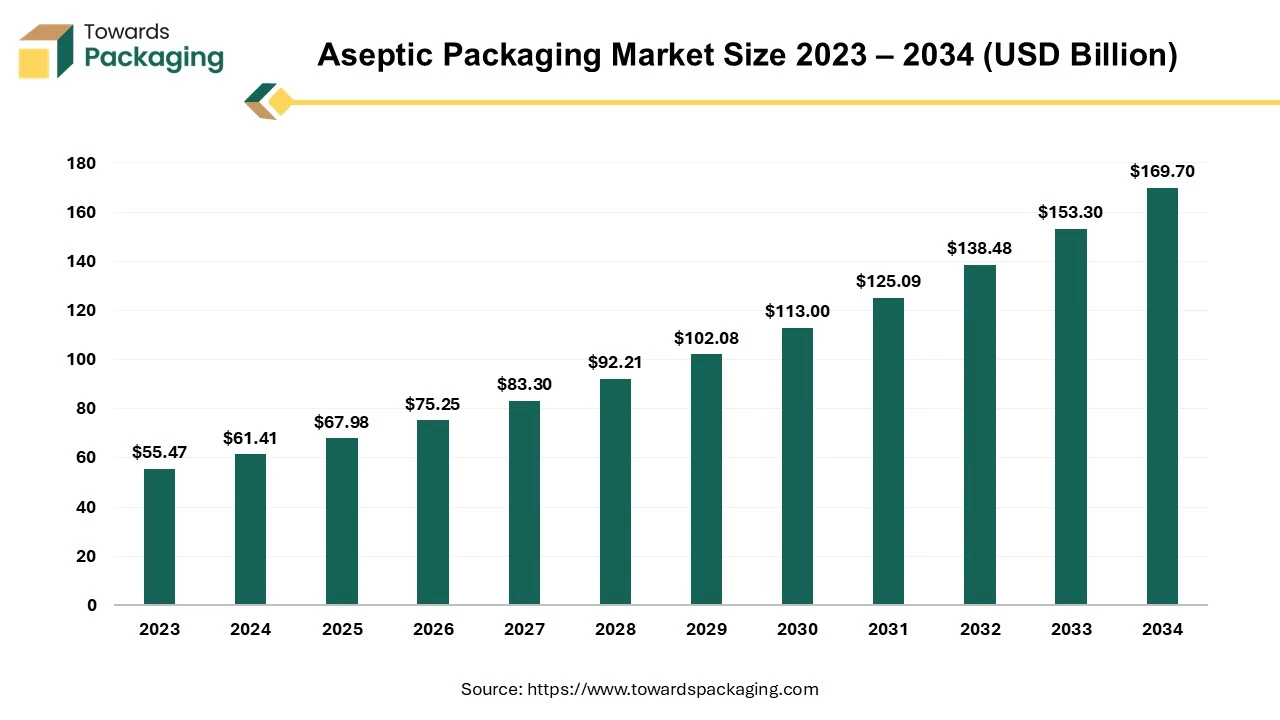

Aseptic Packaging Market Size and Growth (2023 – 2032)

The global aseptic packaging market size is estimated to grow from USD 50.34 billion in 2022 to reach an estimated USD 138.48 billion by 2032, registered at a 10.7% CAGR between 2023 and 2032.

Unlock Infinite Advantages: Subscribe to Annual Membership

Report Highlights: Important Revelations

- Global aseptic packaging sector is poised for growth, starting at a value of USD 50.34 billion in 2022.

- The market is expected to surge, reaching an estimated value of USD 138.48 billion by 2032.

- This expansion is registered at a consistent CAGR of 10.7% over the period from 2023 to 2032.

- Asia-Pacific solidifies its position as a key contributor to the aseptic packaging industry.

- Factors propelling the growth of aseptic packaging in the North American market.

- Aseptic beverage cartons vital packaging solution for long-lasting products.

- Rising food and beverage consumption fuels the demand for aseptic packaging.

Aseptic packaging has become growing in acceptance among producers over the past few decades. This refers to the procedure of placing commercially sterilised goods into sterilised containers that preserve aseptic conditions and securing them hermetically. This approach makes it possible to package shelf-stable goods without additionally requiring for preservatives, assuring that the items can be ingested without refrigeration for up to a year. Aseptic filling is widely used in many industries, notably in the food and healthcare sectors, hence the FDA established rigid regulations for it.

Aseptic packaging offers several benefits, one of which is its capacity to preserve product stability without necessitating refrigeration, hence permitting worldwide distribution without requiring cold storage. This not only lessens the impact on the environment but also improves global accessibility to necessities. Aseptic packaging is a greener option for firms and fits in nicely with sustainability objectives. It drastically lowers plastic waste because the packaging is made mostly of renewable resources and uses about 60% less plastic than traditional solutions. Less energy is also used throughout the production process, which helps with environmental conservation.

Introduction

- Research Objective

- Scope of the Study

- Definition and Taxonomy

Research Methodology

- Research Approach

- Data Sources

- Assumptions

Executive Summary

- Synopsis

- Analyst Recommendations

Market Overview

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Value chain analysis

- Raw Material Sourcing

- Manufacturing Process

- Logistics & Transportation

- Buyer Preferences

- Trends

- Market Trends

- Technological Trends

- Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitute

- Threat of New Entrants

- Degree of Competition

- PESTLE Analysis for 5 Leading Countries

- Regulatory Framework for Leading Countries/Regions

- Supply Demand Analysis

- Production & Consumption Statistics

- Export Import Statistics

- Price Trend Analysis

Global Aseptic Packaging Market Assessment

- Overview

- Global Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Cartons

- Pouches

- Bags

- Cans

- Global Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Food and Beverage

- Pharmaceutical

- Personal Care

- Others

- Global Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By Region Type (2021 – 2033)

- Asia Pacific

- North America

- Europe

- LAMEA

Asia Pacific Aseptic Packaging Market Assessment

- Overview

- Asia Pacific Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Cartons

- Pouches

- Bags

- Cans

- Asia Pacific Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Food and Beverage

- Pharmaceutical

- Personal Care

- Others

North America Aseptic Packaging Market Assessment

- Overview

- North America Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Cartons

- Pouches

- Bags

- Cans

- North America Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Food and Beverage

- Pharmaceutical

- Personal Care

- Others

Europe Aseptic Packaging Market Assessment

- Overview

- Europe Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Cartons

- Pouches

- Bags

- Cans

- Europe Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Food and Beverage

- Pharmaceutical

- Personal Care

- Others

LAMEA Aseptic Packaging Market Assessment

- Overview

- LAMEA Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Cartons

- Pouches

- Bags

- Cans

- LAMEA Aseptic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Food and Beverage

- Pharmaceutical

- Personal Care

- Others

Company Profile

- I. du Pont de Nemours and Company (US)

- Company Overview

- Geographic Footprints

- Financial Performance

- Product Portfolio

- SWOT Analysis

- R&D Efforts

- Recent Developments & Strategic Collaborations

- Product Launch/M&A/Technical Collaboration

- Becton, Dickinson and Company (US)

- Bemis Company, Inc. (US)

- Reynolds Group Holdings Limited (New Zealand)

- Amcor Limited (Australia)

- Robert Bosch GmbH (Germany)

- Tetra Laval International S.A. (Switzerland)

- Greatview Aseptic Packaging Co., Ltd. (China)

- IMA S.P.A (Italy)

- Schott AG (Germany)