Heavy Duty Corrugated Packaging Market Size and Insights 2023 – 2033

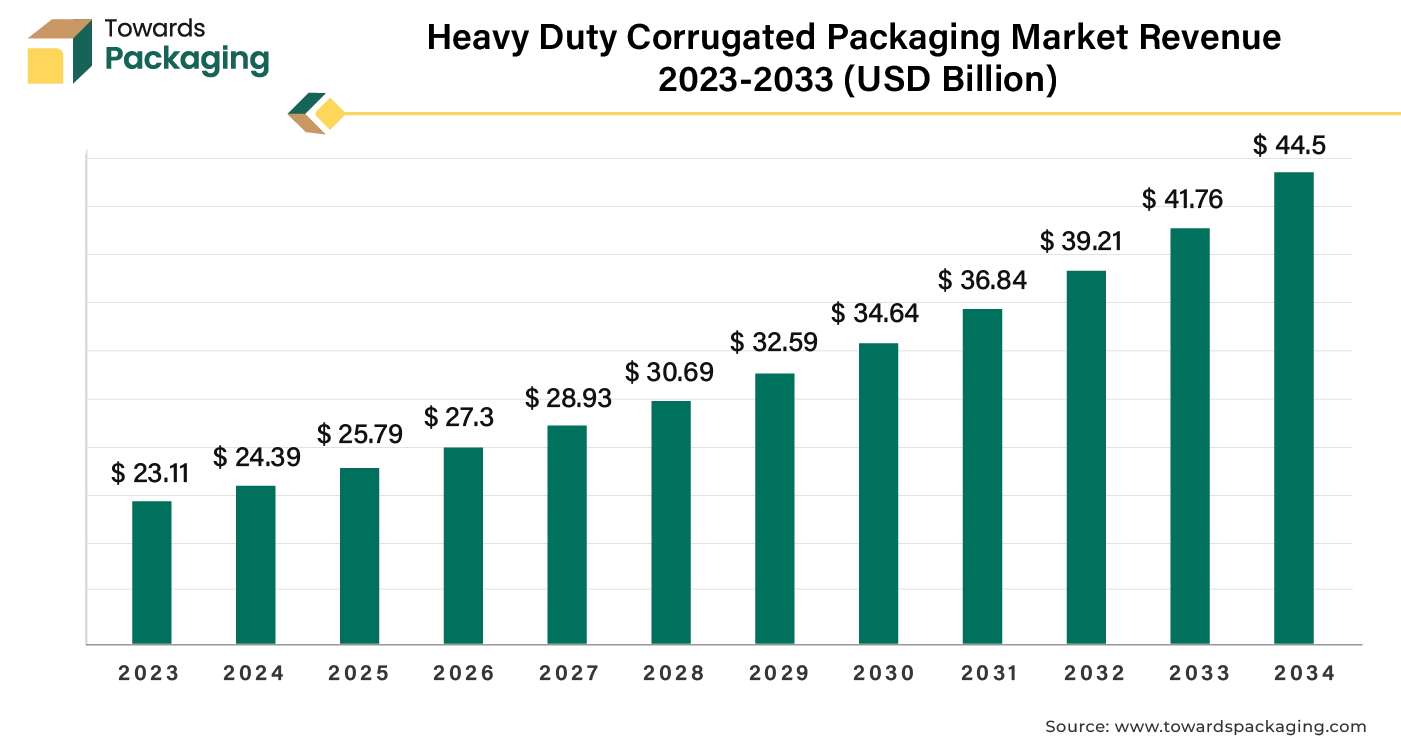

The global heavy duty corrugated packaging market size reached US$ 23.11 billion in 2023 and is projected to hit around US$ 41.76 billion by 2033, expanding at a CAGR of 5.57% during the forecast period from 2024 to 2033. Increasing trend towards heavy duty corrugated sustainable packaging is significant factor anticipated to drive the growth of the heavy duty corrugated packaging market over the forecast period.

Unlock Infinite Advantages: Subscribe to Annual Membership

Heavy Duty Corrugated Packaging Market Key Takeaways

- Europe held a significant share of the market in 2023.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- Corrugated boxes holds 58.85% of the global market share in 2023.

