Table of Contents

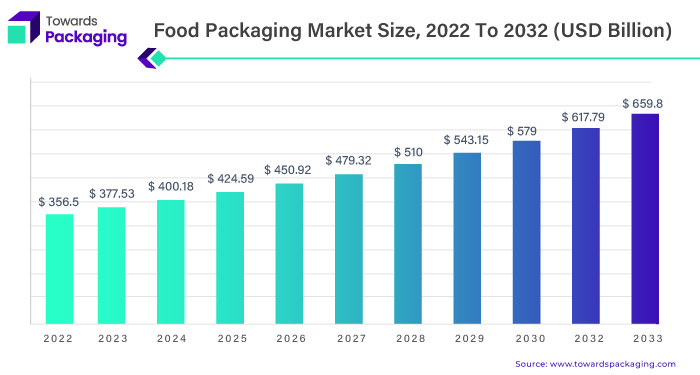

ToggleFood Packaging Market Statistics 2023 To 2032:

-

Market Size Overview:

- Valued at USD 356.5 billion in 2022.

- Expected to reach USD 659.80 billion by 2032.

- Anticipated CAGR of 6.4% during the forecast period (2023-2032).

The food packaging market size has been experiencing substantial growth in recent years, driven by a combination of factors that reflect the evolving dynamics of consumer behavior, industry trends, and global economic shifts. This description will delve into various growth factors contributing to the expansion of the food packaging market.

Changing Consumer Lifestyles and Preferences:

-

- Consumer lifestyles have undergone significant changes with urbanization, dual-income households, and busier routines.

- Increased reliance on packaged and convenience foods has surged, driving the demand for innovative and practical food packaging market solutions.

Rise of E-Commerce:

-

- The growth of online retail and e-commerce has transformed the retail landscape.

- E-commerce platforms necessitate robust packaging solutions to ensure the safe and efficient delivery of food products, leading to increased demand in the food packaging market.

Globalization and Supply Chain Complexity:

-

- The globalization of food markets has expanded the need for efficient and durable packaging to maintain product integrity during transportation over long distances.

- Complex supply chains require packaging that provides adequate protection and ensures the longevity of perishable goods.

Focus on Sustainability:

-

- Growing environmental awareness has led to a significant shift towards sustainable and eco-friendly packaging.

- Consumers and regulatory bodies increasingly favor packaging solutions that minimize environmental impact, leading to the adoption of biodegradable materials and recyclable packaging.

Government Regulations and Initiatives:

-

- Stringent regulations regarding food safety and packaging standards drive the adoption of advanced packaging technologies.

- Government initiatives, such as incentives for sustainable packaging practices, influence industry players to align with environmental goals.

Innovations in Packaging Technologies:

-

- Continuous innovations in packaging technologies contribute to the development of more efficient, cost-effective, and sustainable packaging solutions.

- Advancements such as intelligent packaging, active packaging, and modified atmosphere packaging enhance product shelf life and freshness.

Health and Wellness Trends:

-

- Increasing awareness of health and wellness has influenced consumer choices, leading to a demand for packaging that preserves nutritional value and freshness.

- Packaging designs that highlight health benefits, portion control, and nutritional information cater to health-conscious consumers.

Food packaging market has evolved into a crucial and integral part of our daily lives, especially in light of the global trend of urbanization. A simple rationale drives this phenomenon. As the urban population comprises approximately half of the world’s population, cities cannot provide the necessary land and environment for agricultural development. Consequently, food must be processed, packaged, and available on supermarket shelves for urban dwellers to conveniently purchase. This convenient choice aligns well with the fast-paced lifestyles of city residents, facilitating their access to food amidst their busy routines.

-

Driving Force of Urbanization:

- Food packaging market integral in urban lifestyles due to global urbanization.

- Cities unable to provide sufficient land for agriculture, necessitating processed and packaged food.

-

Role in Cleanliness and Freshness:

- Enhances cleanliness and freshness of food.

- Offers valuable branding opportunities for manufacturers.

-

Preventing Food Spoilage:

- Crucial tool in preventing food spoilage.

- Extends shelf life, minimizing global food waste.

-

Impact on Food Security:

- Approximately 1.3 billion tons of food wasted annually globally.

- Efficient food packaging market can significantly reduce wastage, addressing global food security challenges.

-

Global Packaging Industry Turnover:

- World Packaging Organization (WPO) reports global packaging industry turnover exceeding $500 billion.

