A number of brands are choosing to package cosmetics and various other items in tubes. It is widely used for thick liquids, gels, ointments and the creams. Since it provides a layer of protection that keeps the contents from breaking, it can also be utilized for solids. Tubes may now store a wider variety of contents due to the development of plastic tubes rather than aluminum ones. Nonetheless, tubes made of cardboard with eco-friendly credentials and aluminum tubes are still widely used. Tubes are increasingly chosen as packing container for many products since tube closures come in a variety of sizes and forms. Apart from their affordability, eco-friendliness, and ability to safeguard active ingredients, they are also highly adaptable and convenient. Thus, the tube packaging market is anticipated to augment with a considerable CAGR during the forecast period.

The growing consumer preference for convenience and ease of use in household products coupled with the rise of e-commerce and online retailing is anticipated to augment the growth of the Tube packaging market within the estimated timeframe. The growing awareness and concern for environmental sustainability along with advancements in packaging technology are also expected to support the market growth. Furthermore, the expanding middle-class population in emerging economies as well as the rising disposable incomes and changing lifestyle patterns is also likely to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Tube Packaging Market Size, Analysis, Overview

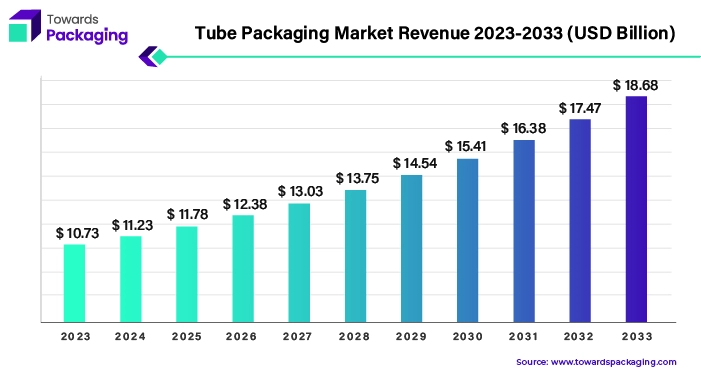

The global tube packaging market size is estimated to reach USD 18.68 billion by 2033, up from USD 10.73 billion in 2023, at a compound annual growth rate (CAGR) of 5.82% from 2024 to 2033.

Unlock Infinite Advantages: Subscribe to Annual Membership

Key Trends and Findings

- Tube packaging design possibilities are almost endless. For specialty cosmetics, manufacturers can create 3 ml tubes and for hair cream they can create 270 ml tubes. To fit the product, a variety of heads and lids are available such as the needlepoint tips with slanted tips, screw-top lids, or the flip lids. Also, the exterior of the tube can be altered to better represent the product and brand.

- Consumers are practicing sustainability in all aspects of their daily lives, including purchasing habits and are growing more environmentally aware. Postal tubes are recyclable, biodegradable as well as sustainable in comparison to the other forms of packaging.

- In the rigid container stream made from the high-density polyethylene (HDPE), tubes make up only 2-4% of the plastic weight. Currently, research is being done to produce final and standardized design guidelines for the best possible recycling.

- Paper tube packaging is becoming popular among the cosmetic businesses for items like perfumes, foundations and lip balms. High-quality printing is made possible by the paper tubes’ flat surface, which helps brands successfully highlight their aesthetics and the core values.

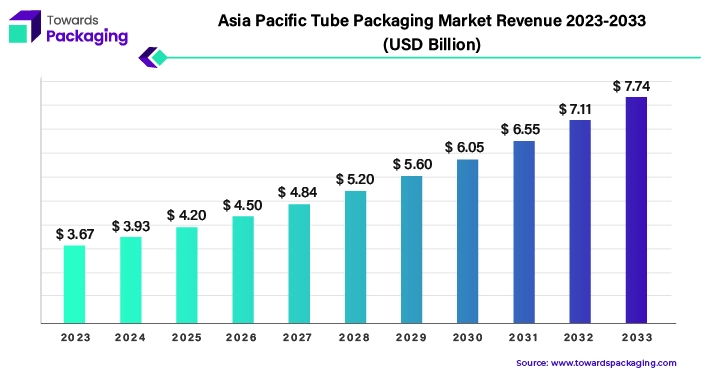

- Asia-Pacific held largest market share of 34.23% in 2023. This is owing to the increasing population, economic growth, and manufacturing capabilities in the region.

- The North America region is expected to grow at a CAGR of 4.89% during the forecast period due to the growing demand for personal care products and the strong consumer spending.