- By product type, the corrugated boxes segment dominated the market with the largest share in 2023.

- By board type, the triple wall heavy duty corrugated packaging segment led the market in 2023.

- By capacity, the 100-300 lbs. segment held the largest share of the market.

- By end use, the consumer electronics segment held the dominating share of the market.

Exploring the Heavy Duty Corrugated Packaging Market

Heavy-duty corrugated packaging is frequently used for bulky, heavy, fragile, or expensive goods because it provides exceptional protection during transportation. The need of dependable and sturdy external protection for protecting shipments especially those that are heavy or prone to damage cannot be emphasized. The robust corrugated boxes are a symbol of security and strength. Heavy-duty corrugated packaging is designed to provide robust protection for goods during shipping and handling. It typically involves a thicker, more durable layer of cardboard compared to standard corrugated packaging. This type of packaging is often used for heavy or fragile items, providing extra strength and cushioning. It can also include features like double-walled construction or additional internal supports to enhance durability.

Heavy duty corrugated packaging provides superior protection for products, reducing the risk of damage during transportation and handling, which is especially important for fragile or valuable items. Its strength helps prevent packaging from collapsing or tearing, ensuring that items arrive in good condition. By reducing damage and returns, heavy duty corrugated packaging helps lower overall costs for businesses and consumers, leading to fewer replacements and repairs. Corrugated packaging is often recyclable and can be made from recycled materials, contributing to environmental sustainability. Enhanced protection reduces the likelihood of injuries caused by broken or damaged items, improving safety for handlers and consumers alike. High-quality packaging can enhance a company’s image and consumer trust, showcasing a commitment to quality and customer satisfaction. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Heavy Duty Corrugated Packaging Market TOC | Table of Content

Executive Summary

- Market Overview

- Key Trends

- Key Market Insights

- Market Size and Growth Projections

- Competitive Landscape Overview

Research Methodology

- Research Approach

- Data Collection Methodology

- Data Sources

- Market Estimation Techniques

- Market Breakdown and Data Triangulation

Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- Impact of COVID-19 on the Heavy Duty Corrugated Packaging Market

Market Segmentation by Product Type

- Introduction

- Corrugated Boxes

- Pallet Boxes

- Single Cover Boxes

- Double Cover Boxes

- Telescopic Boxes

- Liquid Bulk Boxes

- Slotted Boxes

- Octabins

- High-Performance Totes

- Vegetable Totes

- Pallets

- POP Displays

- Others (Edge Protectors, etc.)

Market Segmentation

by Board Type

- Introduction

- Single Wall Heavy Duty Corrugated Packaging

- Double Wall Heavy Duty Corrugated Packaging

- Triple Wall Heavy Duty Corrugated Packaging

by Capacity

- Introduction

- Up to 100 lbs.

- 100 to 300 lbs.

- Above 300 lbs.

by End Use

- Introduction

- Food & Beverages

- Chemicals

- Consumer Electronics

- Cosmetics & Personal Care

- Healthcare

- Textiles

- Glassware & Ceramics

- Automobiles

- Homecare

- Others

Regional Analysis

- North America

-

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Competitive Landscape

- Market Share Analysis

- Company Profiles

- Moraya Packaging

- Mondi Group

- VPK Packaging Group

- International Paper Company

- WestRock Company

- Georgia Pacific LLC

- Pratt Industries Inc.

- Smurfit Kappa Group Plc.

- DS Smith Packaging Limited

- Sonoco Products Company

- Elsons International

- SCG Packaging Public Company Limited

- Felbro Inc.

- Menasha Packaging Company LLC.

Cross-Segment Analysis

By Product Type: Cross-Segment Analysis

- Corrugated Boxes

-

- By Board Type: Single Wall, Double Wall, Triple Wall

- By Capacity: Up to 100 lbs., 100 to 300 lbs., Above 300 lbs.

- By End Use: Food & Beverages, Chemicals, Consumer Electronics, etc.

