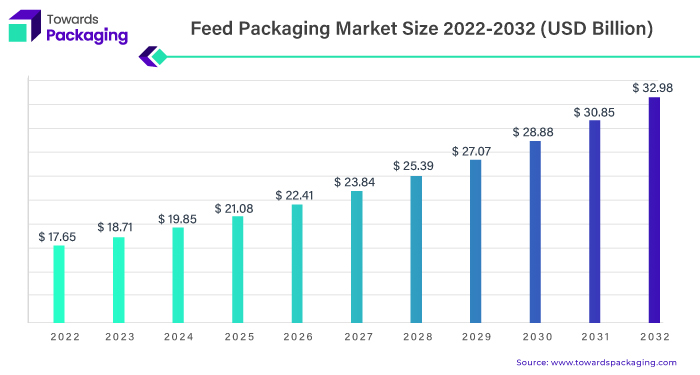

The global feed packaging market is poised for a substantial leap, surging from USD 17.65 billion in 2022 to an impressive estimated valuation of USD 32.98 billion by 2032. This notable growth, encapsulated within a commendable 6.5% Compound Annual Growth Rate (CAGR) between 2023 and 2032, paints a compelling narrative of industry dynamics and market prowess.

Feed, being the sustenance for animals, requires packaging solutions that safeguard the product and ensure its safety for animal consumption.

The feed packaging market plays a pivotal role in ensuring animal feed products’ safe and efficient distribution. As the global demand for animal feed continues to rise with the growth of the agriculture, livestock, and pet care industries, the need for reliable and innovative packaging solutions becomes increasingly crucial. Globally, the commercial feed manufacturing industry is anticipated to have a turnover and sales value of US$ 85 billion annually. To provide the industry with branded feed raw ingredients, tools, and ingredients for processing, handling and technical services around the globe.

The global compound feed production, surpassing one billion tonnes yearly, forms a robust foundation. This extensive output, combined with the commercial feed manufacturing’s impressive annual turnover exceeding US $400 billion, is poised to propel substantial growth in the feed packaging market as the demand for efficient packaging solutions intensifies alongside the expanding feed production sector.

Feed packaging serves as a protective barrier, preserving the nutritional integrity of the feed while meeting regulatory standards for safety and information disclosure. This dynamic market is characterized by ongoing advancements in packaging materials and design, sustainability initiatives, and a keen focus on meeting the diverse needs of end-users in the agriculture and animal husbandry sectors.

Unpacking Growth Catalysts: Key Drivers

Increasing Demand for High-Quality Animal Feed

At the core of the feed packaging market’s expansion lies the burgeoning demand for high-quality animal feed. As the global population continues to rise, so does the need for efficient and nutritious livestock and poultry feed. This surge in demand propels the feed packaging sector into a pivotal position, responding to the call for innovative packaging solutions that ensure the integrity and freshness of animal feed.

Technological Advancements in Packaging Materials

The industry’s growth is intricately tied to advancements in packaging materials and technologies. The integration of cutting-edge materials that enhance shelf life, prevent contamination, and offer eco-friendly alternatives positions feed packaging as a critical player in ensuring the safety and quality of animal feed. This technological leap underscores the market’s commitment to meeting evolving consumer expectations.

Regional Dynamics: Mapping Growth Trajectories

Asia-Pacific: A Hub of Opportunity

The Asia-Pacific region emerges as a hub of opportunity within the feed packaging landscape. Rapid urbanization, coupled with a surge in meat consumption, particularly in countries like China and India, fuels the demand for efficient and secure feed packaging solutions. As the region takes center stage in global agriculture and livestock production, the feed packaging market experiences a paradigm shift with Asia-Pacific playing a pivotal role in its growth story.

Europe: Sustainability Takes the Lead

In Europe, the feed packaging market is characterized by a strong emphasis on sustainability. With an environmentally conscious consumer base, the region spearheads innovations in eco-friendly packaging solutions. This commitment aligns with stringent regulations on waste reduction, pushing the industry towards sustainable practices and setting the stage for a transformative journey in feed packaging.

Market Challenges: Overcoming Hurdles

While the feed packaging market basks in the glow of growth, it grapples with challenges inherent to its expansion.

Raw Material Price Volatility

A persistent challenge is the volatility of raw material prices. Fluctuations impact production costs and necessitate agile strategies to mitigate the impact on pricing strategies. The market’s resilience lies in its ability to adapt and navigate the unpredictable terrain of raw material costs.

Regulatory Compliance

Adherence to evolving regulations, especially in the context of sustainability, poses a challenge for industry players. The dynamic regulatory landscape requires a proactive approach, ensuring compliance while maintaining operational efficiency. This challenge, while significant, is an integral aspect of the industry’s journey towards responsible and sustainable practices.

