Navigating the Corrugated Packaging Market: Unveiling Trends, Growth Factors, and Driving Forces

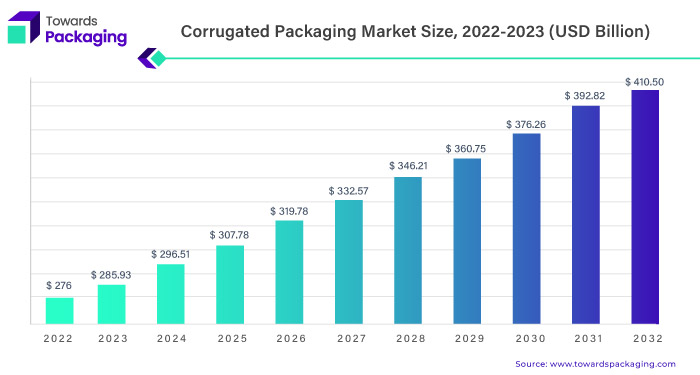

The global corrugated packaging market size, valued at USD 276 billion in 2022, is poised for robust growth at a Compound Annual Growth Rate (CAGR) of 4.10% from 2023 to 2032.This upward trajectory is anticipated to propel the market to an estimated USD 410.50 billion by 2032, underscoring its significance in the realm of packaging solutions.

The corrugated packaging market stands as a dynamic and pivotal player in the global packaging industry, and as of today, it is experiencing significant trends, growth factors, and driving forces that shape its trajectory.

The effectiveness of corrugated packaging is evidenced by its successful deployment in three primary capacities:

- Secondary Shipping Boxes: These robust containers serve as reliable protectors, ensuring the safe transit of products from origin to destination minimizing the risk of damage or loss.

- Primary Boxes for Larger Goods: Corrugated packaging market provides sturdy and dependable encasements for larger and heavier items, ensuring product integrity and security throughout the supply chain.

- Retail Display Stands: Leveraging its versatility, corrugated packaging market plays a pivotal role in presenting products in retail settings, enhancing their visibility and allure to potential consumers, thereby bolstering sales.

The Resilient Rise: Trends Redefining Corrugated Packaging Market

1. Sustainable Practices Take Center Stage

In an era where sustainability is paramount, the corrugated packaging market is witnessing a robust shift towards eco-friendly practices. Manufacturers are increasingly adopting recycled materials, exploring innovative designs for reduced waste, and aligning with circular economy principles. Sustainable packaging is not just a trend but a fundamental shift driving consumer choices and industry standards.

2. E-commerce Boom Amplifies Demand

The surge in e-commerce activities, especially accelerated by global events, has become a major driving force for the corrugated packaging market. The need for sturdy, reliable packaging to ensure safe transit and delivery of goods has led to a substantial increase in demand for corrugated solutions. The market is adapting to the evolving landscape of online retail, emphasizing durability and protection without compromising on sustainability.

3. Customization Emerges as a Competitive Edge

In a world where personalization is key, corrugated packaging market is no exception. The market is witnessing a trend towards customized solutions that not only safeguard the products but also serve as a visual representation of the brand. Unique, eye-catching designs that resonate with consumers are becoming a competitive edge, driving the demand for tailored corrugated packaging market solutions.

Growth Factors Propelling the Corrugated Packaging Market

1. Surging Global E-commerce Penetration

As e-commerce continues to permeate global markets, the demand for reliable and robust packaging solutions is escalating. Corrugated packaging market, with its versatility and strength, emerges as a preferred choice for businesses navigating the challenges of online retail. The correlation between e-commerce growth and increased demand for corrugated packaging market is a key growth factor propelling the market forward.

2. Emphasis on Cost-Efficiency in Supply Chain

Corrugated packaging market offers a compelling advantage in terms of cost-efficiency throughout the supply chain. Its lightweight nature, coupled with strength and durability, facilitates streamlined transportation and warehousing. As businesses seek to optimize their supply chain operations, corrugated packaging market emerges as a strategic choice, contributing to overall efficiency and cost savings.

3. Technological Advancements Transforming Manufacturing

The corrugated packaging market is witnessing a technological revolution in manufacturing processes. Advanced machinery and innovations in printing techniques allow for intricate and high-quality designs. This not only enhances the visual appeal of packaging but also contributes to efficiency in production. Technological advancements are becoming a driving force, enabling manufacturers to meet the evolving demands of the market.