- By Region: North America, Europe, Asia-Pacific, Latin America, MEA

- Pallet Boxes

- By Board Type: Single Wall, Double Wall, Triple Wall

- By Capacity: Up to 100 lbs., 100 to 300 lbs., Above 300 lbs.

- By End Use: Textiles, Glassware, Automobiles, etc.

- By Region: U.S., UK, Germany, China, India, Brazil, South Africa, etc.

- Liquid Bulk Boxes

- By Board Type: Double Wall, Triple Wall

- By Capacity: Above 300 lbs.

- By End Use: Chemicals, Healthcare, etc.

- By Region: North America, Europe, Asia Pacific, MEA

- POP Displays

- By Board Type: Single Wall, Double Wall

- By Capacity: 100 to 300 lbs.

- By End Use: Consumer Electronics, Cosmetics & Personal Care, Homecare, etc.

- By Region: North America, Europe, Asia Pacific, Latin America, MEA

By Board Type: Cross-Segment Analysis

- Single Wall Heavy Duty Corrugated Packaging

-

- By Product Type: Corrugated Boxes, Pallet Boxes, Telescopic Boxes, etc.

- By Capacity: Up to 100 lbs., 100 to 300 lbs.

- By End Use: Food & Beverages, Healthcare, Consumer Electronics, etc.

- By Region: U.S., Canada, Germany, Japan, Mexico, South Africa

- Double Wall Heavy Duty Corrugated Packaging

- By Product Type: Corrugated Boxes, Liquid Bulk Boxes, High-Performance Totes, etc.

- By Capacity: 100 to 300 lbs., Above 300 lbs.

- By End Use: Chemicals, Textiles, Automobiles, Glassware, etc.

- By Region: UK, France, South Korea, Brazil, UAE, etc.

- Triple Wall Heavy Duty Corrugated Packaging

- By Product Type: Octabins, Liquid Bulk Boxes, Pallet Boxes

- By Capacity: Above 300 lbs.

- By End Use: Chemicals, Automobiles, Glassware, etc.

- By Region: U.S., India, Saudi Arabia, etc.

By Capacity: Cross-Segment Analysis

- Up to 100 lbs.

-

- By Product Type: Corrugated Boxes, Slotted Boxes, POP Displays

- By Board Type: Single Wall, Double Wall

- By End Use: Food & Beverages, Homecare, Cosmetics & Personal Care

- By Region: Europe, Asia-Pacific, Latin America

- 100 to 300 lbs.

- By Product Type: Pallet Boxes, Telescopic Boxes, Vegetable Totes, POP Displays

- By Board Type: Single Wall, Double Wall

- By End Use: Healthcare, Consumer Electronics, Chemicals, etc.

- By Region: North America, Europe, Asia Pacific

- Above 300 lbs.

- By Product Type: Liquid Bulk Boxes, Octabins, Pallets

- By Board Type: Double Wall, Triple Wall

- By End Use: Chemicals, Automobiles, Glassware & Ceramics

- By Region: MEA, Latin America, Europe, Asia Pacific

By End Use: Cross-Segment Analysis

- Food & Beverages

-

- By Product Type: Corrugated Boxes, Single Cover Boxes, Vegetable Totes

- By Board Type: Single Wall, Double Wall

- By Capacity: Up to 100 lbs., 100 to 300 lbs.

- By Region: North America, Europe, Asia Pacific, MEA

- Chemicals

- By Product Type: Pallet Boxes, Liquid Bulk Boxes, Octabins

- By Board Type: Double Wall, Triple Wall

- By Capacity: Above 300 lbs.

- By Region: U.S., China, Brazil, Saudi Arabia

- Consumer Electronics

- By Product Type: Slotted Boxes, POP Displays, Telescopic Boxes

- By Board Type: Single Wall, Double Wall

- By Capacity: 100 to 300 lbs.

- By Region: Germany, South Korea, Japan, India

- Automobiles

- By Product Type: Pallet Boxes, High-Performance Totes, Pallets

- By Board Type: Double Wall, Triple Wall

- By Capacity: 100 to 300 lbs., Above 300 lbs.

