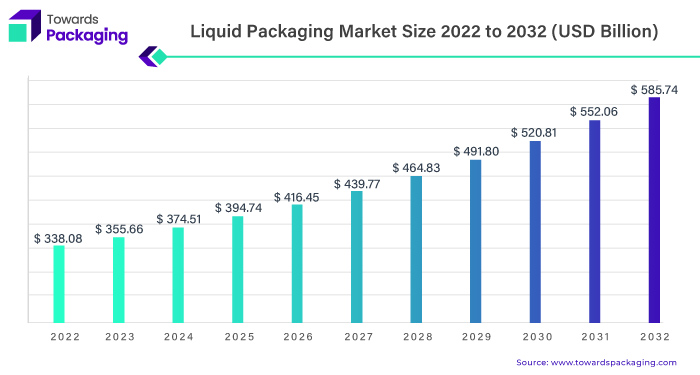

The global liquid packaging market is poised for an extraordinary evolution, projecting a remarkable surge from USD 338.08 billion in 2022 to a staggering USD 585.74 billion by 2032.This substantial growth is anticipated at an impressive 5.7% Compound Annual Growth Rate (CAGR) between 2023 and 2032. In this comprehensive exploration, we delve into the intricacies of this thriving industry, deciphering the factors propelling its ascent and the key trends shaping its future landscape.

Navigating the Complexities of Liquid Packaging Market for Optimal Containment, Preservation, and Consumer Engagement

Liquid packaging market is the sector that creates packaging solutions expressly crafted for liquid products. This industry addresses a diverse range of liquid substances, encompassing beverages, pharmaceuticals, personal care items, household chemicals, and more.

Liquid packaging market, whether juices, gels, lotions, soaps, condiments, or creams, poses a multifaceted challenge. Each liquid, with its unique viscosity and properties, presents its challenges in the packaging process. Effectively addressing these challenges requires a nuanced understanding of how each liquid interacts with and fills the package. Beyond the characteristics of the liquid itself, considerations extend to various aspects, including package format, tear-open features, speciality fitment access, and the critical issue of minimizing spillage.

One of the critical challenges in liquid packaging market is comprehending the behaviour of the liquid within the package. Different liquids have distinct flow characteristics, and packaging experts must carefully analyze how each liquid moves, settles and reacts to various environmental conditions. This understanding is crucial for designing packaging that contains the liquid securely and facilitates easy dispensing or pouring for the end user.

The choice of package format is another critical aspect of liquid packaging market. Factors such as the material used, the design of the container, and the type of closure must align with the specific requirements of the liquid product. For Instance, certain liquids may necessitate a pour spout for controlled dispensing, while others may require a pump or spray nozzle. Packaging specialists must consider these factors to ensure the functionality and user-friendliness of the packaging.

Moreover, spillage is a significant concern in liquid packaging market, as it not only leads to product wastage but can also compromise the safety and cleanliness of the surrounding environment. The costs associated with spillage, in terms of product loss and potential damage to the packaging, underscore the importance of developing packaging solutions that minimize the risk of spills during transportation, handling, and usage.

Recognizing the intricate nature of liquid packaging market, it becomes evident why entrusting this task to experts is imperative. Packaging professionals bring specialized knowledge and experience, allowing them to navigate the complexities of different liquid products. These experts focus on the technical aspects of containment and preservation and leverage their skills in designing visually appealing and functional packaging.

Liquid packaging market involves a multifaceted process that demands a deep understanding of the unique challenges of different liquid products. From fluid dynamics within the package to considerations of package format, tear-open features, and spillage prevention, every aspect requires meticulous attention. Entrusting this task to packaging experts ensures the effective containment and preservation of liquids and the creation of visually appealing and functional packaging that resonates with consumers.