Global Impact: India’s Role in the Corrugated Packaging Supply Chain

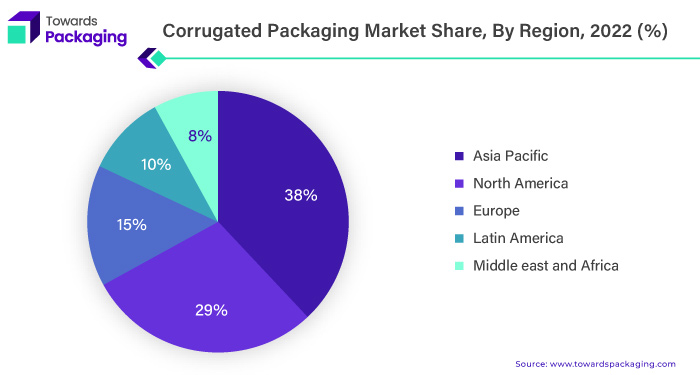

In 2022, the Asia Pacific region emerged as the dominant force in the market, capturing an impressive revenue share of over 38%. Renowned as the global manufacturing hub, this region is pivotal in producing a wide range of electronics, home care, and healthcare products distributed worldwide. The substantial population residing here also positions it as an immensely attractive market for the food & beverages industry, which, in turn, is projected to drive significant demand for corrugated packaging market.

Additionally, the region’s increasing adoption of e-commerce and the rapid growth of various online shopping platforms further contribute to the surging demand for corrugated packaging market. The combination of these factors is expected to propel the growth rate of the Asia Pacific corrugated packaging market in the foreseeable future. Businesses operating in this sector should closely monitor and capitalize on the opportunities arising from the region’s dynamic and flourishing market landscape.

The Indian market’s promising demographic and economic outlook will fuel increased demand for packaged and processed foods and beverages over the next five years. Consequently, this demand rise will directly impact the growth of the corrugated packaging market in India, as it plays a vital role in securing and delivering these products to consumers.

Despite the growth potential, the corrugated packaging market segment in India faces significant fragmentation. Many small, inefficient, and financially stressed companies operate within this sector, which can lead to challenges in terms of productivity and competitiveness. Interestingly, even with the current fragmentation, the top 10 players in the industry only account for 24% of the total containerboard capacity in India, indicating the dominance of many smaller players.

The industry’s fragmentation may present opportunities for consolidation and increased efficiency. As demand for corrugated packaging market rises, there could be room for more prominent players to expand their operations and capitalize on economies of scale. Moreover, it might encourage collaboration and partnerships to collectively improve market share and optimize resources.

Overall, while the growth prospects for the corrugated packaging market in India are promising, addressing the issue of fragmentation and identifying avenues for increased efficiency will be crucial for sustainable and impactful growth in the coming years.

The Indian corrugated paper packaging industry is poised for robust growth in the coming five years, with a projected Compound Annual Growth Rate (CAGR) of 7.6%. This growth is primarily fueled by the nation’s solid demographic and economic prospects. India’s economy is among the fastest-growing globally, and its per capita income is expected to increase by 50% to reach USD 3,000 by 2023.

The country boasts a burgeoning population of young and income-earning consumers, with a median age of 28 years. This demographic dividend is a key factor contributing to increased demand for various goods, including packaged products that rely on corrugated paper packaging for distribution and display.

Furthermore, India’s urban population is on a steady rise, accounting for 33% of the total population. This urbanization trend is projected to continue, reaching 40% by 2025. Urban areas tend to witness higher consumption rates and greater demand for packaged products, thus driving the need for efficient and reliable corrugated paper packaging solutions.

Overall, India’s favourable demographic and economic dynamics, a growing urban population, and a young, income-earning consumer base create a promising environment for sustained growth in the corrugated paper packaging industry over the next five years.

E-commerce Packaging Trends: Staying Ahead in the Corrugated Market

The e-commerce sector is experiencing a remarkable surge in retail sales, and projections indicate an impressive annual growth rate of approximately 20% for e-commerce trade in Europe. On a global scale, online sales are anticipated to surpass an astounding $5.4 trillion by 2023. As a result, the packaging industry, particularly the corrugated segment, is poised to witness a significant upswing in demand.

Corrugated packaging market dominates e-commerce, accounting for approximately 80% of the packaging demand in this rapidly expanding market. The exponential growth of e-commerce directly impacts the corrugated industry, driving the need for more packaging materials to safely and efficiently ship products to consumers.

