than packaging that doesn’t decompose and ends up filling landfills and the ocean.

- The packaging used in the foodservice will keep developing to become more environmentally friendly and sustainable. Customers will want packaging that is not only aesthetically pleasing but also easily transportable as well as environmentally friendly.

- Asia-Pacific held largest market share of 36.25% in 2023. This is owing to the large population, expanding foodservice industry, and growing demand for sustainable products in the region.

- The North America region is expected to grow at a CAGR of 4.96% during the forecast period due to the increasing consumer demand for eco-friendly products and the enacted legislation to reduce plastic waste.

Market Drivers

Increasing Demand from Consumers for Eco-Friendly Products

With more ecologically conscious consumers than ever, the use of sustainable packaging is growing. According to the 2023 Buying Green Report by Trivium Packaging, global inflation has caused consumer prices to increase significantly, yet customers are willing to pay extra for the products that are packaged sustainably. In general, 82% of the people surveyed said they would be willing to pay extra for the sustainable packaging that is an increase of 4 points from 2022 and 8 points from 2021. This suggests that despite the economy being worse, consumers still prioritize protecting the environment. Consumers that are between the ages of 18 and 24 are even more inclined towards sustainability, they lead at 90%. Today, sustainable packaging is essential for the company growth since environmentally concerned consumers are searching out the firms that adopt eco-friendly practices.

Foodservice brands are gradually shifting to using more environment friendly packaging for their goods due to the growing local restrictions, consumer demand along with the increasing need for the companies to be recognized as an ecologically conscious brand. Just by looking at or feeling the packaging, consumers are likely to be able to distinguish between the unsustainable and sustainable packaging. Sustainable packaging, which is typically used in place of most plastics, is more aesthetically acceptable to the consumers and is comprised of natural materials like bagasse, wood pulp, cornstarch and even seaweed. Since2022, especially the younger ones and those with higher incomes, have expressed an interest in buying the products that are packed sustainably. Thus, with the customers demand for more sustainable solutions and governments regulations, companies of the packaging goods and brands are progressively embracing the trend.

Market Restraints

Higher Costs of Sustainable Packaging Materials

The higher cost of sustainable packaging materials is likely to hinder the growth of the sustainable foodservice packaging market within the estimated timeframe. Demand for more ecological packaging options is undoubtedly increasing. However, even though people want their packing materials to be eco-friendly, they additionally desire the same amazing package experience as before, in terms of the safety and quality, which can be difficult for packaging makers to achieve. However, preserving quality isn’t the only challenge that producers face. Almost 40% of the brands have identified cost as one of the most significant hurdles in transitioning to sustainable packaging.

Furthermore, despite the use of the recycled materials is growing in popularity, especially since the passing of the Plastic Tax bill, using the recycled materials is still generally more expensive than utilizing virgin materials. This is due to the fact that the majority of the environmentally friendly packaging materials are quiet new and has a smaller production scale. Therefore, in order to alter the machinery line, more expenditure for research and development is required, which accounts for the increased costs. Furthermore, the majority of sustainable products are now produced at a higher cost due to the use of renewable energy in their manufacturing process. The eco certification is an additional factor that might frequently increase the pricing. These certifications are vital as they demonstrate to the customers that a business or product is truly eco-friendly and that false green marketing is not being used. However, quality checks and inspections, administrative charges, certification fees as well as the marketing expenses must all be covered in order to obtain an eco-certification.

Market Opportunities

Investments in Sustainable Packaging & Composting Infrastructure

The increasing investments in the sustainable packaging and composting infrastructure are likely to create opportunities for the growth of the sustainable foodservice packaging market in the years to come. In a circular economy, efficient sustainable packaging is intended for the recovery either by recycling or composting rather than for disposal in landfills or for burning. Companies have a significant chance to invest in their supply chains and the future of the world by adopting the circular economy. Organizations that focus on the environmentally friendly packaging should also make sure that the infrastructure for product-package sorting and reprocessing such as composting and recycling centers, is supported by the expansion of these facilities.

Some of the recent investments and funding made include

- In June 2024, Walker Industries Holdings invested $25 million in the Arthur Campus in Ontario in order to create an $18 million packaging facility and expand the composting infrastructure. Walker’s capabilities have been enhanced, according to the company, by repurposing 170,000 tons of organic debris into superior compost, soils, and soil supplements.

- In April 2024, Claystone Waste announced the expansion of its compost plant, which is a major step forward for trash diversion as well as sustainability in central Alberta. With this expansion, the company’s facility will be able to process 40,000 tonnes of compost annually instead of just 20,000. Through this expansion, the company will be able to achieve the sustainability goals of the region by providing far better support for commercial customers and municipal organics initiatives.

- In March 2024, after a successful Series B funding round, Watttron secured €12 million ($10.27 million). Leading the funding round were the European Circular Bioeconomy Fund (ECBF) and the global venture capital fund Circular Innovation Fund, highlighting their respective dedication to sustainable packaging improvements worldwide. The funding will help Watttron expand its technological capacity to provide eco-friendly packaging options. Additionally, it will help these solutions’ entry into the US and Asian markets.

- In September 2023, Paptic Ltd. declared that it raised growth capital to the amount of EUR 23 million. The company’s product portfolio development, manufacturing alliances, and the international distribution of Paptic materials will all be aided by the growth funding. Additionally, the funding will speed up the industrialization of Paptic’s foam-based production method. Moreover, the growth investment helps the corporation reach its 2030 carbon neutrality goal.

These strategic investments in sustainable packaging and related infrastructure are important for the sustained growth and development of the sustainable foodservice packaging market.

Buy Premium Global Insight: https://www.towardspackaging.com/price/5212

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/