Liquid Packaging Market Trends

| Trends | |

| Sustainable Barrier Coatings |

|

| Competing Materials |

|

| Smaller Pack Sizes |

|

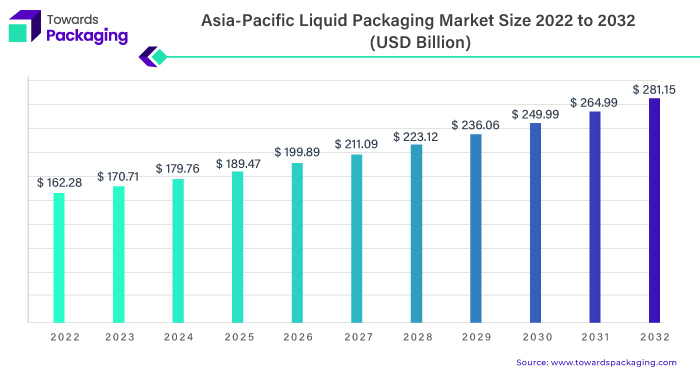

Asia-Pacific’s Accelerating Growth Trajectory in Liquid Packaging Market

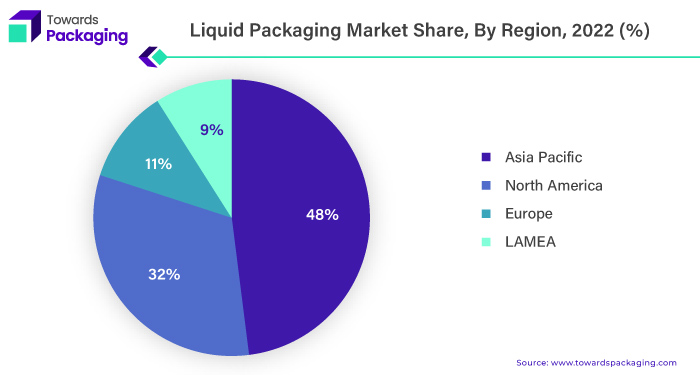

In recent times, significant players in the beverage industry have strategically expanded their presence into the markets of China and India, catalyzing substantial sales growth within the Asia-Pacific liquid packaging market. This heightened demand is notably underpinned by the escalating inclination of millennials towards packaged beverages, encompassing a spectrum from dairy products to soft drinks and juices.

Over the past two decades, China has witnessed a pronounced surge in liquid packaging market, driven by sustainability considerations, technological advancements, and favourable economic conditions. Evolving consumer perspectives on packaging have prompted industry stakeholders to prioritize sustainability, ushering in an era where eco-friendly paperboard carton packaging creatively supersedes traditional rigid alternatives. This paradigm shift positions liquid packaging market as a pragmatic and cost-effective alternative, aligning with the market’s escalating preference for consumer-centric packaging solutions and augmented product preservation.

The trend towards employing natural materials for the production of liquid packing cartons has gained significant traction, contributing substantively to the expansion of this product segment. Liquid packing cartons are increasingly finding applications in industrial and institutional settings, resonating with manufacturers and consumers and further propelling the growth trajectory of this segment.

Governmental initiatives to reduce carbon footprints and foster sustainable packaging practices are pivotal in amplifying the demand for liquid carton packaging in the Asia-Pacific region. India emerges as a substantial market player, being the fourth-largest market for fast-moving consumer goods, as endorsed by the Indian Brand Equity Foundation. The convergence of market dynamics, heightened sustainability consciousness, and progressive technological advancements firmly establishes Asia-Pacific as a dynamic and rapidly expanding epicentre for liquid carton packaging.

North America closely trails Asia Pacific in the growth trajectory of the liquid packaging market. The region, characterized by an intensifying focus on sustainability, technological progress, and evolving consumer preferences, experiences a pronounced surge in demand for innovative liquid packaging solutions. This trend significantly contributes to the noteworthy expansion of the market in the region.

For instances,

- In March 2023, the UK-based grocery retailer Sainsbury’s unveiled environmentally friendly packaging for its proprietary liquid laundry detergent. These new cartons, weighing 35% less than their predecessors, have been designed to exhibit a 50% lower carbon footprint.

- In November 2023, Ariake, a leading Japanese company specializing in producing natural flavours derived from animals and operating across two continents, introduced premium liquid broths in SIG carton packaging. This strategic move exemplifies a commitment to packaging innovation within the global liquid food industry.