- By Region: U.S., Italy, Mexico, South Africa, UAE

By Region: Cross-Segment Analysis

- North America

-

- By Product Type: Corrugated Boxes, Pallet Boxes, Liquid Bulk Boxes

- By Board Type: Single Wall, Double Wall, Triple Wall

- By Capacity: Up to 100 lbs., 100 to 300 lbs., Above 300 lbs.

- By End Use: Food & Beverages, Healthcare, Chemicals, etc.

- Europe

- By Product Type: Pallet Boxes, POP Displays, Octabins

- By Board Type: Double Wall, Triple Wall

- By Capacity: 100 to 300 lbs., Above 300 lbs.

- By End Use: Consumer Electronics, Glassware & Ceramics, Automobiles, etc.

- Asia Pacific

- By Product Type: Slotted Boxes, Telescopic Boxes, Vegetable Totes

- By Board Type: Single Wall, Double Wall

- By Capacity: Up to 100 lbs., 100 to 300 lbs.

- By End Use: Textiles, Chemicals, Food & Beverages, etc.

- Latin America

- By Product Type: Liquid Bulk Boxes, Pallet Boxes, High-Performance Totes

- By Board Type: Double Wall, Triple Wall

- By Capacity: Above 300 lbs.

- By End Use: Chemicals, Automobiles, Glassware & Ceramics, etc.

- Middle East & Africa

- By Product Type: Octabins, Pallet Boxes, POP Displays

- By Board Type: Double Wall, Triple Wall

- By Capacity: 100 to 300 lbs., Above 300 lbs.

- By End Use: Chemicals, Automobiles, Healthcare, etc.

Go-to-Market Strategies (Region Selection)