- Food packaging market a significant sector within the industry.

-

Local Influences on Packaging Preferences:

- Packaging influenced by local food preferences and cultural norms.

- Case study: Japanese consumers reject imperfect packaging; importance of freshness in fish and seafood.

-

Adapting to Cultural Nuances:

- European consumers skeptical about moisture absorption agents in packaging.

- Importance of aligning packaging strategies with local preferences and cultural nuances.

Technological Advancements in Food Packaging:

-

Integration of IoT:

- Introduction of Internet of Things (IoT) in food packaging market.

- Integration of chips, sensors, and electronic label printing into traditional practices.

-

Emergence of “Intelligent” or “Active” Packaging:

- Crucial in reducing food waste.

- Responds to global efforts to inform customers about perishability and protect against spoilage.

-

Capabilities of Intelligent Packaging:

- Displaying current product state.

- Extending shelf life through oxygen absorbers or specialized acids.

-

Example: Sonoco’s Innovative Designs:

- Sonoco, an American company, developing packaging with microchips.

- Microchips collect vital information about product condition, triggering alarms when thresholds are exceeded or fall below target.

Benefits of IoT Technologies in Food Packaging Market:

-

Enhanced Food Safety:

- Real-time data on product condition.

- Active measures to maintain freshness.

-

Waste Reduction:

- Contribution to better supply chain management.

- Informed consumer decision-making.

-

Potential for Sustainable Solutions:

- Leveraging technology advancements to create sustainable packaging.

- Prioritizing food quality, safety, and waste reduction in the evolving landscape of the food packaging market.

Trends in the Food Packaging Market:

Sustainability and Eco-Friendly Materials:

-

- Growing consumer awareness about environmental issues has led to an increased demand for sustainable packaging.

- Biodegradable materials, compostable packaging, and recycled content are becoming more prevalent.

- Companies are exploring alternatives like plant-based plastics and innovative recycling processes.

Smart Packaging:

-

- Integration of technology into packaging for improved functionality.

- Smart labels, QR codes, and sensors are used for providing information about product freshness, origin, and nutritional details.

- Intelligent packaging helps enhance consumer engagement and transparency.

Convenience and On-the-Go Packaging:

-

- Changing lifestyles and a rise in on-the-go consumption are driving packaging innovations.

- Convenient and resealable packaging, single-serve portions, and ready-to-eat packaging solutions are gaining popularity.

Minimalistic and Functional Designs:

-

- Minimalistic packaging designs that focus on essential information and aesthetics.

- Lightweight and functional packaging to reduce material usage and improve transportation efficiency.

Customization and Personalization:

-

- Brands are adopting personalized packaging to create a unique and memorable consumer experience.

- Customized packaging designs, messages, and even individualized portion sizes are gaining traction.

Regulatory Compliance and Safety:

-

- Stringent regulations regarding food safety and labeling are shaping packaging trends.

- Tamper-evident features, antimicrobial packaging, and barrier technologies are implemented to ensure food safety.

E-commerce Packaging:

-

- With the rise of online food shopping, packaging for e-commerce is a crucial focus.

- Packaging solutions that protect products during transit, are easy to open, and reduce waste are emphasized.

Transparency and Clean Labeling:

-

- Consumers are demanding clear and honest labeling on food packaging market.

- “Clean labeling” involves providing information about the ingredients used, sourcing, and nutritional values.

Anti-Microbial Packaging:

-

- Increasing focus on packaging solutions with antimicrobial properties to extend the shelf life of products.

- Active and intelligent packaging technologies that help maintain product freshness.

Globalization and Cultural Sensitivity:

-

- Brands are adapting packaging designs to cater to diverse global markets and cultural preferences.

- Localization of packaging to resonate with different consumer demographics.

These trends reflect the evolving consumer preferences, regulatory landscape, and technological advancements shaping the food packaging market.

Asia-Pacific Food Packaging Market Overview:

-

- Dominates the global food packaging market with the largest market share.

Indian Food Packaging Market Growth:

-

- Projected CAGR of 12.60% from 2022 to 2027.

- Driven by increased demand in processed food, personal care, and pharmaceuticals.

- Growing population, rising disposable income, and evolving lifestyles contribute to higher consumption across industries.

Government Initiatives and Schemes:

-

- Introduction of the Production-Linked Incentive (PLI) scheme in November 2021.

- Aims to boost local manufacturing and exports, including the packaging sector.