- Instance, 13 Mar 2023, Agarwal Enterprises is thrilled to announce the grand inauguration of “Rewynd,” our pioneering packaging eCommerce studio. With Rewynd, we are revolutionizing the packaging industry by offering a one-stop digital platform for all packaging needs. Through this innovative studio, businesses can explore a wide array of packaging solutions, customizable designs, and eco-friendly materials tailored to their specific requirements.

This surge in packaging demand poses challenges and opportunities for the corrugated industry. As companies strive to meet the rising packaging requirements, there is an opportunity for the corrugated industry to grow and innovate to meet the evolving needs of the e-commerce market. It will also drive advancements in packaging solutions to ensure products are adequately protected during transit and delivered to customers in optimal condition.

In conclusion, the surging e-commerce retail sales are a driving force behind the rapid growth of the corrugated packaging market, and this trend is set to continue with significant potential for further expansion in the years ahead.

The logistics chain for direct-to-consumer delivery in e-commerce has become increasingly intricate. During standard distribution processes, E-commerce packages often go through multiple handling stages, sometimes as many as 20 or more. As a result, there is a growing need for cost-effective secondary corrugated board packaging solutions to ensure safe and efficient transportation throughout the supply chain.

- Instance, 14 February 2023, HP proudly announces the release of its latest cutting-edge offering, the HP PageWide C550 Press, a post-print digital corrugated press high-speed. This advanced single-pass platform has been meticulously engineered to empower converters in optimizing manufacturing expenses and enhancing operational efficiency for the production of corrugated packaging market. By leveraging the capabilities of the HP PageWide C550 Press, businesses can achieve unprecedented levels of productivity and deliver superior results in the fast-paced and ever-evolving packaging industry. This launch underscores HP’s unwavering commitment to pushing the frontiers of technology and providing unmatched solutions to address the dynamic demands of the market.

The high number of handling stages exposes packages to risks, such as potential damage, wear, and tear. Cost-effective secondary corrugated board packaging plays a critical role in mitigating these risks by providing additional protection for the primary product packaging. It is a sturdy and reliable outer packaging that shields the contents from external forces and minimizes the chances of in-transit damage.

To address the demands of the modern e-commerce logistics chain, secondary corrugated board packaging is designed to be lightweight yet durable, optimizing shipping costs while safeguarding the products within. As the e-commerce industry continues to grow, the demand for efficient and economical secondary packaging solutions is expected to rise, further emphasizing the crucial role of corrugated board packaging in enhancing the overall supply chain efficiency and customer satisfaction in the direct-to-consumer delivery model.

In response to evolving market trends and consumer preferences, brand owners are emphasizing their packaging more to extend their brand image beyond the retail outlet and into consumers’ homes. As a result, this shift in demand is impacting the converting industry, which is now facing growing requirements to ensure that secondary packaging not only serves as a protective container but also carries the brand’s visual identity effectively.

To meet these demands, converters must produce high-quality graphic designs directly on the secondary pack or shipper. This entails implementing advanced printing technologies and techniques to create eye-catching, visually appealing packaging that resonates with consumers. High-quality graphic designs on the secondary packaging help reinforce brand recognition and loyalty, making the product stand out on the store shelves and in consumers’ homes.

With its well-designed graphics, the secondary packaging becomes an extension of the brand’s marketing strategy, making it an essential tool for driving brand engagement and leaving a lasting impression on consumers. Converting companies that can deliver such high-quality, aesthetically pleasing packaging solutions are well-positioned to meet the demands of brand owners and gain a competitive edge in the market.

Moreover, the converting industry is experiencing a significant shift driven by brand owners’ requirements for secondary packaging to carry their brand image effectively into consumers’ homes. This has led to an increased focus on producing high-quality graphic designs for shippers, creating opportunities for converters to provide value-added solutions that align with the evolving needs of the packaging market.

Comparative Landscape

The corrugated packaging market exhibits robust growth and intense competition, driven by surging demand across various industries. Major players dominate the global market, including International Paper Company, WestRock Company, Smurfit Kappa Group, DS Smith Plc, and Packaging Corporation of America. Geographically, North America, Europe, Asia-Pacific, and Latin America are the key regions with expanding consumer bases and industrial activities. Innovation and technology play a pivotal role in this sector, with companies investing in R&D for eco-friendly solutions and advanced packaging technologies like digital printing and smart packaging.

Sustainability initiatives are rising as companies adopt environmentally friendly materials and recycling practices. Mergers and acquisitions are common strategies to strengthen market position and expand product portfolios. Given the increasing demand from e-commerce and direct-to-consumer models, efficient supply chain management is essential. Building strong customer relationships and delivering exceptional service remain crucial factors for success in this dynamic market.