Unpacking Growth Catalysts: Key Drivers

Increasing Demand for High-Quality Animal Feed

At the core of the feed packaging market’s expansion lies the burgeoning demand for high-quality animal feed. As the global population continues to rise, so does the need for efficient and nutritious livestock and poultry feed. This surge in demand propels the feed packaging sector into a pivotal position, responding to the call for innovative packaging solutions that ensure the integrity and freshness of animal feed.

Technological Advancements in Packaging Materials

The industry’s growth is intricately tied to advancements in packaging materials and technologies. The integration of cutting-edge materials that enhance shelf life, prevent contamination, and offer eco-friendly alternatives positions feed packaging as a critical player in ensuring the safety and quality of animal feed. This technological leap underscores the market’s commitment to meeting evolving consumer expectations.

Regional Dynamics: Mapping Growth Trajectories

Asia-Pacific: A Hub of Opportunity

The Asia-Pacific region emerges as a hub of opportunity within the feed packaging landscape. Rapid urbanization, coupled with a surge in meat consumption, particularly in countries like China and India, fuels the demand for efficient and secure feed packaging solutions. As the region takes center stage in global agriculture and livestock production, the feed packaging market experiences a paradigm shift with Asia-Pacific playing a pivotal role in its growth story.

Europe: Sustainability Takes the Lead

In Europe, the feed packaging market is characterized by a strong emphasis on sustainability. With an environmentally conscious consumer base, the region spearheads innovations in eco-friendly packaging solutions. This commitment aligns with stringent regulations on waste reduction, pushing the industry towards sustainable practices and setting the stage for a transformative journey in feed packaging.

Market Challenges: Overcoming Hurdles

While the feed packaging market basks in the glow of growth, it grapples with challenges inherent to its expansion.

Raw Material Price Volatility

A persistent challenge is the volatility of raw material prices. Fluctuations impact production costs and necessitate agile strategies to mitigate the impact on pricing strategies. The market’s resilience lies in its ability to adapt and navigate the unpredictable terrain of raw material costs.

Regulatory Compliance

Adherence to evolving regulations, especially in the context of sustainability, poses a challenge for industry players. The dynamic regulatory landscape requires a proactive approach, ensuring compliance while maintaining operational efficiency. This challenge, while significant, is an integral aspect of the industry’s journey towards responsible and sustainable practices.

For Instance,

- In August 2022, Constantia Flexibles acquired FFP Packaging Solutions, the leader in sustainable and flexible packaging solutions.

Feed Packaging Market Trends

| Trends | |

| Technological Advancements in Packaging Materials | The feed packaging market is witnessing a notable trend of technological advancements in packaging materials. Innovations such as high-barrier films, modified atmosphere packaging, and intelligent packaging solutions are gaining prominence.

These technologies not only enhance the shelf life of the feed but also provide real-time monitoring capabilities, ensuring the quality and freshness of the product throughout the supply chain. |

| Sustainability Initiatives | The industry’s commitment to sustainability is a significant trend shaping the feed packaging market. With increasing environmental awareness, stakeholders are actively seeking eco-friendly alternatives.

Biodegradable packaging materials, recyclable options, and reduced packaging waste initiatives are gaining traction. Manufacturers are aligning their strategies with sustainable practices to meet the demands of environmentally conscious consumers and comply with stringent regulatory norms. |

| Customization for Branding and Information | Feed packaging is increasingly becoming a tool for effective branding and information communication. Producers customise packaging designs to enhance brand visibility and convey essential product information to consumers.

This trend helps build brand loyalty but also aids end-users in making informed decisions regarding the nutritional content and suitability of the feed for specific animals. |

| Globalization and Market Expansion |

The feed packaging market is experiencing globalization trends as key players expand their operations to new regions. This expansion is driven by the rising demand for quality feed in emerging markets and the need to establish a global presence to capitalize on diverse opportunities. Market players are strategically establishing partnerships, acquisitions, and distribution networks to cater to the evolving needs of different regions. |

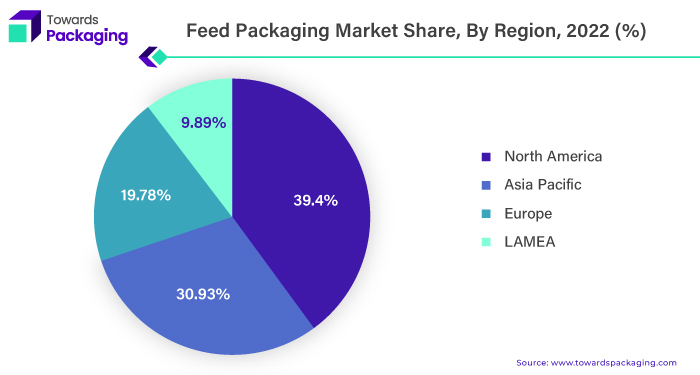

North America’s Pre-eminence in the Feed Packaging Sector

North America stands out as a prominent leader in the feed packaging market. Fuelled by the Vigor of its expansive agriculture and livestock industries, the region has become a focal point for advancements in packaging methodologies and a vanguard for sustainable practices.