Key Segment Analysis

Type Segment Analysis Preview

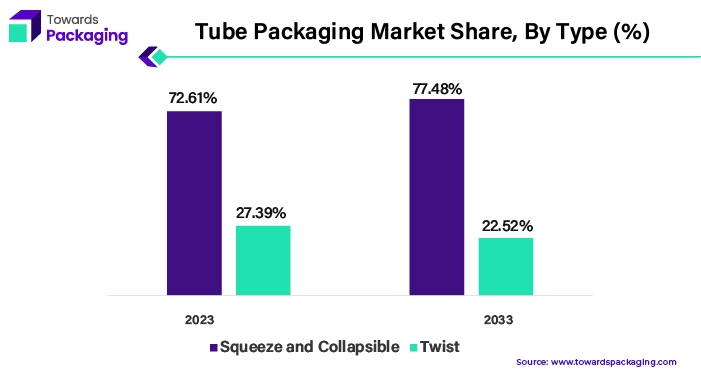

The squeeze and collapsible segment captured largest market share of 72.61% in 2023. Since they are more flexible and are able to hold and dispense more types of products than traditional containers like jars and bottles, as well as being less complicated and costly to build, fill and cap, squeezable and collapsible tubes are becoming much more common in practically every industry today. For all of the above stated reasons along with the superior durability, improved resistance to breakage, airtightness as well as the extended product shelf life; the cosmetics and personal care sectors have substantially increased their usage of plastic squeeze tubes. Squeeze tubes are being used more and more and this has led to the introduction of numerous varieties such as plastic, laminate and metal tubes.

Application Segment Analysis Preview

The personal care & oral care segment held largest market share of 62.34% in 2023. This is owing to the increasing consumer awareness and demand for hygiene and grooming products. The innovation and variety in the product formulations and packaging designs within the personal care and oral care industries is also likely to support the segmental growth the market. Companies are continuously launching new products with specialized packaging to maintain efficacy and appeal to consumers.

For instance,

- In February 2022, Colgate unveiled its revolutionary recyclable tube in America and used a striking message on its packaging to spread the information. The tube from Colgate-Palmolive is made of HDPE, identical to the No. 2 plastic utilized by milk and detergent bottles. There is no need to take any additional action when recycling the tube with plastic bottles; it may be thrown into a recycling bin without needing to be rinsed, chopped, or cleaned.

Regional Insights

Asia Pacific held largest market share of 34.23% in 2023 and is expected to grow at a fastest CAGR of 7.83% during the forecast period. This is owing to the growing demand for cosmetics and personal care products in economies like Korea, China and India. According to the data by the International Trade Administration, in 2021, South Korea’s cosmetic production reached the pre-pandemic levels, with a 9.8% increase in value from the year before to $14.5 billion. Additionally, the cosmetic exports reached a new high, rising by 21.3 percent to $9.2 billion from the year before. Furthermore, the increasing middle-class population and a growing preference for premium products are also likely to support the regional growth of the market.

North America is expected to grow at a substantial CAGR of 4.89% in 2023. This is due to the increasing demand for demand for pharmaceutical products such as medications, ointments, and creams across the region. Also, the increasing rise of direct-to-consumer brands, particularly in the beauty and personal care sectors along with the growing online shopping trend is further expected to support regional growth of the market in the years to come. Furthermore, the growing demand for convenience and ease of use in packaging as well as increasing use of candles for home décor, relaxation and stress reduction is also expected to support the regional growth of the market in the near future.

Recent Developments by Key Market Players

- May, 2024: Neopac declared that at its Wilson, North Carolina facility, it will launch a new range of cosmetic tubes. With improved capacity and capabilities, the latest-generation tube line can now produce an extra 70 million tubes annually, with diameters ranging from 25 to 40 mm and volumes from 15 to 150 ml. Furthermore, the company introduced Polyfoil Sensation, a brand-new product to its EcoDesign line. A barrier tube made especially for cosmetic purposes that are ready for recycling.

- March, 2024: Sonoma reached an achievement in its Tube Recycling Project by launching PlasticTubeRecycling.org, a website dedicated to outlining and illustrating the main features of recycling for plastic squeeze tubes.

- January, 2024: In an effort to reuse the tubes from house collection, Pringles introduced a new crisp tube with a paper base manufactured from recycled paper. There is a recyclable plastic top on the tube as well. The action, which has required an expenditure of £86 million (US$110 million) on novel technology, comes after the testing of a paper tube in the UK in 2020 and a steel can in Italy in 2019.

Market Companies

Some of the key players in tube packaging market are Albéa Group, Berry Global Inc., Essel Propack Limited, CCL Industries, Huhtamäki Oyj, Amcor plc, Sonoco Products Company, Montebello Packaging, Alltub Group, and Hoffmann Neopac AG, among others.

Download White Paper: https://www.towardspackaging.com/personalized-scope/5205

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5205

Get the latest insights on packaging industry segmentation with our Annual Membership – https://www.towardspackaging.com/get-an-annual-membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/