Strategic Dominance of Rigid Plastic, Drive Towards Sustainable Solutions in the Business Landscape

The rigid plastic packaging industry has witnessed a significant shift away from traditional formats such as glass bottles, jars, liquid cartons, and metal cans, marking its dominance in the market. This transition is driven by the inherent advantages of rigid plastic, including its lighter weight, cost-effectiveness, design flexibility, and recyclability. However, increasing public pressure on brand owners and retailers to address the environmental impact of plastic packaging is compelling the industry to adopt more sustainable practices.

In response to environmental concerns, stakeholders in the packaging sector are implementing measures such as weight reduction and the use of biodegradable or sustainably sourced materials. The growth of the rigid plastic packaging market is shaped by a combination of technological, economic, social, and demographic factors. Advances such as enhanced barrier solutions, improved resin formulations, and more efficient processing machinery increase consumption, including hot-filling and aseptic-filling solutions.

While ongoing opportunities exist to expand rigid plastic packaging, especially at the expense of traditional formats, specific segments, such as carbonated soft drinks and mineral water, have reached market saturation in developed regions. Simultaneously, initiatives like lightweight and the increased use of recycled plastics are expected to limit the consumption of virgin polymers.

Moreover, the rigid plastic packaging market faces heightened competition from the flexible plastic packaging industry, with a notable surge in the popularity of flexible stand-up pouch packaging across various food and beverage applications. As the industry navigates these complexities, adopting a strategic approach that balances innovation, sustainability, and market dynamics becomes crucial for ensuring sustained growth and relevance in the ever-evolving liquid packaging market landscape.

For Instance,

- In May 2023, Allpack launched sustainable packaging PaintGuard, In-transit liquid product solution, since the impact on the environment is becoming a more pressing concern

Exploring the Versatility of the Flexible Liquid Packaging Market

Flexible liquid packaging marke is not just limited to single-serve fruit drinks or household product refills like laundry detergent; it also proves highly effective for storing bulk quantities of various items, including health and beauty products, salad dressings, chemicals, and paint, all while ensuring freshness. Their remarkable versatility is the defining characteristic that sets flexible materials apart from rigid packaging.

When opting for flexible Packaging, one can typically achieve the same storage capacity with smaller containers compared to rigid alternatives. This holds even for bag-in-box styles, where the containers are smaller when empty and more compact when filled. This inherent space efficiency translates to more effective utilization of storage spaces, providing more excellent mileage for your storage facilities.

Beyond the advantages in storage, the space-saving nature of flexible Packaging extends its benefits to transportation costs and environmental impact. Smaller and lighter containers reduce transportation requirements, leading to fewer vehicles, fewer trips, and ultimately fewer carbon emissions. This environmentally conscious approach aligns with sustainability goals, making flexible packaging a compelling choice.

Despite its lightweight nature, flexible Packaging does not compromise on durability. In the case of bag-in-box containers, there is a significant reduction in plastic usage compared to rigid or semi-rigid alternatives. This reduction contributes to a lighter environmental footprint and reflects a commitment to resource efficiency.

In essence, flexible liquid packaging market emerges as a versatile solution with broad applications, efficiently accommodating various products while offering storage, transportation, and sustainability advantages. These packages’ lightweight yet durable nature, particularly evident in bag-in-box containers, emphasize a commitment to minimizing environmental impact while maximizing efficiency.

For Instance,

- In November 2023, Sealed Air (SEE) launched a new automated liquid packaging technology as a vertical form-fill-seal system.

Aseptic Packaging’s Strategic Role in Ensuring Sterility

Aseptic packaging, a meticulous process characterized by filling a commercially sterile product into a container under impeccably uncontaminated conditions, has emerged as a linchpin ensuring product sterility. The essence of aseptic packaging lies in hermetically sealing containers, eliminating the possibility of any reinfection and resulting in shelf-stable products at ambient conditions.