- Europe

-

- Market Entry Strategy

- Regional Regulatory Landscape

- Distribution and Retail Partnerships

- Consumer Behavior and Preferences

- Competitive Landscape and Market Positioning

- Asia Pacific

- Localization and Market Adaptation

- E-commerce and Digital Marketing Tactics

- Trade Policies and Regional Supply Chain Management

- Partnership with Local Manufacturers

- Growth in Emerging Economies

- North America

- Consumer-Centric Approach

- Branding and Product Differentiation

- Market Penetration and Distribution Channels

- Trade Regulations and Import/Export Guidelines

- Regional Competitiveness and Innovation

- Latin America

- Customization of Packaging Solutions

- Strategic Partnerships with Local Distributors

- Addressing Supply Chain Challenges

- Marketing and Sales Channels

- Consumer Trends and Opportunities

- Middle East

- Cultural and Economic Sensitivities

- Regulatory Compliance and Standards

- Distribution Network and Infrastructure Development

- Market Dynamics and Consumer Behavior

- Expansion through Strategic Alliances

Integration of AI in the Heavy Duty Corrugated Packaging Market

- Overview of AI Technologies in Packaging Market

-

- AI-Driven Packaging Design and Prototyping

- Machine Learning Algorithms in Packaging Automation

- AI-Enabled Robotics for Packaging Operations

- Computer Vision for Defect Detection and Quality Control

- Advanced Data Analytics for Packaging Process Optimization

- Applications of AI in Packaging

- Smart Tracking and Inventory Management

- Real-Time Inventory Monitoring

- AI-Powered Demand Forecasting

- Smart Labels and RFID Integration

- Inventory Automation using AI and IoT

- Predictive Maintenance and Quality Control

- Predictive Algorithms for Equipment Failure

- AI-Based Condition Monitoring

- Real-Time Quality Inspection Systems

- Defect Prediction and Reduction Techniques

- Optimization of Supply Chain Logistics

- AI-Powered Route Optimization

- Real-Time Supply Chain Visibility

- Automated Supply Chain Decision-Making

- Blockchain Integration for Transparency

- Smart Tracking and Inventory Management

Benefits of AI Integration in Packaging

- Enhanced Efficiency and Productivity

-

- Faster Production Cycles with AI Automation

- Reduced Downtime and Improved Uptime

- Scalability in Packaging Operations

- Cost Savings and Waste Reduction

- Optimized Material Usage

- Automated Error Reduction and Correction

- Decrease in Energy Consumption

- Improved Sustainability

- Reduction of Environmental Footprint

- Sustainable Material Management via AI

- Circular Economy Initiatives Driven by AI

Production and Consumption Data

- Global Production Volumes

-

- Overview of Heavy Duty Corrugated Packaging Production Worldwide

- Major Producing Countries and Manufacturers

- Year-on-Year Growth Analysis

- Regional Production Analysis

- Production Insights in North America

- Production Insights in Europe

- Production Insights in Asia Pacific

- Production Insights in Latin America

- Production Insights in the Middle East

- Consumption Patterns by Region

- Packaging Consumption Trends in North America

- Packaging Consumption Trends in Europe

- Packaging Consumption Trends in Asia Pacific

- Packaging Consumption Trends in Latin America

- Packaging Consumption Trends in the Middle East

- Key Trends in Production and Consumption

- Growth in Sustainable Packaging Demand

- Shift Toward Automation in Production

- E-commerce Driving Packaging Consumption

- Regional Disparities in Packaging Demand

Opportunity Assessment

- New Product Development

-

- R&D Initiatives in Heavy Duty Corrugated Packaging

- Customization and Product Innovation

- Trends in Sustainable and Biodegradable Packaging

- Financial Planning and ROI Analysis

- Investment in AI-Driven Packaging Solutions

- Cost-Benefit Analysis of AI Integration

- Long-Term ROI Projections for Automation Adoption

- Supply Chain Intelligence/Streamline Operations

- Leveraging AI for Supply Chain Optimization

- Forecasting and Demand Planning using AI

- Risk Mitigation and Contingency Planning

- Cross Border Intelligence

- Market Opportunities in International Trade

- Regulatory and Compliance Challenges

- Emerging Markets and Trade Routes

- Business Model Innovation

- Transition to Digital Packaging Solutions

- Subscription-Based Packaging Services

- Omni-Channel Packaging Strategies

- Blue Ocean vs. Red Ocean Strategies

- Identifying Untapped Markets and Opportunities (Blue Ocean)

- Competing in Saturated Markets with Differentiation (Red Ocean)

- Strategic Movements to Navigate Market Competitiveness

Case Studies and Examples

- Successful AI Implementation in Packaging

-

- Real-World Examples of AI-Driven Packaging Automation

- AI Use in Predictive Maintenance in Packaging

- Case Studies on Smart Tracking and Supply Chain Optimization

- Companies Leading in AI Adoption

- Profile of Top Companies Pioneering AI in Packaging

- Innovations in Packaging Design and Logistics

- AI-Driven Quality Control Case Studies

Future Prospects and Innovations

- AI and the Future of Packaging Design

-

- Evolution of AI in Customizable Packaging Solutions

- Smart Packaging Technologies with AI and IoT Integration

- Use of AI for Sustainability and Eco-Friendly Packaging

- Emerging Trends and Technological Innovations

- Next-Gen Robotics in Packaging

- AI in Smart Manufacturing and Industry 4.0

- AI-Enhanced Materials Development and Circular Economy

- Potential Challenges and Opportunities

- Regulatory and Ethical Considerations of AI in Packaging

- Potential for AI Disruption in the Packaging Market

- Future Investment Opportunities in AI-Driven Packaging

Market Forecast and Projections (2024-2034)

- By Product Type

- By Board Type

- By Capacity

- By End Use

- By Region

Technological Advancements and Innovations

- Smart Packaging Solutions

- Sustainability Initiatives

- Digital Printing and Customization

Supply Chain Analysis

- Raw Material Sourcing

- Manufacturing Process

- Distribution Channels

- Logistics and Transportation Challenges

Impact of Macroeconomic Factors

- Global Trade Policies

- Economic Slowdown and Inflation Impact

- Geopolitical Risks and Their Influence on Market Dynamics

Strategic Recommendations

- Go-To-Market Strategies

- Key Partnerships and Collaborations

- Focus on Emerging Markets

- Strategies for Enhancing Operational Efficiency

Conclusion and Future Outlook

- Summary of Key Findings

- Future Growth Opportunities

- Closing Remarks

Download White Paper: https://www.towardspackaging.com/personalized-scope/5228

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5228

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com

https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/