- Provides financial incentives to enhance competitiveness and attract investments.

Self-Reliance Initiatives:

-

- Atmanirbhar initiatives and structural reforms for self-reliance.

- Expected to spur significant growth by enhancing domestic production capabilities and reducing import dependence.

- Creates a favourable business environment, attracting investments and promoting technological advancements.

Surge in Packaging Consumption in India:

-

- Indian Institute of Packaging (IIP) reports nearly 200% growth over the past decade.

- Contributing factors include e-commerce expansion, urbanization, changing consumer preferences, and overall economic growth.

Media Influence on Rural Packaging Demand:

-

- Proliferation of internet and television media in rural areas.

- Increased connectivity influences consumer preferences and purchasing behaviour.

- Growing demand for conveniently packaged goods in rural markets.

Transformation Trends in Food Packaging Market:

-

- Adoption of environmentally friendly and sustainable packaging solutions.

- Trends include bioplastics, paper-based packaging, and compostable materials.

- Rising demand for convenience and ready-to-eat food products, driving innovation in packaging solutions.

Intelligent Packaging Technologies:

-

- Adoption of technologies like RFID tags, QR codes, and smart labels.

- Enables consumers to access product information, enhancing transparency and engagement.

Challenges in the Food Packaging Varket in India:

-

- Need for standardized packaging materials.

- Insufficient recycling and waste management infrastructure.

- High expenses associated with packaging equipment and technology.

- Disruptions caused by the COVID-19 pandemic, leading to increased costs.

Opportunities in the Face of Challenges:

-

- Growing demand for sustainable and eco-friendly packaging solutions.

- Expansion of e-commerce and online food delivery services creates opportunities for innovative packaging.

- Rising disposable income and evolving lifestyles offer avenues for packaging designs aligned with consumer preferences.

Segmentation of Paper and Paperboard Market:

-

- Corrugated boxes, boxboard, rigid boxes, folded boxes, trays, flexible packaging, paper bags, shipping bags, and sachets/pouches.

- Choice of material varies based on the specific food and beverage packaging requirements.

Environmental Preference of Paper and Paperboard:

-

- Widely preferred in the food and beverage industry.

- Degradable and recyclable properties make them environmentally friendly.

- Suitable for packaging ready-to-eat meals, on-the-go snacks, and frozen or fresh foods, addressing environmental concerns.

Transportation Preferences:

-

- Rigid boxes favored for sturdiness and durability during transportation.

- Flexible and molded paper or paperboards used for fresh products to meet specific packaging needs.

Investment Trends in the Indian Paper & Packaging Industry:

-

- Mayur Uniquoters Private Limited, a corrugated box manufacturer, secures $10 million investment from SIDBI Venture Capital Ltd. and Edelweiss Financial Services Ltd.

- Amcor Ltd., an established player, experiences increased merger and acquisition (M&A) activities, completing four acquisitions in a year.

- Highlights the attractiveness of investing in India’s Paper & Packaging Industry.

Innovations in Paper and Paperboard Packaging:

-

- Fres-co System USA’s NextPak flexible coffee packaging achieves approval for NexTrex store drop-off recycling.

- Recognized as the first ultra-high-barrier package meeting NexTrex program recyclability requirements.

- Positions Fres-co System USA as a pioneer in sustainable packaging, contributing to environmentally friendly practices in the industry.

Overall Market Overview:

-

- Paper and paperboard packaging market offers diverse options for the food and beverage industry.

- Provides practical and sustainable solutions aligning with the industry’s focus on environmental responsibility.

- Addresses the varied needs of packaging and transporting different food and beverage products.

Optimizing Efficiency and Gaining Competitive Edge: Unveiling the Power of Automation in the Food Packaging Market

As technology advances, industries across various sectors have shifted from manual processes to integrating new machines and automation. The food packaging market is no exception and has greatly benefited from the scientific advancements of our time.

Almost every food product, except for fruits and vegetables, is packaged in today’s food industry using automated food packaging market machines. These machines have revolutionized packaging by streamlining operations, increasing efficiency, and ensuring consistent and hygienic packaging.

- Instance, Mar 7, 2022, Sealed Air, a leading packaging solutions provider, has successfully implemented meat packaging automation, revolutionizing the industry by enhancing predictability. This innovative automation technology streamlines the meat packaging process, improving efficiency, accuracy, and reliability.