Manufacturers in North America are spearheading the adoption of cutting-edge packaging technologies, setting a high standard for innovation within the industry. This proactive approach reflects a commitment to staying ahead of the curve and underscores the region’s dedication to meeting the evolving needs of the agriculture and animal husbandry sectors. Approximately 284 million tonnes of animal feed were eaten in the United States, which is supported by the packaging, helping to grow the feed packaging market, which supplies the packaging to animal feed producers.

A key aspect of North America’s dominance in the feed packaging arena lies in the strategic utilization of leading materials. High-density polyethene (HDPE) and polypropylene (PP) emerge as the region’s primary choices for packaging solutions. The selection of these materials is driven by their exceptional properties, including durability, moisture resistance, and the capacity to endure diverse environmental conditions.

HDPE, known for its robustness and resistance to wear and tear, ensures that feed products remain securely packaged throughout the supply chain. Its resilience makes it particularly adept at safeguarding the nutritional integrity of the feed, a critical consideration in the overall quality assurance process. Meanwhile, polypropylene brings advantages, offering a combination of strength and flexibility that enhances the packaging’s ability to withstand external pressures, maintaining the feed’s safety and freshness.

For Instance,

- In October 2022, LC Packaging launched traditional woven polypropylene bags for the animal feed and nutritional sector.

Moreover, deploying HDPE and polypropylene aligns with the stringent regulatory standards prevalent in North America, ensuring that packaged feed meets and exceeds safety requirements. This commitment to compliance enhances consumer confidence and reinforces the region’s reputation for delivering high-quality feed packaging solutions.

In essence, North America in the feed packaging market is not only a witness to its robust agricultural foundation but also a result of its proactive stance in embracing technological advancements and sustainable practices. The strategic use of materials like HDPE and polypropylene underscores a commitment to product integrity and safety, establishing the region as a trendsetter in the evolving landscape of feed packaging. As the market continues to evolve, North America’s role as a regional leader is likely to persist, driven by its dedication to excellence and responsiveness to industry dynamics.

Asia-Pacific has emerged as a significant regional leader, propelled by the rapid growth of its aquaculture and poultry industries. This surge in demand for animal feed has positioned the region as a critical player in the global feed packaging sector. One of the distinguishing features driving Asia-Pacific’s prominence is the widespread adoption of flexible packaging materials. Laminates and films, in particular, have become integral components of the packaging ecosystem in this region. Their popularity is attributed to their cost-effectiveness and remarkable adaptability to diverse packaging formats. The flexibility of these materials not only facilitates efficient packaging processes but also ensures the preservation of feed quality throughout the supply chain.

Exploring bio-based plastics in feed packaging aligns with the broader industry trend towards sustainability. By incorporating these innovative materials, Asia-Pacific manufacturers are addressing environmental concerns and positioning themselves as leaders in meeting regulatory standards. This proactive stance enhances the region’s reputation for adopting cutting-edge solutions and places it at the forefront of the evolving global feed packaging market. As Asia-Pacific continues to navigate the intersection of growth, innovation, and sustainability, its role as a second regional leader is poised to strengthen, contributing significantly to the overarching narrative of the feed packaging industry.

Future Outlook: Paving the Way Forward

Adoption of Smart Packaging Technologies

The future of feed packaging embraces smart technologies, offering real-time monitoring and data-driven insights. From ensuring optimal storage conditions to traceability throughout the supply chain, the integration of smart packaging technologies enhances efficiency and transparency. This shift towards intelligence aligns with the industry’s commitment to innovation and meeting the evolving demands of a technologically advanced market.

Collaboration for Sustainable Solutions

In response to the growing emphasis on sustainability, industry stakeholders are forging collaborative initiatives. These partnerships aim to drive the development of eco-friendly and recyclable packaging solutions. By pooling resources and expertise, the industry moves towards a collective commitment to sustainable practices, ensuring a balance between market growth and environmental responsibility.