In essence, aseptic packaging is a robust mechanism to maintain the sterility and freedom from harmful microorganisms in food products for an extended period, precisely eight months at room temperature. A distinctive characteristic of this packaging is its ability to prevent the need for refrigeration, making it a compelling choice for various products. Packaging items such as flavoured milk, dairy products, and liquor using aseptic packaging materials is poised to be a catalyst in driving the growth of aseptic packaging globally.

For Instance,

- In January 2022, SIG declared the release of Signature Evo, which it said was the first complete barrier packaging material for aseptic carton packs made entirely of aluminium in the world.

As of 2021, the Indian aseptic liquid packaging market is experiencing a remarkable growth rate of 17-18% annually. Projections indicate that the market will witness a twofold increase over the next five years, reaching an estimated 20 billion packs annually. Drawing parallels with the Chinese market, which has already achieved a staggering figure of approximately 80 billion packs, India, with a similar population, presents an immense growth potential.

The trajectory of aseptic packaging in India underscores a compelling growth story fueled by factors such as changing consumer preferences, technological advancements, and an increasing awareness of the importance of product sterility. The adaptability of aseptic packaging, particularly in accommodating a variety of products without the requirement for refrigeration, positions it as a strategic solution for a broad spectrum of industries.

The growth potential in the market is underscored by the surging demand for aseptically packaged products, particularly in the domains of flavoured milk, dairy, alcoholic beverages and several cosmetic brands. The versatility of aseptic packaging in preserving the integrity of these products while offering convenience to consumers aligns with evolving market dynamics.

Aseptic packaging is a pivotal player in ensuring the sterility and longevity of products, emerging as a critical driver of growth in the Indian market. As the demand for aseptically packaged products continues to rise, propelled by consumer preferences and market dynamics, the industry is poised for substantial expansion in the coming years. The Indian aseptic liquid packaging market is experiencing significant growth and is indicative of the global trajectory, where aseptic packaging is becoming increasingly indispensable in various sectors.

For Instance,

- In March 2022, Elopak and GLS declared a joint venture, with Elopak as the managing partner. Roll-fed aseptic cartons in multiple sizes are available under the “ALPAK” name.

Competitive Landscape

The liquid packaging market is characterized by intense competition because there are several key players, such as Elopak AS and SIG Global Ptv. Ltd, Evergreen Packaging LLC, Tetra Laval International SA, Greatview Aseptic Packaging Co. Ltd, Mondi PLC, Nippon Paper Industries Co. Ltd, IPI SRL, Refresco Group NV. This market has a medium level of market concentration, and several major players are present, using tactics such as product innovation, acquisitions, and mergers to obtain a competitive edge.

The market players are significantly impacting environmental development by adopting sustainable packaging and creating awareness among consumers through innovative packaging materials. Elopak AS and Mondi PLC are lead players who have a global impact by reducing carbon through innovative packaging materials adopted by leading companies that started sustainable packaging by introducing liquid packaging for personal care, food and beverage and several pharmaceuticals industries in their packaging and other materials.

Major Key Player in the Liquid Packaging Market Includes:

- Elopak AS

- SIG Global Pte. Ltd

- Evergreen Packaging LLC

- Tetra Laval International SA

- Greatview Aseptic Packaging Co. Ltd

- Mondi PLC

- Nippon Paper Industries Co. Ltd

- IPI SRL

- Refresco Group NV

Recent Developments

- In October 2022, Liquibox Shows Advancement Towards Sustainability Goals The company is still committed to reaching its lofty sustainability goals by 2025.

- In October 2023, A significant advancement in the packaging of hazardous liquids was made possible by Berry Global’s technical and production prowess. The business has recently introduced the first 20- and 25-litre containers with 35 per cent recycled material.

- In November 2023, the pricing of cartons with liquid packing for milk and other beverages has been revised, according to Nippon Paper Industries Co. All cartons for liquid packaging are included in the product and are subject to price adjustments.

- In November 2023, the first company in Belgium to fill food goods aseptically in SIG carton packs was Ariake, the leading manufacturer of natural animal seasonings operating on two continents. Ariake is expanding its line of premium liquid broths that come in SIG Slimline carton packs, adding to its portfolio of broths.