By automating various stages of the packaging workflow, Sealed Air ensures consistent and precise packaging outcomes, minimizing errors and variability. This advancement enables meat producers to achieve higher productivity, cost-effectiveness, and customer satisfaction. Sealed Air’s commitment to continuous improvement and cutting-edge technology reinforces its position as a trusted partner for the meat industry, delivering solutions that optimize operations and drive positive business outcomes.

Automated food packaging market machines offer various capabilities, including weighing, filling, sealing, labelling, and inspecting product quality. They can handle multiple packaging formats, such as pouches, containers, bottles, and cans, depending on the specific needs of the food product.

By utilizing automated food packaging market machines, manufacturers can achieve higher production volumes, improved accuracy in portion control, enhanced product safety and hygiene, and reduced labour costs. These machines are designed to meet strict quality and regulatory standards, ensuring that food products are packaged efficiently and meet the required standards for shelf life, freshness, and consumer satisfaction.

The integration of automation in food packaging market has significantly contributed to the industry’s ability to meet the demands of consumers, retailers, and regulatory authorities. It has also played a crucial role in ensuring product integrity, extending shelf life, and reducing food waste.

Utilizing automated industrial robots in the food industry offers several advantages, particularly regarding worker safety, productivity, scalability, cost-effectiveness, consistency, and traceability.

One significant benefit is that automated systems increase workplace safety by reducing the risk of worker injuries. For instance, in the processing and packaging meat items, robots can handle tasks that would otherwise require manual labour with sharp knives, minimizing the potential for accidents and harm.

Moreover, automation enhances production line productivity significantly. While a human worker may process one product at a time, machines can handle tens of products simultaneously, increasing output and overall efficiency.

The performance and output of automated food packaging market robots can be adjusted according to manufacturers’ requirements, providing flexibility in meeting production demands.

Automation offers scalability to food packagers. If there is a need to double the output, another food packaging market machine can be installed, eliminating the need to scale up every aspect of the business.

Automated food packaging market operations generally have lower operating costs compared to manual processes. The machines primarily require electricity to function, while other running costs are minimal, making them cost-effective in the long run.

Consistency in product quality is another advantage of automated food packaging market. Machines handling the packaging process eliminate human errors, resulting in products with identical dimensions, weight, and visual appearance.

Automated food packaging market enables end-to-end traceability of the entire production line. Manufacturers can use codes on automated labels to track and document the facilities and packaging processes that a food product has undergone, ensuring transparency and quality control.

Integrating automated industrial robots in the food packaging market offers numerous benefits, ranging from increased worker safety to improved productivity, cost-effectiveness, consistent product quality, and enhance traceability throughout the production process.

Comparative landscape

The food packaging market is a highly competitive and rapidly evolving industry that plays a pivotal role in the safe and efficient delivery of food products. To succeed in this dynamic market, businesses must navigate the competitive landscape and understand the key players, market trends, and strategic developments. This comparative landscape analysis provides insights into major companies’ market positioning, product offerings, and competitive strategies.

Major key players in the food packaging market include: Berry Plastics Group, Amcor Plc, Sigma Plastics Group, Sealed Air Corporation, DS Smith PLC, American Eagle Packaging, Ball Corporation, Crown Holdings, Inc., Huhtamaki Oyj., and Ardagh Group

Recent Developments

- June 13, 2023, according to Amcor, the AmFiberTM Performance Paper packaging line will be expanded across Europe, a significant participant in the global market for developing and producing sustainable packaging solutions. These will include instant coffee, spices, drink powders, seasonings, dried soups, and heat-seal sachets created especially for various dry culinary and beverage applications. This tactical decision aligns with Amcor’s dedication to meeting the changing demands of the market while focusing on ethical and sustainable packaging solutions.

- February 1, 2023, Amcor, a renowned industry leader, has emerged as the third consecutive winner of the prestigious Lift-Off program. This accomplishment paves the way for Amcor to introduce an innovative concept called “Packaging as a Service” within reusable food packaging market. By adopting this novel approach, Amcor aims to revolutionize the packaging landscape by providing a comprehensive and sustainable solution that encompasses physical packaging and a service-oriented model.

Segments covered in the report:

By Material

- Plastics

- Paper & Paper-based

- Glass

- Metal

- Others

By Type

- Semi-rigid

- Rigid

- Flexible

By Application

- Dairy Products

- Bakery & Confectionary

- Fruits & Vegetables

- Sauces & Dressings

- Meat, Poultry, & Seafood

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Leave a Reply