Major key players in the corrugated packaging market include: Mondi Group, WestRock Company, International Paper Company, DS Smith PLC, Smurfit Kappa Group, Nine Dragons Paper (Holdings) Limited, Georgia-Pacific Equity Holdings LLC., Oji Holdings Corporation, Lee & Man Paper Manufacturing Ltd., Packaging Corporation of America

Driving Forces Steering the Corrugated Packaging Market

1. Sustainability Imperative

The global call for sustainability is a major driving force in the corrugated packaging market. Businesses are recognizing the importance of aligning with environmentally conscious practices to meet consumer expectations and regulatory standards. The imperative to reduce carbon footprints and embrace eco-friendly materials is steering the market towards a greener future.

2. Shifting Consumer Preferences

Consumer preferences are evolving, with an increasing inclination towards brands that prioritize sustainability and environmental responsibility. This shift is influencing purchasing decisions, prompting businesses to adopt corrugated packaging solutions that resonate with eco-conscious consumers. The market is responding to this driving force by integrating sustainable practices into every aspect of corrugated packaging production.

3. E-commerce Evolution

The continuous evolution of the e-commerce landscape is a potent force shaping the corrugated packaging market. As online retail becomes a dominant force in the global economy, the demand for packaging that ensures the safe and intact delivery of products is escalating. The adaptability of corrugated solutions to the ever-changing requirements of the e-commerce sector is a driving force steering the market’s growth.

Recent Developments:

- 17 October 2022, Aldi UK is delighted to announce the upcoming launch of porridge pots packaged in sustainable cardboard packaging. As part of our ongoing commitment to environmental responsibility, we have developed this innovative solution to replace traditional single-use plastic packaging. The new cardboard packaging is recyclable and helps reduce plastic waste, contributing to a greener and more sustainable future. Aldi’s porridge pots in cardboard packaging offer our customers a convenient and eco-friendly breakfast option, aligning with our dedication to providing high-quality products that prioritize sustainability.

- 25 Jan 2023, Cascades is delighted to introduce a novel closed-loop basket crafted from recycled and recyclable corrugated cardboard, designed specifically for the produce sector. This innovative solution is a sustainable substitute for conventional food packaging, often posing recycling challenges. By adding this cutting-edge product to our extensive range of eco-friendly packaging offerings, Cascades further demonstrates our commitment to environmental responsibility and sustainable business practices.

- 2 February 2023 Hygiene specialist Satino by WEPA proudly presents its latest innovation, the PureSoft range, crafted entirely from 100% recycled corrugated cardboard. This eco-friendly range comprises toilet tissue, kitchen rolls, and hand towels designed to meet the highest sustainability standards. Using recycled materials, the PureSoft range achieves an impressive 70% reduction in carbon footprint compared to traditional virgin fibre production methods. Moreover, the range eliminates the bleaching process to enhance its environmentally conscious approach, resulting in a more natural-looking paper. Satino’s PureSoft range exemplifies our commitment to offering environmentally responsible solutions without compromising quality and performance.

- 20 March 2023, Sainsbury’s is thrilled to introduce its latest eco-conscious initiative – the launch of cardboard packaging for its own-brand detergent. As part of our commitment to reducing plastic waste and promoting sustainability, this innovative packaging solution replaces traditional plastic containers with recyclable cardboard. By adopting this eco-friendly approach, we aim to contribute to a cleaner environment and offer our customers a more sustainable choice for their laundry needs. Sainsbury’s cardboard packaging for own-brand detergent aligns with our dedication to making positive environmental changes while maintaining the same level of product quality and convenience for our valued customers.

- 5 July 2023, Sainsbury’s proudly introduces its latest initiative, the launch of recyclable cardboard packaging exclusively designed for our premium steak products. With a strong emphasis on sustainability and environmental responsibility, this innovative packaging solution aims to significantly reduce plastic waste in the food industry. By opting for recyclable cardboard, we aim to positively impact the environment while ensuring the same level of quality and freshness for our esteemed customers. This launch is a testament to Sainsbury’s commitment to adopting greener practices and meeting the evolving demands of conscious consumers.

Segments Covered in the Report:

By Package Type

- Single Wall Boards

- Double Wall Boards

- Triple Wall Boards

- Single Face Boards

By Application

- Electronics & Electricals

- Food & Beverages

- Transport & Logistics

- E-Commerce

- Personal Care Goods

- Healthcare

- Homecare Goods

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa