The dairy product packaging market plays a crucial role in ensuring the safe storage and transportation of various dairy products. This industry encompasses a wide range of packaging solutions designed to meet the specific needs of dairy manufacturers and consumers. The packaging of dairy products involves considerations such as product protection, shelf life extension, branding, and environmental sustainability.

Report Highlights: Important Revelations

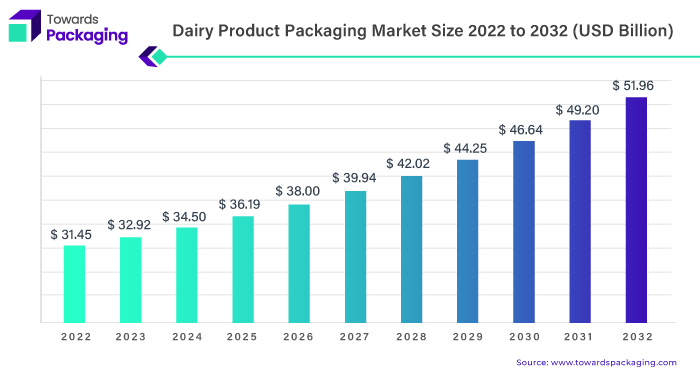

- Current Market Size (2022): USD 31.45 billion.

- Projected Market Size (2032): Land up at USD 51.96 billion.

- Compound Annual Growth Rate (CAGR): Anticipated growth rate of 5.2%.

- Growth Period: The growth is expected to occur between 2023 and 2032.

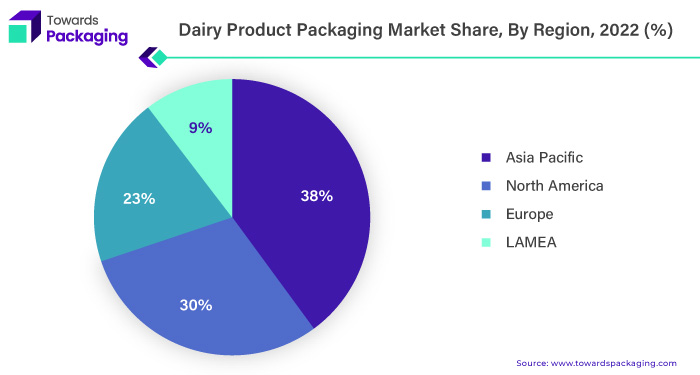

- Asia Pacific’s dominant force in the growing dairy product packaging market.

- Shaping consumer preferences in North America’s dairy product packaging.

- Significance of continuous packaging innovation in the evolving cheese market.

- How packaging innovations shape the future of the dairy industry.

- Plastic packaging solutions for dairy distribution and storage.

Dairy Product Packaging Market Trends

| Trends | |

| Convenience-Oriented Packaging | Dairy product packaging sales are still largely driven by convenience. Consumers want packaging that is easy to handle, has portion control, and can be resealed. As consumers seek efficient and time-saving solutions, single-serve packaging, on-the-go choices, and user-friendly designs are gaining appeal. |

| Smart Packaging Technologies | Innovative dairy product packaging solutions are making their way into the market. These technologies include QR codes, RFID tags, and sensors that educate consumers about the origin, freshness, and safety of a product. Furthermore, creative packaging can help dairy producers with inventory management and supply chain optimisation. |

| Customization and Personalization | Consumer tastes differ, and the dairy industry is reacting by providing more customisable and personalised packaging alternatives. Personalised labels, packaging sizes, and product compositions that cater to specific dietary demands are all examples of this trend. Technology is being used by brands to offer a more personalised and engaging consumer experience. |

| Extended Shelf-Life Packaging | Extending the shelf life of dairy products is crucial for both farmers and consumers. Packaging methods that improve the retention of freshness and avoid rotting are gaining popularity. Modified Atmosphere Packaging (MAP) and vacuum packing, among other innovative techniques, improve the shelf life of dairy products and reduce food waste. |

Asia Pacific’s Dominant Force in the Growing Dairy Product Packaging Market

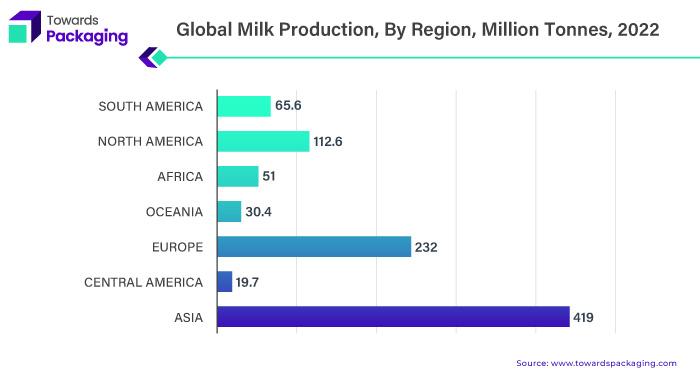

The Asia Pacific region has emerged as a dominant force in the dairy product packaging market, enjoying rapid growth and contributing significantly to the total expansion of the sector. The region’s importance in the dairy product packaging market is due to several factors. Asia is the top milk-producing region in the globe. In 2022, it is predicted to increase by 2.1% annually to around 419 million tonnes, with a large portion of this rise forecast in India, China, Japan, Pakistan, Uzbekistan, and Kazakhstan are a few of the nations.

The growing population and increased disposable incomes in many Asia Pacific countries have increased dairy consumption. As demand for dairy goods, such as milk and various cheese varieties, grows, so does the need for effective and efficient packaging solutions. Second, urbanisation and changing lifestyles in the Asia Pacific region have resulted in a trend towards convenience-oriented packaged dairy products. This shift has compelled dairy product packaging makers to develop and adjust their offers to satisfy changing consumer tastes for on-the-go and ready-to-eat dairy products.

The Asia Pacific area has seen tremendous developments in packaging technologies and materials. To address global environmental concerns, manufacturers invest in cutting-edge facilities and use sustainable packaging procedures. The varied range of dairy products eaten in the region, from traditional milk to dairy-based snacks, has created a desire for adaptable and customised packaging options. This variety of product options needs an adaptable and responsive dairy product packaging market.

The Asia Pacific region’s dairy product packaging market leadership can be ascribed to several factors, including population growth, rising disposable incomes, changing lifestyles, technical improvements, and various dairy product preferences. As the region’s economy and culture evolve, the Asia Pacific dairy product packaging market is expected to remain a dynamic and influential participant in the global landscape.

For Instance,

- In September 2021, the “National Milk” product line, which comes in SIG’s transportable carton packs composed of SIGNATURE Full Barrier packaging material, was introduced by the Dairy Farming Promotion Organisation of Thailand (DPO). As certified forest-based renewable materials are linked to the few polymers, this is a first for Asia.

Significance of Continuous Packaging Innovation in the Evolving Cheese Market

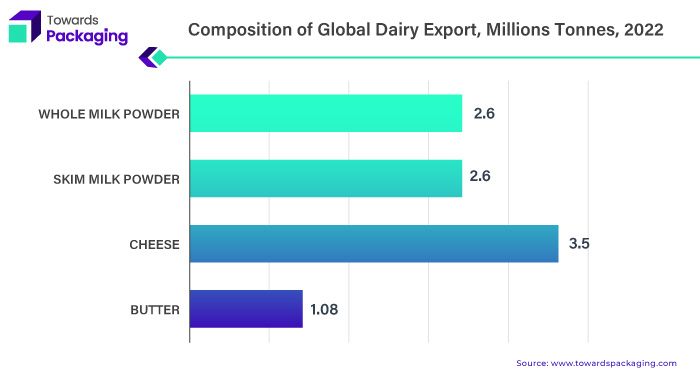

Cheese is the dominating category in the speciality foods sector in the United States, with sustained market growth year after year. The country has approximately 600 cheese kinds, with over 1,000 licenced artisan, speciality, and farmstead cheesemakers contributing to producing handmade, naturally flavoured, and farm-fresh cheeses. This diversification of cheese offers is gaining appeal among Americans, showing a preference for artisanal and unusual dairy products. When assessing the current market conditions for both traditional and speciality types of cheese, it is worth noting that cheese ranks 112th among all traded items globally. Despite its low ranking, the cheese sector has risen significantly, and packaging innovations have played a critical role in meeting customer needs.

One notable example of packaging innovation is Sargento’s successful launch of Balanced Breaks, on-the-go cheese nibbles. This creative packaging approach connects with changing customer lifestyles, offering handy, portable solutions that increase sales. The success of such goods emphasises the significance of adjusting packaging tactics to accommodate changing customer demands. Insights indicate fascinating patterns when diving into consumer preferences for package size and kind. Respondents preferences vary, with a clear preference for containers for shredded (34%), sliced (35%), and cottage/ricotta (36%). Block (36%) and spread (41%) cheeses are preferred; nevertheless, containers are preferred.

For Instance,

- In December 2023, Premium cheeses were launched by a French brand in recyclable paper packaging from Amcor. French family-owned cheese manufacturer has received supplies from Amcor, a flexible and paper packaging powerhouse.