For Instance,

- In December 2021, Anmol Feeds launched its products under the Nouriture Umbrella brand to address the industry’s increasing need for high-quality animal feeds.

Innovations in Feed Packaging Materials for Sustainable and Superior Solutions

The selection of materials for feed packaging plays a pivotal role in determining the quality and longevity of the products. Polyethylene (PE) and polypropylene (PP) stand out as predominant choices, maintaining their dominance owing to their versatile properties, inherent strength, and moisture resistance. These materials collectively form a robust barrier, shielding the feed from external elements and preserving its nutritional content.

Polyethylene, known for its durability and resistance to wear and tear, provides a secure and protective packaging solution. Its strength ensures the safe transportation and handling of feed products throughout the supply chain, contributing to the overall quality assurance process. Simultaneously, polypropylene brings its unique combination of strength and flexibility to the forefront, enhancing the packaging’s ability to endure external pressures and preserving the safety and freshness of the feed.

In response to the growing emphasis on sustainability, there is a noticeable shift towards alternative packaging materials. Paper-based packaging is gaining significant traction, particularly in regions with a heightened focus on eco-conscious practices. Utilizing paper bags and cardboard boxes is becoming a preferred choice due to their recyclability and environmentally friendly attributes. Additionally, the feed packaging industry is witnessing a surge in the use of bio-based plastics derived from renewable sources. This shift reflects a collective commitment within the industry to mitigate its environmental impact, aligning with global efforts to promote sustainability and reduce the ecological footprint of packaging materials.

For Instance,

- In November 2023, UPM Specialty Papers introduced paper packaging free of PFAS and recyclable for pet food businesses.

Tailored Feed Packaging Solutions for Livestock, Pets, and Aquaculture

The diverse landscape of feed packaging end users encompasses various sectors within agriculture and animal husbandry. Livestock farming, including cattle, poultry, and swine, stands as a primary end user, driving the demand for bulk packaging solutions tailored to the specific needs of each segment. The pet food industry represents another crucial end user, with an increasing focus on packaging formats that enhance pet owners’ convenience while preserving the products’ freshness and nutritional quality.

The aquaculture sector, experiencing substantial growth globally, has distinct packaging requirements to address the unique challenges associated with aquatic feed. This includes considerations for water resistance, durability, and efficient storage and transportation.

Dynamic trends, regional variations, and a commitment to sustainability characterize the feed packaging market. As the industry evolves, stakeholders are challenged to balance innovation with regulatory compliance and environmental responsibility. The choice of packaging materials, technological advancements, and customization for branding are critical factors shaping the market. At the same time, the global expansion of crucial players reflects the industry’s responsiveness to diverse regional needs. As the demand for high-quality animal feed persists, the feed packaging market is poised for continued growth and transformation.

For Instance,

- In August 2023, the leading pet supply companies, Mondi and Fressnapf, switched to recyclable mono-material packaging for their line of dry pet food. Together, the two businesses developed the packaging utilizing cutting-edge printing techniques, giving it a distinctive look while using fewer chemicals and inks.

Competitive Landscape

The feed packaging market is characterized by intense competition among key industry players, Including Amcor plc, Mondi Huhtamaki, ProAmpac, El Dorado Packaging, LC Packaging, Plasteuropa, Winpak Ltd., ABC Packaging Direct, Constantia Flexibles. These entities are making significant investments in the manufacturing of Feed packaging solutions. Notably, industry leaders are adopting inorganic growth strategies such as acquisitions, mergers, partnerships, and collaborations to augment their product portfolios, thereby contributing to the global expansion of the feed packaging market.

Major Key Player in the Feed Packaging Market Includes:

- Amcor plc

- Mondi

- Huhtamaki

- ProAmpac

- El Dorado Packaging

- LC Packaging

- Plasteuropa – Flexible Packaging

- Winpak Ltd.

- ABC Packaging Direct

- Constantia Flexibles

Recent Developments

- In November 2023, Ahlstrom won a sustainability award for their pet food packaging. Natural cellulose fibres derived from wood are used to make Ahlstrom’s PawPrint pet food packaging, which is recyclable and biodegradable.

- In May 2022, An international pioneer in paper and packaging, Mondi, unveiled Interzoo, a comprehensive line of eco-friendly packaging options, showing how flexible packaging can promote sustainability in the pet food sector.

- In July 2022, Mondi invested 65 million euros in consumer packaging plants to meet the demand for sustainable packaging solutions for pet food packaging.

Market Segmentation

By material

- Paper

- Plastic

- Metal

- Jute

- Glass

By End Users

- Livestock

- Pets

- Aquaculture

By Region

- North America

- Asia-pacific

- Europe

- LMEA